- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Won $1000 cash/prizes at casino. Added info from1099-Misc., Have a win/loss stmt I was told I...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Won $1000 cash/prizes at casino. Added info from1099-Misc., Have a win/loss stmt I was told I could claim up to that amount in losses. Where is this done?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Won $1000 cash/prizes at casino. Added info from1099-Misc., Have a win/loss stmt I was told I could claim up to that amount in losses. Where is this done?

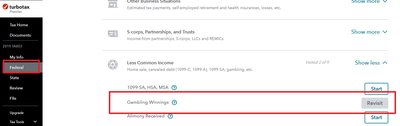

Proceed through Gambling Winnings under Less Common Income in the Wages and Income section (refer to the screenshot below). Enter your losses on the screen provided in the interview and note that your losses will only factor into your income tax equation if your itemized deductions exceed your standard deduction.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Won $1000 cash/prizes at casino. Added info from1099-Misc., Have a win/loss stmt I was told I could claim up to that amount in losses. Where is this done?

Proceed through Gambling Winnings under Less Common Income in the Wages and Income section (refer to the screenshot below). Enter your losses on the screen provided in the interview and note that your losses will only factor into your income tax equation if your itemized deductions exceed your standard deduction.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Won $1000 cash/prizes at casino. Added info from1099-Misc., Have a win/loss stmt I was told I could claim up to that amount in losses. Where is this done?

Congratulations on your win!

Gambling winnings are normally reported on Form W-2G. To enter your gambling or prize winnings in TurboTax (even if you didn't receive a W-2G), please follow these steps:

- Click on Federal > Wages & Income

- In the Less Common Income section , click on the Start/Update box next to gambling winnings.

- On the Gambling Winnings screen, click the Yes box.

- On the screen, Whose W-2G do you want to work on?, mark the box We didn't receive a W-2G.

- Answer Yes on the next screen.

- On the screen, Enter your gambling or lottery winnings that weren't reported on W-2G, enter your winnings.

- After entering your winnings, you will be asked to enter your losses (if any) on the next screen, Gambling Losses. [Gambling losses can be deducted as an itemized deduction up to the total of reported gambling and prize winnings.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Won $1000 cash/prizes at casino. Added info from1099-Misc., Have a win/loss stmt I was told I could claim up to that amount in losses. Where is this done?

My confusion is, that I didn't received the W2G, I received it as a 1099 Misc. If I add it to income on the 1099, then it doesn't let me deduct my losses. But if I add it to the G2, then it will add it as income in like both places and doubles.

This was done as a cash and prize and not while I was playing the machine.

Please help me for this is the only thing holding me up for I have to file quickly so it is completed before the stimulus.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Won $1000 cash/prizes at casino. Added info from1099-Misc., Have a win/loss stmt I was told I could claim up to that amount in losses. Where is this done?

I received this as a cash and prizes and not where I was paying the slot and won and I had to fill out papers. I received a 1099 Misc. instead. If I go to the area for gambling winnings, I still would have to include the 1099 and then it doubles my winnings for income which wouldn't be correct. right?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Won $1000 cash/prizes at casino. Added info from1099-Misc., Have a win/loss stmt I was told I could claim up to that amount in losses. Where is this done?

Right. Don't enter the winnings twice.

Enter the 1099-MISC and label it as "Gambling winnings".

Click Federal

Click Wages & Income

Click “See All Income” if needed

Scroll down (PAST SELF-EMPLOYMENT) to “Other Common Income”

Click “Show more”

Scroll down to “Form 1099-MISC”

Click Start

Enter the 1099-MISC and Continue

On the “Describe the reason for this 1099-MISC” screen enter something like “Gambling Winnings” and Continue

Select “None of these apply” and Continue

Select “No, it didn’t involve work like main job” and continue through the interview.

The amount from the 1099-MISC will be reported as Other income on the 1040 line 7a, not as Self-employment

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Won $1000 cash/prizes at casino. Added info from1099-Misc., Have a win/loss stmt I was told I could claim up to that amount in losses. Where is this done?

How do I claim my $`1000 losses. It won't let me do it in that area and if I do it in the other area, then I'd be putting it in twice. This is the real confusion and the only thing I need to answer before I can complete. Please help.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Won $1000 cash/prizes at casino. Added info from1099-Misc., Have a win/loss stmt I was told I could claim up to that amount in losses. Where is this done?

Thankyou for your answer and I had done this previously. Although it won't let me deduct my losses in this area. It only lets me do that if I had entered the W2G form and this was give n to me thru s 1099 Misc. and not a W2G and that is the only place that I'm able to use my losses against it. and if I go there, then it adds the /$1000 twice. Can I still deduct my losses when it was given to me thru a 1099 Misc. vs the other way. This is the only thinking holding me up to completing this and with the stimulus package I have to get this in for I need them to use my 2019 taxes for info and not 2018.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Won $1000 cash/prizes at casino. Added info from1099-Misc., Have a win/loss stmt I was told I could claim up to that amount in losses. Where is this done?

Will it make a difference on your return? Will your Itemized Deductions be more than the Standard Deduction for your filing status this year?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

dionne_materioli

New Member

ad4ee335e27c

New Member

jbmi375803

New Member

mcstel

Level 1

sichi2024

Level 2