- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: New Child Tax Credit

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

New Child Tax Credit

I am in the process of filing using Turbo Tax, and despite entering all information for my 2 kids, it only shows a deduction of 1k. I have checked and double checked all information, and all information, on my end, has been entered correctly. Honestly, this wouldn't bother me, except for the fact that I currently owe. Any help is appreciated.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

New Child Tax Credit

how old are your children?

...that $2,000 tax credit only applies for children under 17 year old. for qualified dependents over 16, there is a credit of $500 per dependent.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

New Child Tax Credit

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

New Child Tax Credit

please recheck the following

that the children reported are:

- YOUR children

- under the age of 17 on Dec 31, 2018 (recheck their stated birth month, day and year)

- did not provide over half their own support

- the child is a US citizen or resident alien of the US

- there is a valid social security number listed

- did the child live with you for over half the year?

Turbo Tax is going to ask each of these questions. All 6 tests must pass to take the credit.

there is also the $500 Credit for Other Dependents, so I wonder if TT is providing two $500 credits or only giving you credit for 1 child (at $1000) because of the way some of the inputs have been provided.

Lastly, there is in income limitation ($400,000 is married; $200,000 for all other filers)

Also, look at the "Child Tax Cr" worksheet in Turbo Tax and follow the math. It will explain what TT is doing,.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

New Child Tax Credit

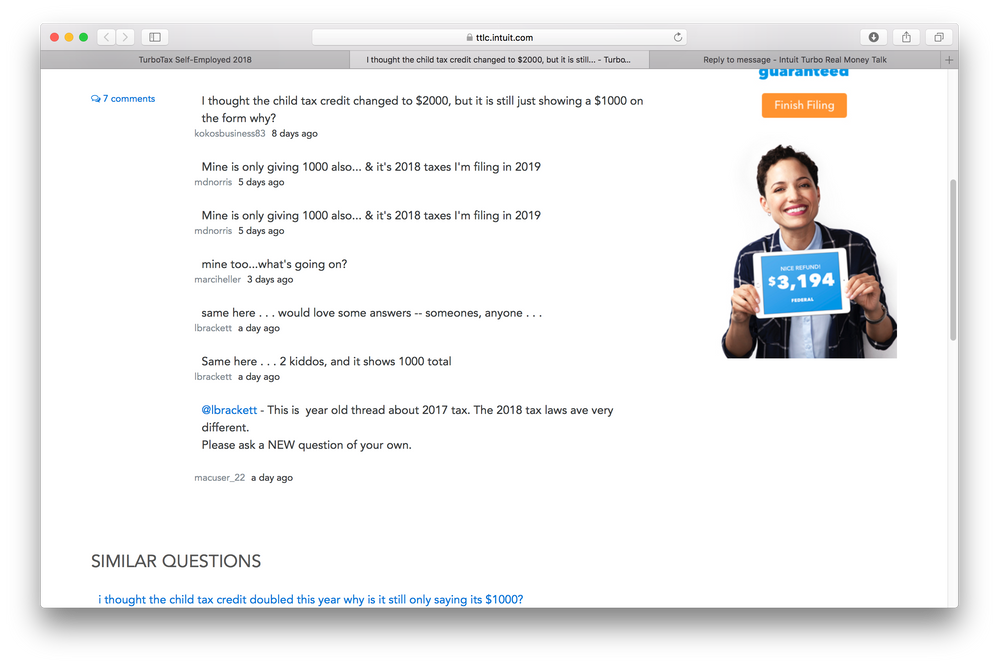

A similar thing is happening to me and many other people. I meet all the requirements. My daughter is only 2. TurboTax online even said I am receiving the $2000 Credit, but in reality, its only reflecting $1000 in my refund. Ive been scouring the forums for answers and Ive found multiple people that use the software instead of online that said they had this problem and it was fixed by updating the software. Personally, I use online and its still showing an issue. Ive found several others having this issue. Ive attached an image from another thread with people with the same problems. Its an old thread, but the people commenting are current and referring to this problem...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

New Child Tax Credit

I am totally confused. I thought the 2 children would receive the standard deduction of $12,000 each? I see this nowhere on the forms. Only $24,000 on line 8 for me and my husband. No standard deduction for children?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

New Child Tax Credit

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

LC2024

New Member

Garbanzor29

Level 2

ba4f97382165

New Member

3f32ca3a9063

New Member

yss225

New Member