- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Material Participation to Recognize Rental Property Losses

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Material Participation to Recognize Rental Property Losses

@tagteam @taxtime24 Question regarding this topic, do you report your STR income in Schedule C as well or do you leave that in Schedule E, but only move your depreciation over to the Schedule E? My concern is that if you move STR income over to Schedule C, you're subject to self employment taxes correct? Curious how you ultimately entered this information within the system. Thanks in advance!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Material Participation to Recognize Rental Property Losses

Yes, we have a short-term rental and it is reported on Schedule E, exclusively, since we do not provide services (at least not of the type that would be considered "significant" or "substantial").

Note, however, that the average period of customer use for this particular rental is over 7 days since, although the typical rental is Saturday to Saturday, there are some renters who rent the property for 2, or more weeks.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Material Participation to Recognize Rental Property Losses

In the example where my rentals are 7 days are less and can prove I materially participate, I’m assuming both (income and depreciation) would be reported on a schedule C

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Material Participation to Recognize Rental Property Losses

You would use Schedule E Rental Income and Expenses.

The only time Schedule C would be used is in the situation when significant personal services are provided by you to your tenants. For example, think of the case of a bed and breakfast. The host provides daily services (hotel-like services such as daily cleaning, meal service, etc.) to the tenants and is therefore operating as a business, not just a rental.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Material Participation to Recognize Rental Property Losses

@jvmoney wrote:

In the example where my rentals are 7 days are less and can prove I materially participate, I’m assuming both (income and depreciation) would be reported on a schedule C

My opinion is that is the wrong assumption and I wholeheartedly agree with @AnnetteB6's assessment.

Report the rental on Schedule C only if you provide significant personal services for your renters.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Material Participation to Recognize Rental Property Losses

Thank you both. My understanding is the only difference is if the amount of days. For example, the less than 7 days gives it that exception for up to 25K in deductions is what I’m understanding of active income. Follow the flow on the right. How do you set it up so it’s reported in schedule E but also take advantage of the deductions for active income within TurboTax?

https://www.hrblock.com/tax-center/wp-content/uploads/2018/05/airbnb-taxes.pdf

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Material Participation to Recognize Rental Property Losses

You materially participated in the operation of this business activity during the year, if you meet ANY of the following tests:

1. You participated in the activity for more than 500 hours during the tax year.

2. You are the only person who substantially participates in the activity, including individuals who do not have an ownership in the activity.

3. You participated in the activity more than 100 hours during the year and no one else participates more than you do, including individuals who do not have an ownership in the activity.

4. The activity is a significant participation activity, and you participated for more than 100 hours in each of several activities, and the total for all these activities is in excess of 500 hours.

5. If any of the above situations applied to you in any five of the last ten years, you are deemed to have materially participated this year.

6. Based on all the facts and circumstances, you participated in the activity on a regular, continuous, and substantial basis during the tax year (you must have participated for more than 100 hours during the year).

However, your participation in managing the activity does not count in determining whether you materially participated if anyone (other than you) received compensation for managing the activity or if anyone spent more hours during the tax year than you performing services in the management of the activity.

If you are an active participant in your rental activity, then you may be entitled to additional deductions. To meet the active participant requirements, you must be at least a 10% owner and have made major management decisions regarding the property such as approving tenants and authorizing repairs.

Screens regarding your material participation and screens relating to your active participation can be found in the Rental Properties and Royalties section of TurboTax (CD/download, but it's similar for TurboTax online). As you move through the introductory screens, you will get to the Rental Summary screen. Select Property Profile and as you move through the screens in this section, you will see a screen that relates to active participation.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Material Participation to Recognize Rental Property Losses

Are you referring to the $25,000 exception?

See https://www.irs.gov/publications/p527#en_US_2022_publink1000219124

That is automatic and based upon your AGI.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Material Participation to Recognize Rental Property Losses

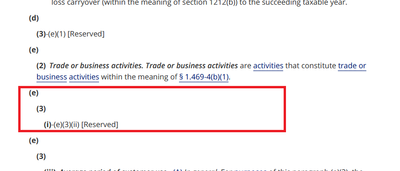

@AnnetteB6 yes, a cost seg was done and meet the qualifications under Reg. Section 1.469-1T(e)(3)(ii)(A), and defines exceptions to the definition of “rental activity”. Because I own, used it entirely for STR with avg stays less than a week and spend 100 + hours (all logged) and more than anyone else (I manage, clean, furnished, etc) but don’t see how in turbo tax to take those dedications against my active income since it’s now classified as non passive activity.

passes this check as outlines on this HR block flow when determining if it’s active or passive activity. You are supposed to be eligible for an additional 25k in losses from that STR property against active income. (Not full losses). https://www.hrblock.com/tax-center/wp-content/uploads/2018/05/airbnb-taxes.pdf

the system doesn’t seem to recognize this.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Material Participation to Recognize Rental Property Losses

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Material Participation to Recognize Rental Property Losses

@AnnetteB6 basically I need to understand where and how to tag that schedule E entry as Non passive activity. Can you advise how that’s done? Do I need to go to a form specifically and check something ?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Material Participation to Recognize Rental Property Losses

@tagteam my mistake, sounds like it’s unrelated to the 25K cap. There’s a separate exception which is for what I mentioned 7 days or less rentals and you meet one of the 7 rules. It’s still reported on a schedule E but I can’t seem to find where to tag it as non-passive, which will allow it to be used to offset w2 income. Anyone know where or how to

do that?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Material Participation to Recognize Rental Property Losses

@jvmoney wrote:

@tagteam my mistake, sounds like it’s unrelated to the 25K cap. There’s a separate exception which is for what I mentioned 7 days or less rentals and you meet one of the 7 rules.

Please note that the particular section of the Temporary Reg you cited has been omitted from the Final Reg.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

jeprice2842

New Member

nirbhee

Level 3

sselaya

New Member

Electric1

Level 1

56Huck

New Member