The amount of income for the taxable year required to be distributed currently to such beneficiary, whether distributed or not.

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: K1 Inheritance form from out of state

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K1 Inheritance form from out of state

What do I do with my 2019 K1 from South Carolina when I live in PA? My dad passed away and I just got the check this week and K1 form last month (K1 is dated 2019). I did not receive the money in 2019 so I am unsure why the executor is telling me to amend my 2019 taxes. Do I pay Federal and State? Any guidance on this would be greatly appreciated.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K1 Inheritance form from out of state

Which lines on your K-1 (1041) have figures on them?

You have to report the K-1 in the tax year in which it was issued (regardless of whether or not you received any funds). For example, if the K-1 was for the 2019 calendar year, then you would report it on your 2019 individual income tax return (Form 1040).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K1 Inheritance form from out of state

Which lines on your K-1 (1041) have figures on them?

You have to report the K-1 in the tax year in which it was issued (regardless of whether or not you received any funds). For example, if the K-1 was for the 2019 calendar year, then you would report it on your 2019 individual income tax return (Form 1040).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K1 Inheritance form from out of state

If there is no state K-1 then you pay taxes in PA. if there is a SC K-1, you may have to file in SC as a non-resident to pay taxes on the K-1 income. there are filing thresholds for SC so it may all depend on how much income the K-1 shows. If you do have to pay taxes to SC you still have to report the income for PA and Federal but PA will grant a credit for some or all of the taxes you owe to SC. you have to amend your Federal 1040 and PA returns to report the income since it seems you ignored the K-1 or had already filed the returns. if you owe the taxes on the amended returns you may be billed for late payment penalties and interest. Pay the taxes with the amended returns. if you owe SC pay with the return. they too may bill you for late payment penalties and interest. you can try to request abatement of the penalties if you get billed.

if you were not given a heads-up that a K-1 was coming, you need to talk to the administrator of the estate.

Unless the 2019 K-1 was final you need an estimate for 2020 so you can put that in your returns so you don't get hit with more penalties and interest.

you would have to talk with a lawyer to see if there is legal action you could take against the administrator to recoup any penalties and interest. WARNING. if the amounts are small it may cost you more in legal fees just to consult with a lawyer

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K1 Inheritance form from out of state

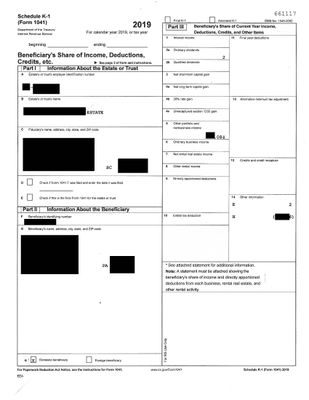

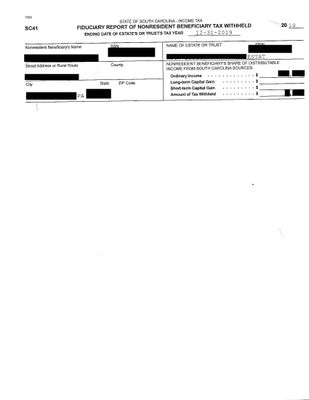

Ok Thank you so much for answering me! I have a Schedule K-1 (Form 1041) no state on it. I also have a SC1041 K1 and an out of state form from SC. I just need to know what to do to amend my taxes - I believe I have until 11/15. I have only had these forms about 3 weeks b/c she waited until the last possible second to file on the deadline in SC. I have attached them here and just blurred out my information. I figured this is easier for someone to help!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K1 Inheritance form from out of state

Please see my other reply for all the information!

Thank you so much!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K1 Inheritance form from out of state

you got a SC k-1 that reports income and apparently also non-resident withholding. So a 2019 SC non-resident return was due 4/15/2020 (based on SC instructions for who must file and when for a non-resident).

Your Federal and PA returns need to be amended to reflect the K-1.

If you used the online free edition of TT, it doesn't support k-1's. you may need to get the deluxe desktop software (1 state is free) so you'll also have to buy aSC as a second state. you should contact support for your options. that may push a free copy of TT to your computer so you only need to purchase SC.

5am-5pm Pacific Time (8-8 Eastern) Monday - Friday

https://support.turbotax.intuit.com/contact

if this seems beyond your capabilities then you should consult a pro.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K1 Inheritance form from out of state

@Anonymous wrote:if this seems beyond your capabilities then you should consult a pro.

I agree with @Anonymous, consult a tax professional since the Line 5 figure on your K-1, based on your redaction, appears as if it is a large number.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K1 Inheritance form from out of state

Thank you so much for your help! I will get it sorted out, just needed some insight!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K1 Inheritance form from out of state

Thanks! I agree, just wanted some insight!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K1 Inheritance form from out of state

one other point. for an estate to take a deduction for distributions to beneficiaries which results in them having taxable income they must either distribute the income for the calendar year 2019 during that year or make an IRC 663(b) election and make the distribution within 66 after the tax year-end for 2019 that would be by March 5, 2020 (the 65-day rule). if after that date the estate is not entitled to a deduction for the distribution to beneficiaries and no K-1 should be issued.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K1 Inheritance form from out of state

Except per Section 662 the amount deemed distributed to a beneficiary is the amount required to be distributed whether distributed or not.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K1 Inheritance form from out of state

So I was told by my sister that the executor did not pay estate taxes so it falls on us. WE did not get the K1 until October 2020!

I am talking to an old co worker today that is a CPA and IRS agent.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

biscuitme

New Member

keremyldz

New Member

PAMID7

New Member

vbm8786

New Member

jayolinger

New Member