- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: I have an LLC partnership. I used personal funds to pay business expenses. Can I take a deduction for the personal funds used to pay business expenses? If so, how would I include the amount on my ...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have an LLC partnership. I used personal funds to pay business expenses. Can I take a deduction for the personal funds used to pay business expenses? If so, how would I include the amount on my tax return?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have an LLC partnership. I used personal funds to pay business expenses. Can I take a deduction for the personal funds used to pay business expenses? If so, how would I include the amount on my tax return?

You can submit the receipts for the funds expended on behalf of the partnership for reimbursement.

You can deduct unreimbursed partnership expenses (UPE) if you were required to pay such expenses personally under the partnership agreement.

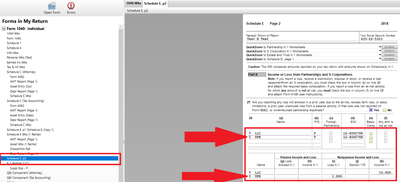

As you enter the K-1 you receive from the partnership, TurboTax will inquire as to whether or not you paid partnership expenses for which you were not reimbursed. The notation and amount will appear on Schedule E (see screenshot).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have an LLC partnership. I used personal funds to pay business expenses. Can I take a deduction for the personal funds used to pay business expenses? If so, how would I include the amount on my tax return?

I am using Turbotax business software, is there a section in the that software, where I would indicate the amount of personal funds used to pay business expenses using the business software, so that I can file my business tax forms?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have an LLC partnership. I used personal funds to pay business expenses. Can I take a deduction for the personal funds used to pay business expenses? If so, how would I include the amount on my tax return?

First if you are new to a partnership and filing a partnership return then I highly recommend you seek local professional assistance to get educated on the workings of partnership returns and the keeping of the books for the same. And if this is for the 2018 calendar year form 1065 be aware the return is now every late and the penalties and interest is accruing monthly.

Next ... those expenses would only be on the partnership return IF the partnership reimbursed the partner for the amount ... then they would be deducted as the kind of expense that was reimbursed for example if it was for office supplies it goes under office supplies. If the partnership did not pay back the partner then it goes on the partner's personal tax return as described in the other answer BUT only if the partner was required to incur those expenses per the written partnership agreement. Seek professional help if any of this sounds foreign.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have an LLC partnership. I used personal funds to pay business expenses. Can I take a deduction for the personal funds used to pay business expenses? If so, how would I include the amount on my tax return?

Hello Forum, I have another question on t his topic.

I paid some partnership expenses in late 2020. I will be reimbursed for these shortly (2021). These expenses were for startup costs (legal fees) and a computer.

2020 will be the first tax return for the partnership..

I am using cash basis accounting.

For t-tax business (and my books) I just created a "liability" account for the amount owed. When I report this liability in turbotax, it creates a entry of this amount for "recourse liabilities" on the General Partner K1 section K.

I am not sure of the significance of this and if it is right... I thought that partners liability entry was used when partners contributed property that came with debt/liabilities etc.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have an LLC partnership. I used personal funds to pay business expenses. Can I take a deduction for the personal funds used to pay business expenses? If so, how would I include the amount on my tax return?

The "loan" that was created and showing up as recourse liability is incorrect. It's not considered a recourse liability.

Here is an IRS explanation about recourse and nonrecourse debt.

Startup expenses must be recorded separately from computer expenses (equipment). Although it isn't recommended to mix personal and business funds, it happens sometimes, and that is fine. Startup costs are typically amortized. Up to $5,000 of these expenses are eligible to be expensed as a deduction, and the remainder is amortized over 15 years. Computers are depreciable assets. Here is a link about capital assets.

In Quickbooks, it would be "other current liability" and in TurboTax it's called a "non recourse loan." You'll need to reclassify the debt as nonrecourse. Here's how:

For the startup costs, from INTERVIEW mode on the FEDERAL TAXES tab, go to Deductions. When the software asks if you had any startup costs, click 'yes' and then input the information. Remove any amounts that you have under Liabilities.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have an LLC partnership. I used personal funds to pay business expenses. Can I take a deduction for the personal funds used to pay business expenses? If so, how would I include the amount on my tax return?

Hello Renee, thank you for the reply.

I had recorded the starup expenses as you describe in ttax and I think that this is all correct.

What I was trying to further record was the fact that:

- I paid these expenses personally while the LP was being setup late Nov. 2020

- The LP still hasn't paid me back

- I want to record that the LP owes me money so I thought this would just be a "liability" like an unpaid credit card or other bill.

- When the LP pays me in 2021 , the liability will disappear from the 2021 tax return, and the partners liability would also be eliminated.

I guess I should have collected my reimbursement in 2020 but I didn't :).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have an LLC partnership. I used personal funds to pay business expenses. Can I take a deduction for the personal funds used to pay business expenses? If so, how would I include the amount on my tax return?

There is still time for the LP to reimburse you in 2021, for the expenses paid from your personal funds.

As stated above by @tagteam you can deduct unreimbursed partnership expenses (UPE) if you were required to pay such expenses personally under the partnership agreement. In other words this must be written in the partnership agreement to use on your personal return.

- As you enter the K-1 you receive from the partnership, TurboTax will inquire as to whether or not you paid partnership expenses for which you were not reimbursed. The notation and amount will appear on Schedule E, page 2 when the return is completed.

@ReneeM7122 has explained how to record the current liability in her response.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have an LLC partnership. I used personal funds to pay business expenses. Can I take a deduction for the personal funds used to pay business expenses? If so, how would I include the amount on my tax return?

Hello DianeW, thank you for the reply.

My partnership agreement does not require me to pay expenses, so I can't use schedule E as you describe.

ReneeM explained how to record expenses for startup and other costs (which I have done), but also advised to me remove any liability entries. This would be correct if LP had simply paid its own expenses. But it doesn't fit my scenario. He/she did say this would be a nonrecourse loan which makes sense to me.

So I have the liability under "other short term liabilities" (entered in the balance sheet dialogue) which puts it on sched L. I then edited the 1065 and changed it from recourse to non-recourse loan (this done in the partners liabilities smart w/s).

Now the amount shows up as non-recourse loan portioned out in each partner's K1 section K. This seems logical to me.

I wonder if I should just skip the complexity and have the LP pay me the owed amount in cash? Just as If the LP had cut me a cheque in 2020 but I failed to cash it before 2021...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have an LLC partnership. I used personal funds to pay business expenses. Can I take a deduction for the personal funds used to pay business expenses? If so, how would I include the amount on my tax return?

Since you have the amount recorded as it should be I would not advise changing the information through a cash transaction after the fact since it has occurred at year end and into the new year.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

Reemo

Level 1

Dchackert

New Member

fillini00

Level 2

sherryburke1206

New Member

ajv28

New Member