- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: I had a NOL for tax year 2018. I thought I remembered that I would be able to carry this loss forward to tax year 2019. How do I figure this out within TT?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I had a NOL for tax year 2018. I thought I remembered that I would be able to carry this loss forward to tax year 2019. How do I figure this out within TT?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I had a NOL for tax year 2018. I thought I remembered that I would be able to carry this loss forward to tax year 2019. How do I figure this out within TT?

You have to manually calculate your NOL for 2018 and then enter that NOL into the 2019 program.

TurboTax does not support calculating an NOL and does not carry forward an NOL (or negative AGI).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I had a NOL for tax year 2018. I thought I remembered that I would be able to carry this loss forward to tax year 2019. How do I figure this out within TT?

I have calculated the NOL. It shows up in the worksheet but not on the tax form. Please advise.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I had a NOL for tax year 2018. I thought I remembered that I would be able to carry this loss forward to tax year 2019. How do I figure this out within TT?

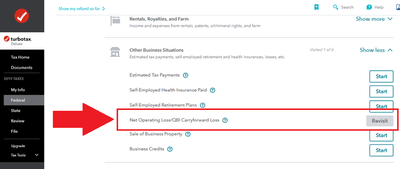

Which version of TurboTax are you using? You need to enter the NOL into the program (see screenshot).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I had a NOL for tax year 2018. I thought I remembered that I would be able to carry this loss forward to tax year 2019. How do I figure this out within TT?

My screen does not look like that. I am using Desktop version of Premier for Windows.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I had a NOL for tax year 2018. I thought I remembered that I would be able to carry this loss forward to tax year 2019. How do I figure this out within TT?

While inside the software and working on your return, type nol carryforward in the Search at the top of the screen (you may see a magnifying glass there). There will be a popup that says Jump to nol carryforward. Select that link.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I had a NOL for tax year 2018. I thought I remembered that I would be able to carry this loss forward to tax year 2019. How do I figure this out within TT?

@burgyathome Do you have a section in your version that reads "Less Common Business Situations"? If so, expand that section and see if there is an NOL entry line.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I had a NOL for tax year 2018. I thought I remembered that I would be able to carry this loss forward to tax year 2019. How do I figure this out within TT?

You have to manually enter in the "other Income" section as a negative number. and attach a written statement showing the calculation used to come up with the amount.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I had a NOL for tax year 2018. I thought I remembered that I would be able to carry this loss forward to tax year 2019. How do I figure this out within TT?

Desktop has a search box and if you type nol it will give you a jump link to the screen you need.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

ahabshire

New Member

NotLearnedHand

Level 2

aka51

Returning Member

passiveobserver

Level 2

RoseKo

Level 2