- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: I am Married Filing Joint. Tax Table says my tax should be $12,959. Why is my tax on Line 16 $12,902?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am Married Filing Joint. Tax Table says my tax should be $12,959. Why is my tax on Line 16 $12,902?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am Married Filing Joint. Tax Table says my tax should be $12,959. Why is my tax on Line 16 $12,902?

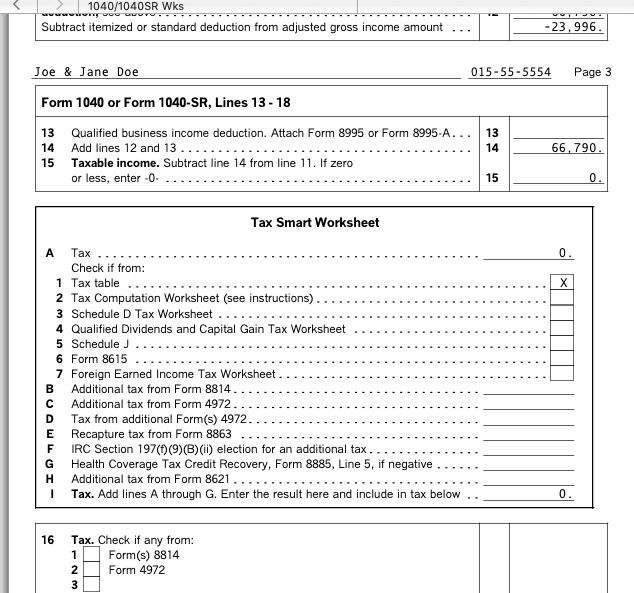

The tax table is only ine of 7 ways to calculate the tax depending on what is on the tax return. Moat often it is qualified dividends or capital gains that used a worksheet to calculate the tax since those are taxed at a different rate.

Print all forms and worksheets to see the 1040/1040SR Worksheet for the "Tax Smart Worksheet" that will show the method used.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am Married Filing Joint. Tax Table says my tax should be $12,959. Why is my tax on Line 16 $12,902?

I received a response, so now I am satisfied. Thank you!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am Married Filing Joint. Tax Table says my tax should be $12,959. Why is my tax on Line 16 $12,902?

Thank you for your reply. Since you stand behind the amount of my tax, I am satisfied that there is no error. I signed and mailed my return as Turbo Tax prepared it. Thanks again!

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

tdelsouz-tarrar-

New Member

michaeldora1644

New Member

venusaroberts

New Member

xwardestiny

New Member

art862

New Member