- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: How do I spread the tax liability of a CARES Act withdrawal over 3 years on Turbo Tax, it is ...

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I spread the tax liability of a CARES Act withdrawal over 3 years on Turbo Tax, it is putting all tax liability on this year

Where is this screen?? It is assuming I only want one third, but I want to pay tax on the whole thing this year.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I spread the tax liability of a CARES Act withdrawal over 3 years on Turbo Tax, it is putting all tax liability on this year

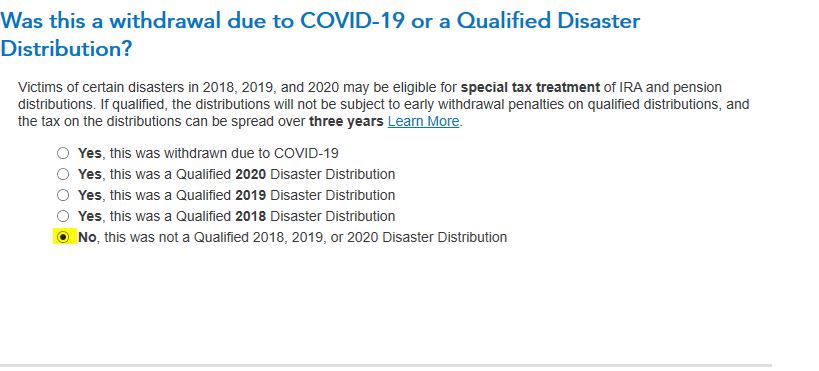

@LisaOD When you enter your form 1099-R, you will come to a screen that says Was this withdrawal due to COVID-19 or a Qualified Disaster Distribution?, that is where you can choose No, this was not a Qualified 2018, 2019 or 2020 Disaster Distribution. That will allow for the full distribution to be taxable in the current year.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I spread the tax liability of a CARES Act withdrawal over 3 years on Turbo Tax, it is putting all tax liability on this year

@LisaOD wrote:

Where is this screen?? It is assuming I only want one third, but I want to pay tax on the whole thing this year.

The answer by @ThomasM125 will indeed tax it all this year but will not eliminate the 10% penalty if you are under age 59 1/2, it must be COVID related to do that.

If you are using the online version then: Try deleting the 1099-R and the 8915E form and re-enter the 1099-R?

If using the CD/download desktop version then switch to the forms mode and select the 8915E form and near the bottom of Part I you will find "Taxable 3 year spread Worksheet" Check the box to pay it all in 2020, uncheck to spread over 3 years.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I spread the tax liability of a CARES Act withdrawal over 3 years on Turbo Tax, it is putting all tax liability on this year

I also am not seeing the ability to spread it over 3 years even though I qualify under the CARES act. Is there a reason why I do not have this option.

- « Previous

- Next »

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Navigation

Returning Member

taxbear09

New Member

triman023b

Level 1

jamesjohn94

Level 1

GlennD1

Level 1