- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Foreign Rental Property Depreciation - 30 or 40 year

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Foreign Rental Property Depreciation - 30 or 40 year

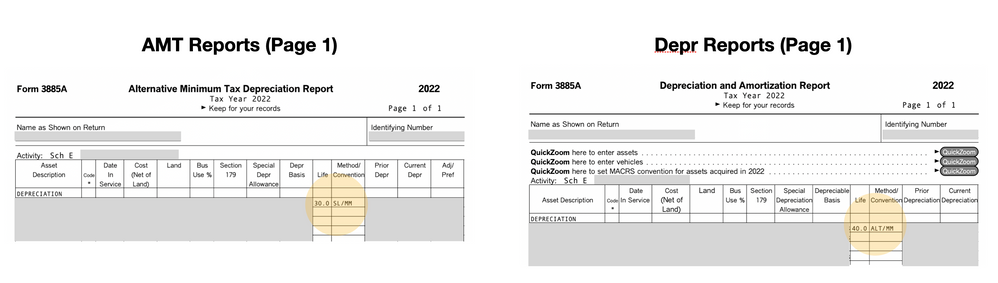

I have a foreign rental property. In TurboTax, I found there are calculations for both 30 years (SL/MM) and 40 years (ALT/MM). I'm wondering which calculation will be eventually used for my Federal and California tax return?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Foreign Rental Property Depreciation - 30 or 40 year

After further research, a resource was found that verifies the way TurboTax is handling the depreciation for the foreign rental property on the California return.

When the Federal tax law changed in 2017 due to the Tax Cuts and Jobs Act to shorten the recovery period for foreign rental properties from 40 years to 30 years, California state law did not conform to this change. They opted to keep the longer recovery period and then report the difference between the Federal depreciation and the California allowed depreciation as an adjustment on the California return. So, therefore, TurboTax calculates it both ways for the California return and includes the difference as an adjustment.

For your reference, here is a link to the document that states the Federal change in recovery period (see page 158 or the screenshot below) and then later the fact that California does not conform to the change (see page 159 or the screenshot below): Summary of Federal Income Tax Changes 2017

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Foreign Rental Property Depreciation - 30 or 40 year

If your property was put into service prior to 2018, then the 40 years (ALT/MM) is to be used. 30 years (SL/MM) is used if placed in service 2018 or after.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Foreign Rental Property Depreciation - 30 or 40 year

This foreign property was rented out after 2018/01/01.

However, in the tax return, I saw the depreciation is calculated by both 30 years (Depreciation value A) and 40 years (Depreciation value B).

And what's more, the difference C = A - B is added to my California state income, as "Net California Adjustment". Is it supposed to be this way?

Thanks!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Foreign Rental Property Depreciation - 30 or 40 year

I am not sure why it is calculating a 40 yr and a 30 yr depreciation schedule. At this point, we may need to take a look at your return by looking at a diagnostic.

It would be helpful to have a TurboTax ".tax2022" file that is experiencing this issue.

You can send us a “diagnostic” file that has your “numbers” but not your personal information. If you would like to do this, here are the instructions:

If using Turbo Tax online:

- Click on Tax Tools in the black left menu bar

- Click on Tools>share my file with agent

- press ok and you should get a token number. Reply back in this thread with the token number.

If you are using the software, select online>send tax file to agent. Here you should receive a token number and when you do, reply back in this thread letting us know what the token number is.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Foreign Rental Property Depreciation - 30 or 40 year

Hi Dave, the file has been sent, and the token number is 1112489. Thanks for your help and looking into this!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Foreign Rental Property Depreciation - 30 or 40 year

After further research, a resource was found that verifies the way TurboTax is handling the depreciation for the foreign rental property on the California return.

When the Federal tax law changed in 2017 due to the Tax Cuts and Jobs Act to shorten the recovery period for foreign rental properties from 40 years to 30 years, California state law did not conform to this change. They opted to keep the longer recovery period and then report the difference between the Federal depreciation and the California allowed depreciation as an adjustment on the California return. So, therefore, TurboTax calculates it both ways for the California return and includes the difference as an adjustment.

For your reference, here is a link to the document that states the Federal change in recovery period (see page 158 or the screenshot below) and then later the fact that California does not conform to the change (see page 159 or the screenshot below): Summary of Federal Income Tax Changes 2017

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

Ashleej828

New Member

obeteta

New Member

bruced63

New Member

user483784620

New Member

JMB011

New Member