- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Anyone else having problem e-filing with IRS Form 2210 under tax reform

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Anyone else having problem e-filing with IRS Form 2210 under tax reform

Description of error received:

"If Form 2210, Part II, Line A checkbox 'WaiverOfEntirePenaltyInd' is checked, then [WaiverExplanationStatement] must be attached to Form 2210."

So, I added "85% waiver" as my explanation on Form 2210 Part II Box A WaiverExplanationStatement.

eFile accepted!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Anyone else having problem e-filing with IRS Form 2210 under tax reform

My return continues to me rejected for this issue. Where does TurboTax say that they will have a fix for it? Is that February 22 date accurate? Thank you.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Anyone else having problem e-filing with IRS Form 2210 under tax reform

I put in "85% waiver" on Part II Box A checkbox line on Form 2210 just like you did and got rejected on Feb 15 and Feb 16. I assume you filed today on Feb 17? Maybe IRS has caught this issue, and fixed their e-file algorithm maybe just today??

I am down to 2 free e-files so I have to be careful to do this right within next 2 e-file attempts.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Anyone else having problem e-filing with IRS Form 2210 under tax reform

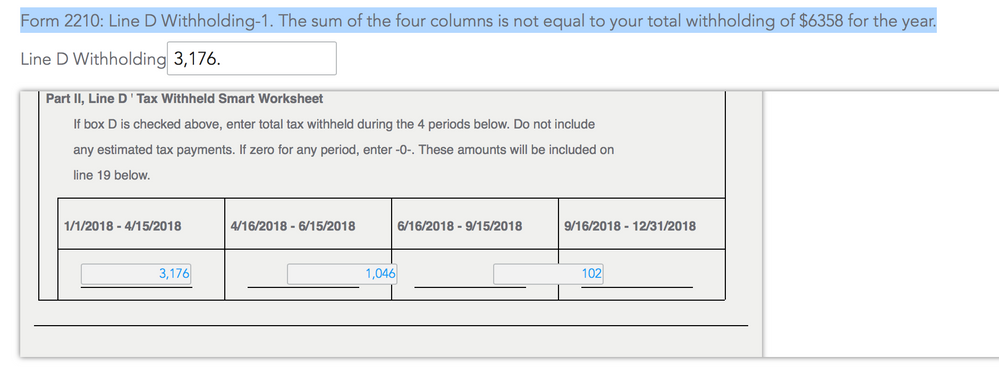

I'm having the same problem but when TT reviews, it kicks back saying "Form 2210: Line D Withholding-1. The sum of the four columns is not equal to your total withholding of $6358 for the year." For the sum it is only taking my first quarter 1040-ES payment instead of adding up all 4 payments. When I look at where the payments are listed I only see the first 3 payments in form fields. There is no 4th quarter form field! That fourth quarter payment was 888, but it's not showing. Not sure how they got the $6358 figure. Maybe because I tried doing the annualized income thing to try and get it accepted. Here is a screenshot of what I'm getting. IRS rejects it even if I try to send it anyway. I'll have to go to a tax guy if this isn't fixed soon. I hate the thought of that. I've used TT for several years now and have always been happy with it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Anyone else having problem e-filing with IRS Form 2210 under tax reform

> Is that February 22 date accurate?

That's what jgramil said yesterday in this thread that he was told about the download version of TT.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Anyone else having problem e-filing with IRS Form 2210 under tax reform

I am having the same problem with getting rid of form 2210. If you actually get the full form, which you cannot do (or even access) in the on-line version of turbotax, section III of the form specifies that form 2210 need not be filed if you paid more in estimated taxes than is due. As with others, however, I cannot delete the form and both my federal and state returns are rejected as a consequence. This is a software bug that intuit had better fix if it wants my continued business after 15 years. I did not pay $139 for the pleasure of filing a paper return. Their customer service on this issue is abysmal. Nobody has a clue.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Anyone else having problem e-filing with IRS Form 2210 under tax reform

Thanks. I'm using the online version, so not sure if they can update it as well.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Anyone else having problem e-filing with IRS Form 2210 under tax reform

I am on the phone with Intuit support about this right now. I am facing the exact same issue with the online version. I am trying to get them to grant me a copy of the desktop version to see if that works. Can others who have been successful confirm what they did was with the desktop version?

Thanks

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Anyone else having problem e-filing with IRS Form 2210 under tax reform

e-filing does not work for the desktop version either with IRS Form 2210. I tried several "fixes" and resubmitted the return but each time it was rejected. Are these refilling of the same return eating up my 5 free federal e files?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Anyone else having problem e-filing with IRS Form 2210 under tax reform

I will ask this guy when he gets back from putting me on hold.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Anyone else having problem e-filing with IRS Form 2210 under tax reform

Thanks. This has been a big waste of time!!!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Anyone else having problem e-filing with IRS Form 2210 under tax reform

Select "Yes" to question that asks if you want to request a waiver to the underpayment penalty and in your explanation you can reference the 85% threshold due to the with-holding changes implemented in 2018 (assuming your tax due is >85%, but <90%) . This will add the Form 2210, which will have Part II, Line A checkbox 'WaiverOfEntirePenaltyInd' selected and thus require the [WaiverExplanationStatement] referencing 85% to be attached to Form 2210. This should get federal to accept the efile.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Anyone else having problem e-filing with IRS Form 2210 under tax reform

Yes, I e-filed successfully today, 2/17/19, on my third attempt. I had to leave form 2210 attached (although I did not receive an underpayment penalty) and had to add the explanation form (referencing 85% threshold) to get the algorithm to accept it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Anyone else having problem e-filing with IRS Form 2210 under tax reform

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Anyone else having problem e-filing with IRS Form 2210 under tax reform

clagstar - you're using the desktop version correct? I think the issue many of us are seeing that this is not fixable on the online version. The guy on the support line is telling me I cannot get the download version despite having paid $60 already and the won't refund me, and that I need to file the return by mail. I am now arguing over getting a refund for the $60 I paid. I am not using TT again at this rate.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Rjkast

New Member

nicekeech

New Member

joannabanana6

Level 2

hoch

Level 3

trust812

Level 4