- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Post Secondary Education Expenses Missing in Turbo Tax Deluxe 2022

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Post Secondary Education Expenses Missing in Turbo Tax Deluxe 2022

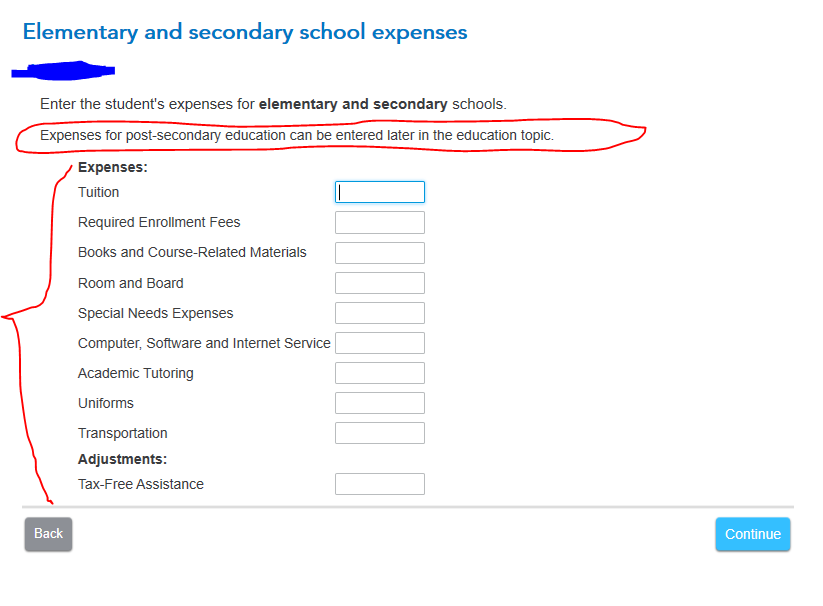

I only see where to enter in Post Secondary Expenses in the Form View. It's not in the walk through section. The only education expenses I see are for elementary and secondary schools and it says you will see post secondary later...but you do not. Also because of this it seems to want to tax my 1099-Q form at 10 percent. Is this a glitch? I thought with the Deluxe version I should be able to enter this in the Walk-Thru form vs trying to do it myself in the forms. Please help!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Post Secondary Education Expenses Missing in Turbo Tax Deluxe 2022

Please clarify

Are you are entering a 1099-Q?

What was the distribution used for ?

Who is the student?

Did you (or the student) also get a 1098-T?

Is the student you or your dependent and claimed on your tax return?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Post Secondary Education Expenses Missing in Turbo Tax Deluxe 2022

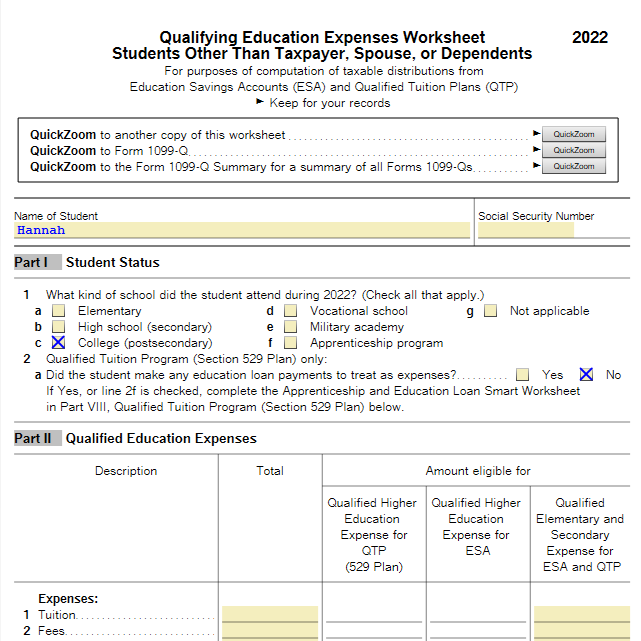

The student would be a dependent to be claimed on my tax form.

The student did get a 1098-T and a 1099-Q. I can see the Start and Update buttons of those in the Education section of the deductions. What is not working and is where you can enter the qualifying expenses for higher education. Because of that I do not think it is pulling the 1098-T and Q information properly either.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Post Secondary Education Expenses Missing in Turbo Tax Deluxe 2022

Is this your return claiming the student as your dependent?

Did you first enter the 1098-T ?

The screen you are showing me is only for Elementary and Secondary school, so K-12.

That would only pertain to a 529 distribution which was used for K-12.

You may want to revisit how you entered the 1099-Q,

this indicates that you may have selected that it was used for K-12 education expenses.

In the 1099-Q interview you need to select

"Attended College/vocational school in 2022"

If this is for College, the 1098-T needs to be entered in the Education section and from there, you can continue to add other expenses which are not reported on the 1098-T.

To enter additional expenses, such as Room and Board (which can offset a 529 distribution, but cannot be applied to a credit)

select Expenses and Scholarships (Form 1098-T) and enter the 1098-T

(if you already entered it, click Edit next to the name f the student which will bring you to a "Here's Your Education Summary" page

Click Edit under Tuition to enter the 1098-T

be sure to select Start or Edit for Other Education Expenses (under Tuition) to enter expenses not on the 1098-T

Next select YES to "Did you pay for Books or Materials to attend school?" to add other expenses relating to college expense.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

Irasaco

Level 2

ualdriver

Level 3

astrz

New Member

ndfontenot

New Member

larockmanhere

Returning Member