- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Please help me figure out how to correct the schedule c error I made on my taxes on Turbo Taxes.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Please help me figure out how to correct the schedule c error I made on my taxes on Turbo Taxes.

Greetings,

I was in the process of finishing up my taxes on Turbo Tax when I ran into a snag. Turbo Tax (It says Turbo Tax premium) gave me the option to sign into my bank account to locate expenses that could be deductible for self-employment. I signed into my bank account, and the feature on Turbo Tax located a plethora of expenses that could be counted as deductible for my self-employment. This more than doubled my state and federal refund amount. I was ready to file my return, and Turbo Tax asked me to review some issues. I was asked to complete a question on the Schedule C regarding whether the investment was all at risk or some of it was at risk. I incorrectly answered the question, and it drastically decreased my state and federal refund. I've been trying to find out how to go back and correct the question. I've spoken with Turbo Tax, and I was told to use the "delete form option and delete the schedule C to try and re-prompt the question again. Unfortunately, this did not work. I also have tried to clear everything and start over, but this is disallowed because I filed my return and it was rejected, which forced me to refile. However, I merged my bank account to locate self-employment deductions AFTER the file was rejected. Please help! I want to file my return at the amount it was prior to my answering the "at-risk" question incorrectly. Thanks in advance!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Please help me figure out how to correct the schedule c error I made on my taxes on Turbo Taxes.

You can get back to the question about your business investment being at risk by going to the Schedule C and finding the Final Details > Special Situations section (if using TurboTax Home and Business) or the Uncommon Situations section (if using TurboTax Self-Employed Online).

Within those sections, there will be a check-box to indicate 'I have money invested in this business that I'm not at risk of losing; that is, certain cash, property, or borrowed amounts that are protected from loss.' Uncheck that box if your investment in your business is not at risk.

For more information about this, see the following TurboTax help article:

Is my business investment at risk?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Please help me figure out how to correct the schedule c error I made on my taxes on Turbo Taxes.

Hi!

I haven’t located the section you referenced in the instructions. Do you have a video example?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Please help me figure out how to correct the schedule c error I made on my taxes on Turbo Taxes.

Open your return and go to your Schedule C business page. Scroll down below Expenses, Income, and Business Summary to Uncommon Situations and click Edit to the right of this topic. On the page "Do you have any of these other business situations?" be sure the box is NOT checked for "I have money invested in this business that I'm not at risk of losing." See the screenshot below.

The easiest way to find Schedule C in TurboTax is to open your return and use the Search box at the top right side of the TurboTax header. Click on the magnifying glass, type in "schedule c", hit Enter, and click the "jump to" link to go directly to beginning of that topic.

Or go to the left column in TurboTax Online and click on Tax Tools >> Tools >> Topic Search. Type in your topic, then click the topic in the list to go directly to the start of that section.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Please help me figure out how to correct the schedule c error I made on my taxes on Turbo Taxes.

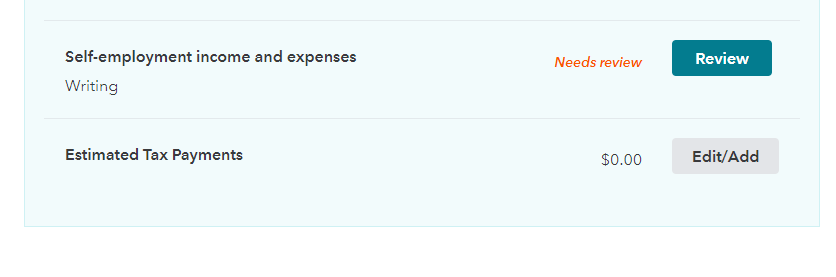

Thanks for the reply! The issue is that I do not have an "edit" option. My self-employment work summary screen only says review. After I click on "review", the website still doesn't give me an "edit" option. I've been trying to figure this out since March. By chance, is there an option for a tax expert to schedule a time to call me in an effort to rectify this? I've spoke with several Turbo Tax representatives and I spoke to one for about 2 hours today trying to figure this out. I'm simply trying to re-enter the question regarding my investment being at-risk. The representative suggested that I delete the 1099 information and delete my bank account information. I'm not sure of how to do this. I have Turbo Tax deluxe (my home screen says premium for some reason), but the representative said to delete the 1099 info and delete the imported data. I don't seem to have that option either. I truly need assistance. I attached a photo for reference.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Please help me figure out how to correct the schedule c error I made on my taxes on Turbo Taxes.

Yes, you can click on Review to open up the Self-Employment section.

Next, when you come to the screen that says Here's your <Business name> info at the top

Scroll all the way down to the bottom, to UNCOMMON SITUATIONS and click on Edit or Review

Unselect the box for I have money invested in this business that I'm not at risk of losing; that is, certain cash, property, or borrowed amounts that are protected from loss.

And select the box for None of the Above, if that is correct and click on Continue at the the bottom right.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

TomG6

New Member

obeteta

New Member

NeUnhappy

New Member

Melissa-cooks7

Returning Member

Fuzzy Red Baron

Returning Member