- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- NJ State Tax Reporting for Backdoor Roth IRA Conversion

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NJ State Tax Reporting for Backdoor Roth IRA Conversion

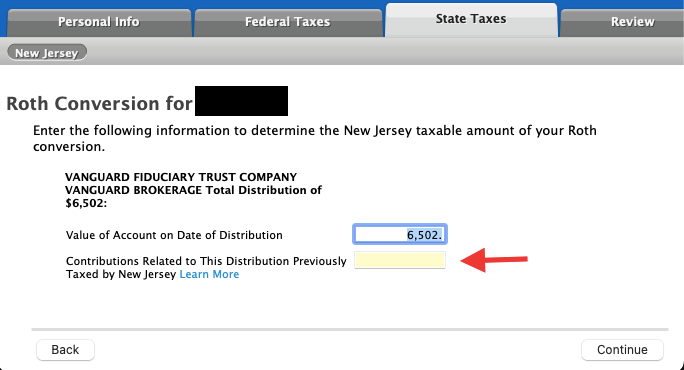

When completing my New Jersey state tax return, I encountered a field labeled

- Contributions related to this distribution previously taxed by New Jersey.

Could someone please clarify what I should enter in this field?

Context: I performed a backdoor Roth IRA conversion in 2023. In 2023, I contributed $6500 to a traditional IRA, which accrued $2 in interest by the time I converted the entire amount ($6502) to a Roth IRA. Should I include the full $6500 contribution amount, considering it was contributed to the traditional IRA or $6502 or some other field from my form 1099-R?

Any assistance with this matter would be greatly appreciated. Thank you in advance!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NJ State Tax Reporting for Backdoor Roth IRA Conversion

You will enter the $6,500.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NJ State Tax Reporting for Backdoor Roth IRA Conversion

You will enter the $6,500.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

mbtn

Level 1

thegoodreturn

Returning Member

Greg RZB

Level 1

aayush246

Returning Member

sevens777

Returning Member