- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- New York income allocation after moving to New Jersey area

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

New York income allocation after moving to New Jersey area

It is well known that New York requires total Federal wages to be reported in Box 16.

I have a tax situation. I worked for the same employer the entire year 2022.

- 1/1/2022 to 8/8/2022 - lived in Indiana. Working remotely. All my paychecks showed Federal+Indiana tax withholdings. This equals 220 days in Indiana.

- My employer asked me to move to New York area.

- 8/9/2022 to 12/31/2022 - lived in New Jersey. Worked for same employer in New York City. All paychecks showed Federal+New York tax withholdings. This equals 145 days in New Jersey.

Question: While filing for taxes using TurboTax. It is saying: "since you were a nonresident of New York, we need to figure out how much was earned in NY state and how much is earned somewhere else".

How should I allocate NY income? Should I do 145/365 = 39.72% of the year?

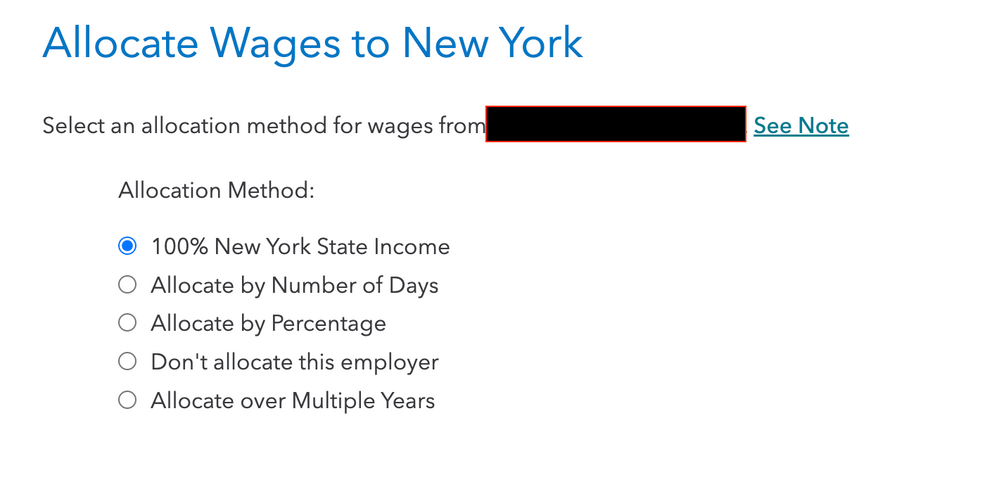

It is showing me these options.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

New York income allocation after moving to New Jersey area

If you actually (physically) worked within New York State from 8/9 to 12/31 only, and you never set foot in NY prior to 8/9, then the allocation % you should use is: income earned from 8/9 through 12/31 divided by total income for the tax year.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

psh84

New Member

nitesho

New Member

pghdznygrl

New Member

kejia-shi

New Member

vnparaskov

New Member