- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Need help with K1 from Energy Transfer

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Need help with K1 from Energy Transfer

Do I need 4 K1s as follows?

1 to enter part III of the main info (1st page

and 3 for each entities in the supplemental K1 (ET, USAC, SUN)

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Need help with K1 from Energy Transfer

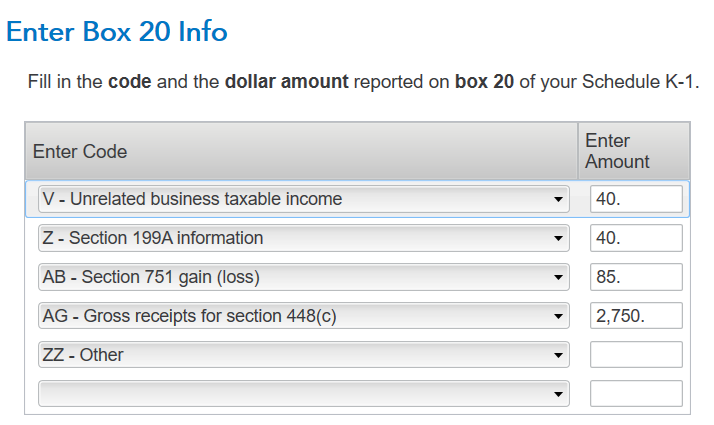

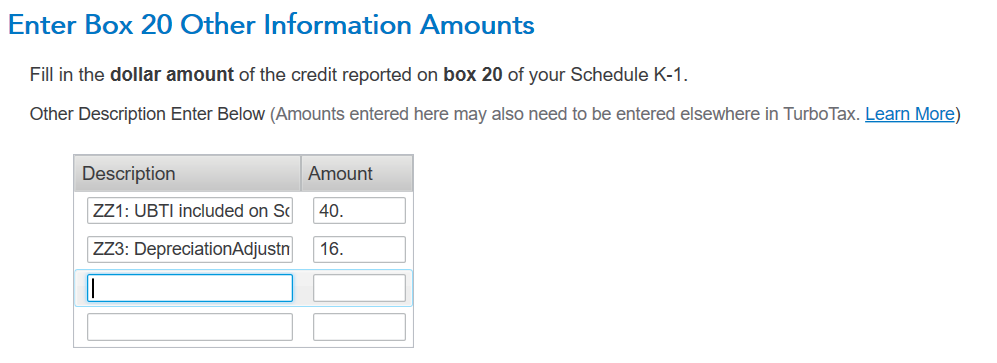

Also Did I enter box 20 correctly

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Need help with K1 from Energy Transfer

By the way I sold all my shares last year because of the headache at tax time.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Need help with K1 from Energy Transfer

On "describe how you disposed this partnership/LLC", What does "No Entry" option mean? Do I pick that or "Complete disposition"

I sold all shares last year through my brokerage account

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Need help with K1 from Energy Transfer

Another question: Should it be treated as part of a combined business? I have small side gig and report self employment income.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Need help with K1 from Energy Transfer

No. These are two separate business interests. Besides, you do not report an entry in Box 14 of a K-1 in a Schedule C because your share of the profit and loss is reported in Box 14. If it is a profit, you will be assessed a self-employment tax.

You would report this as a liquidation of partnership interest if that choice appears before you, if working in the desktop version of Turbo Tax. If online, pick Disposed of a portion of my interest in partnership during 2023.

Your Box 20 entries look good especially the ZZ details.

Anyhow, enjoy the remainder of your year.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

diaspora1010

New Member

ccacioppo

Level 1

scardekat01

New Member

bobdolan

New Member

megan0956

Returning Member