- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- My daughter is in college in MA and her health insurance is from GA trough my job. She didn't received the form MA1099hc and Turbotax don't let me efile the taxes. Help

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My daughter is in college in MA and her health insurance is from GA trough my job. She didn't received the form MA1099hc and Turbotax don't let me efile the taxes. Help

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My daughter is in college in MA and her health insurance is from GA trough my job. She didn't received the form MA1099hc and Turbotax don't let me efile the taxes. Help

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My daughter is in college in MA and her health insurance is from GA trough my job. She didn't received the form MA1099hc and Turbotax don't let me efile the taxes. Help

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My daughter is in college in MA and her health insurance is from GA trough my job. She didn't received the form MA1099hc and Turbotax don't let me efile the taxes. Help

As a student attending college out-of-state, she is considered to remain a resident of her home state unless she takes action to establish residency in another state (does not have to be the state where she goes to college). The time she spends there is irrelevant while a student.

See "What makes you a resident of a state (or country)?" at the bottom.

When she completes the Personal Interview:

- Select Georgia as the state of residence on December 31, 2016;

- Answer "No" when asked if she "Lived in another state in 2016?" That question only applies if you changed your state of residence in 2016.

- Answer "Yes" when asked if she "Earned money in another state?", that state being Massachusetts.

This will prompt the program to prepare a non-resident MA return and a resident GA return. The non-resident MA return interview won't ask about MA health care forms

If she has to pay tax to MA, GA will also want to tax that income but will give you a credit (against GA tax, for the amount paid to MA on the same income.

What makes you

a resident of a state (or country)?

Generally, you're a resident of a state (or country) if you intend to either stay there permanently, or return there after a temporary absence. It's where home is – where you come back to after being away on vacation, business trip, overseas or out-of-state employment, or school. Many factors are considered, not the least of which are where you are registered to vote, own homestead property and are licensed to drive.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My daughter is in college in MA and her health insurance is from GA trough my job. She didn't received the form MA1099hc and Turbotax don't let me efile the taxes. Help

I am in this same situation, even though I have it filed as a nonresident, it is making me fill out the health insurance portion of the MA refund. I do not have a 1099HC. I do not have a box to check that I don't have the form. I tried deleting the form and it's still asking me for the information.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My daughter is in college in MA and her health insurance is from GA trough my job. She didn't received the form MA1099hc and Turbotax don't let me efile the taxes. Help

It depends. Makes sure you indicate you are a non-resident and not a part-year resident. If you file a NR return, you should not be asked questions regarding health insurance.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My daughter is in college in MA and her health insurance is from GA trough my job. She didn't received the form MA1099hc and Turbotax don't let me efile the taxes. Help

I've confirmed that I'm attempting to file as a Nonresident, I'm still being asked these questions and I am not sure what to do!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My daughter is in college in MA and her health insurance is from GA trough my job. She didn't received the form MA1099hc and Turbotax don't let me efile the taxes. Help

Follow these steps for a workaround:

- Select the it met coverage all year. The note on the screen tells you that even if you were only there part of the year and met the rules, select all year.

- Select I had something else

- Select Other Government Programs

- Enter program name - enter Private Insurance in GA

- continue

Since a nonresident is not subject to the rules, this gets you around the issue and also tells them why.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My daughter is in college in MA and her health insurance is from GA trough my job. She didn't received the form MA1099hc and Turbotax don't let me efile the taxes. Help

Thank you so much for your help!

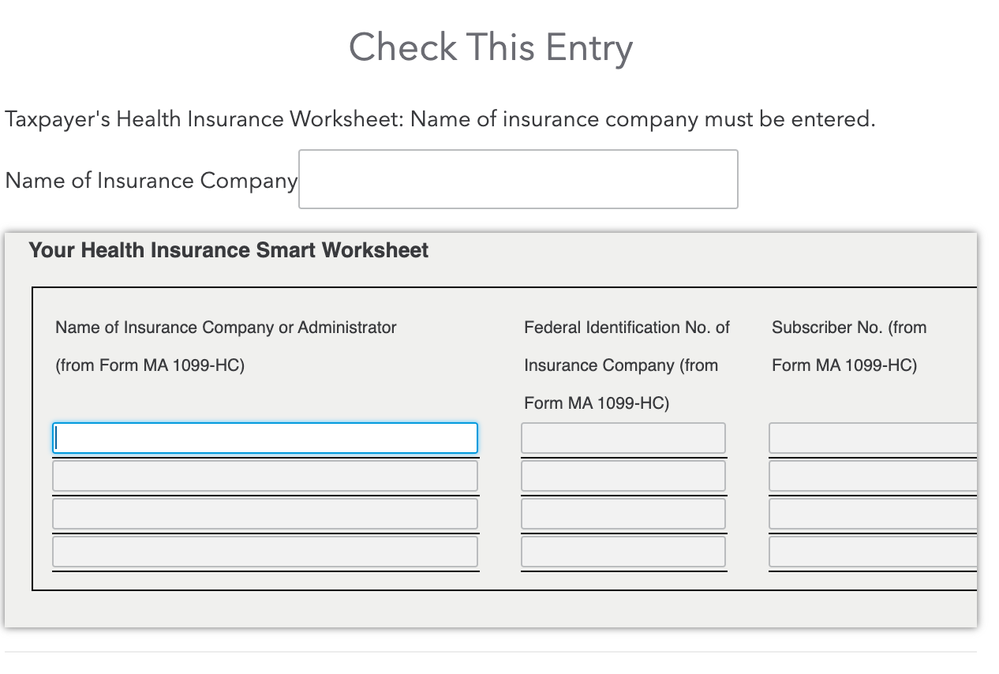

This makes sense, but please find the format that the questions are asked below, this is the first question, then followed by subscriber no., and Ins Co ID number, none of which information I have!

Additionally, it already has "private insurance" pre-checked on the "Schedule HC Worksheet"

Again, thanks so much for your help!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My daughter is in college in MA and her health insurance is from GA trough my job. She didn't received the form MA1099hc and Turbotax don't let me efile the taxes. Help

You should be able to add the other check box and fill in the information. Continue, then go back and uncheck your private insurance box. Since it is showing up as already selected, it must be coming from something in the federal You may have to delete some insurance form you have entered that is causing the issue. Maybe an HSA account?

Before you do all that, let's try something else since you should not be going through this. Follow these steps:

Desktop version:

- Delete the form

- Save your return while closing the program.

- Update the program

- Open

- Enter the information again.

Online version:

A full or corrupted cache can cause problems in TurboTax, so sometimes you need to clear your cache (that is, remove these temporary files).

For stuck information follow these steps:

- Delete the state -if possible

- Log out of your return and try one or more of the following:

- Log back into your return.

- Enter the information again.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

DomN9

New Member

likungchuen

New Member

DanTheDapperMan

Level 1

kheimbuch

New Member

Jojoz

New Member