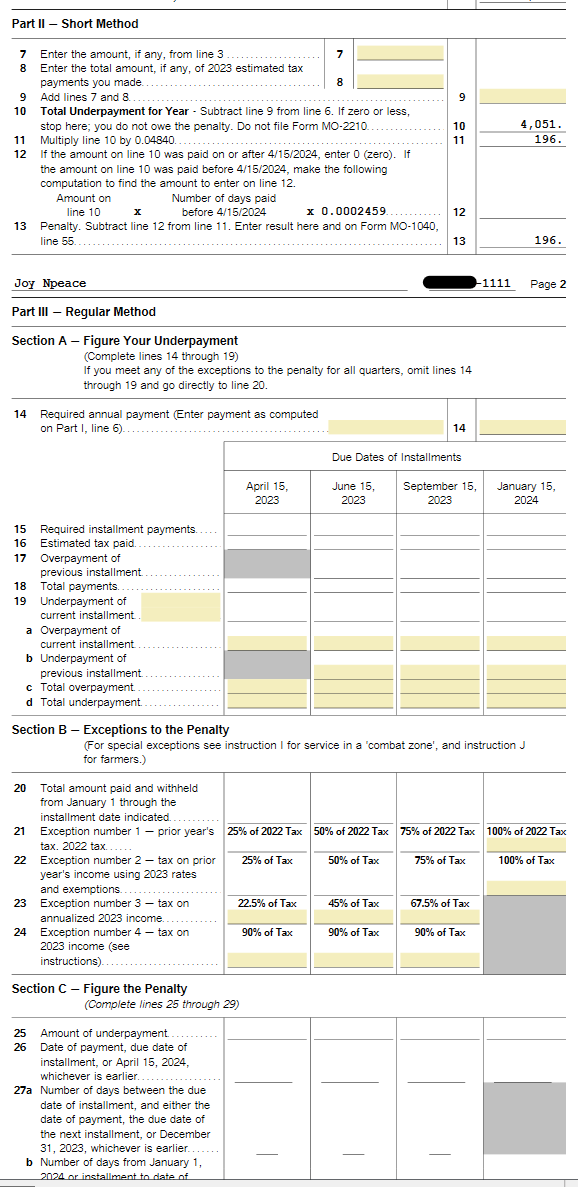

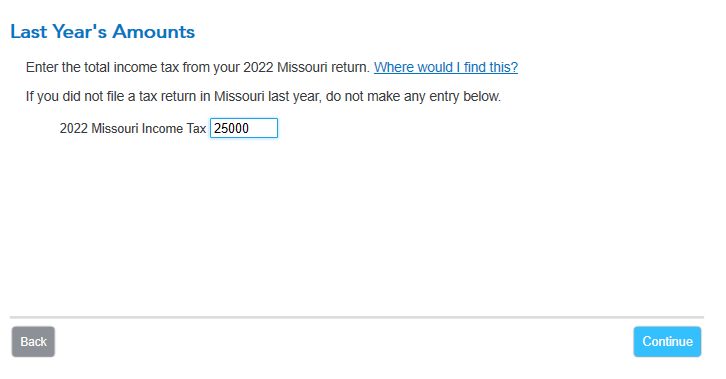

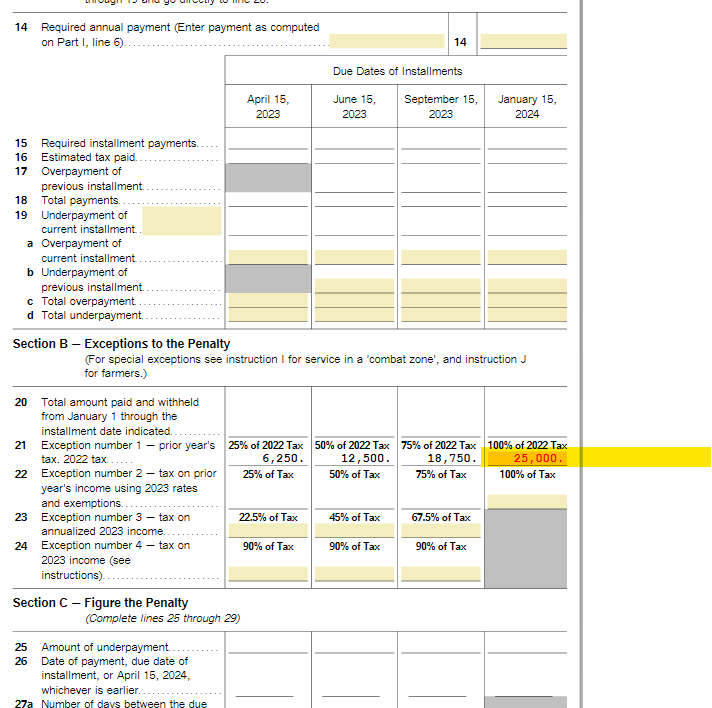

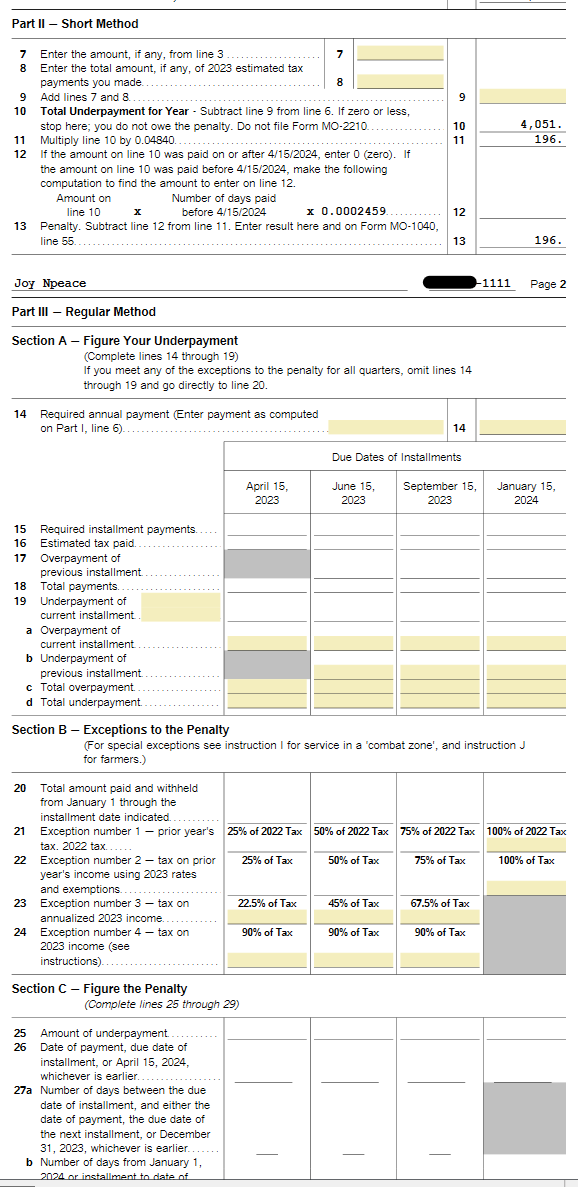

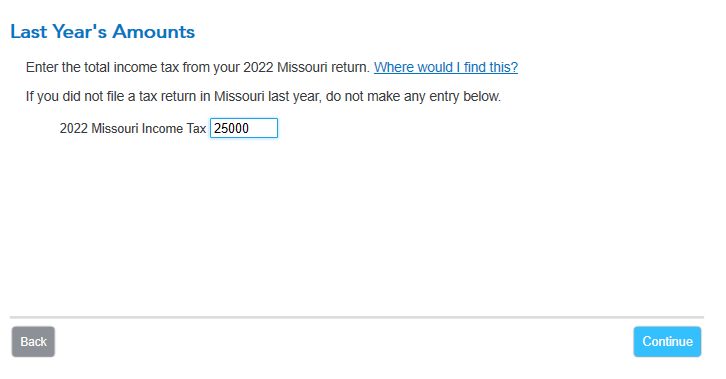

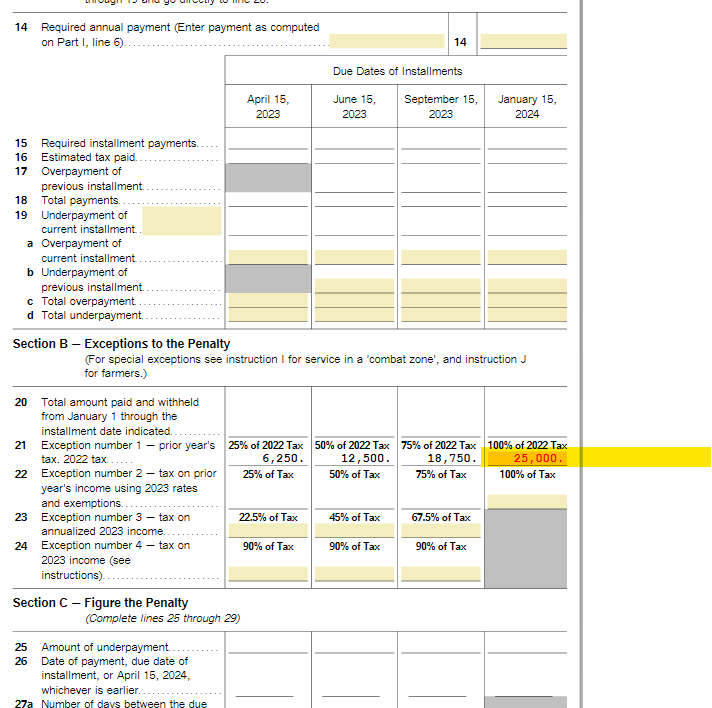

The MO 2210 will automatically do the short method. You have to go into the program and enter the annualization amounts to use the regular method. The program does have a spot to enter last year's tax liability for line 21 and that can change the tax liability.

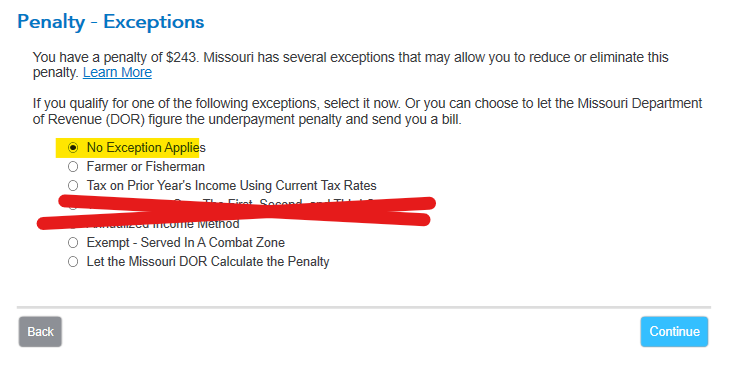

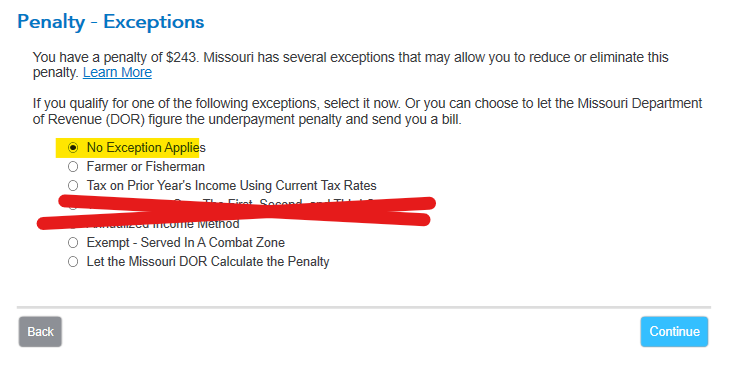

As you continue through the program, it will ask about exceptions and you can choose to fill in lines 14-19. Since those are the lines causing you trouble, delete those entries by going back in and removing the entries, then go back and select no exception applies to remove lines 14-19.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"