- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Land Market value or Assessed value? This year's tax bill or the tax bill from the basis year?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Land Market value or Assessed value? This year's tax bill or the tax bill from the basis year?

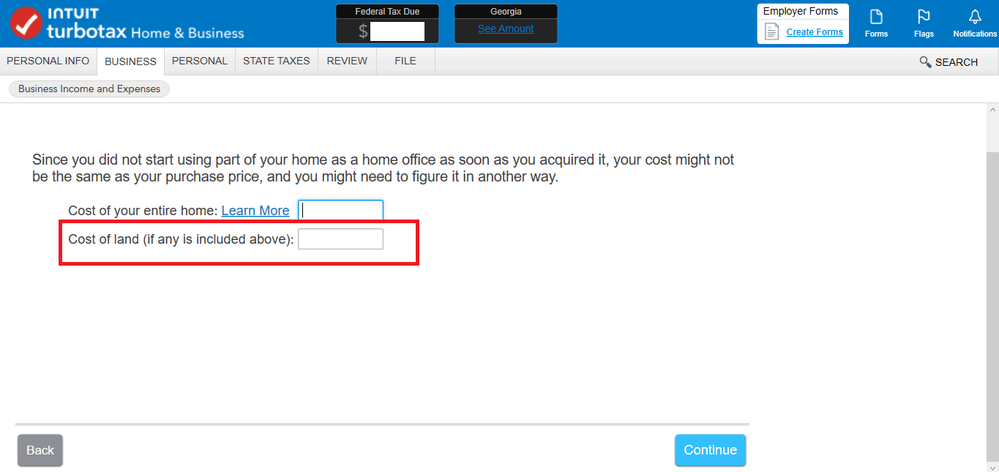

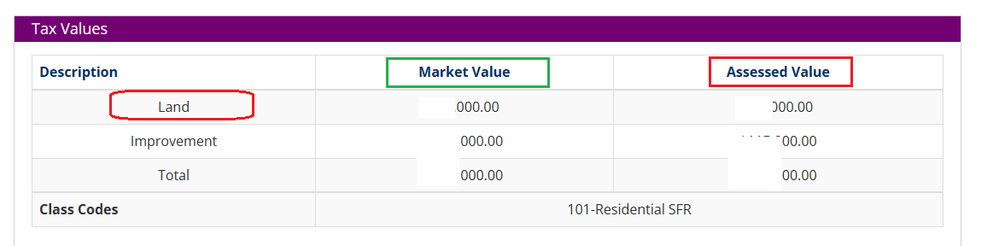

In the TurboTax software Home & Biz, in the home office section, which figure should I enter for the cost of land (if any is included above)? In my 2023 property tax bill, there are two figures for land: Market value and Assessed value. Which one is the correct one for the cost of land (if any is included above)?

Regarding the line above the cost of land, which is the cost of your entire home, should I choose basis because the current home market value is higher than basis, right? If I choose basis and take the value from 2010, then for the cost of land, should I also take the value from my 2010 property tax bill instead of the 2023 property tax bill?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Land Market value or Assessed value? This year's tax bill or the tax bill from the basis year?

Leave the land entry blank and enter the entire cost basis of your home in the first box. You do not enter the current market value of the house.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Land Market value or Assessed value? This year's tax bill or the tax bill from the basis year?

I don't see where to enter box 1 on Form 1098 for home office expenses. Where do I enter the mortgage interest from box 1?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Land Market value or Assessed value? This year's tax bill or the tax bill from the basis year?

To enter mortgage interest.

- Go to federal

- Deductions and Credits

- Your home

- mortgage Interest

- Answer the questions until you reach a screen titled let's Get the Details from your 1098

- The form will appear and you will enter the mortgage interest amount in Box 1

The home office expense is different. If you are self-employed and preparing a self-employed return, there is a entry to be made within the expense section to claim the deduction. If you are an employee though, you would enter this in Deductions and Credits>employee business expenses>job related expenses.

Because of the Tax Cuts and job Act in 2018, home office expenses for employees are no longer deductible on a federal return but if you live in the states of Alabama, Arkansas, California, Hawaii, Minnesota, New York and Pennsylvania, these are deductible on the state returns. You would enter this in the federal return in Deductions and Credits>employee business expenses>job related expenses and the information will flow to your state return if you live in one of those states.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

shawnmerrick8614

New Member

banpicker

New Member

Kim C1

Returning Member

CHICATEMI

Level 1

TheWisdom

Level 3