- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- K-1 (form 1065) - How do I enter the sale information for an LP that ended last tax year?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K-1 (form 1065) - How do I enter the sale information for an LP that ended last tax year?

To clarify, where are you trying to enter this information?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K-1 (form 1065) - How do I enter the sale information for an LP that ended last tax year?

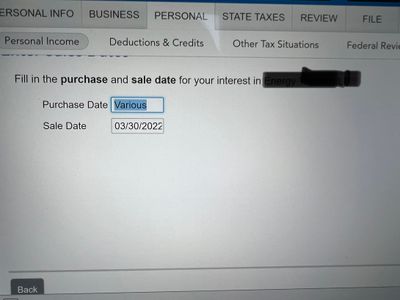

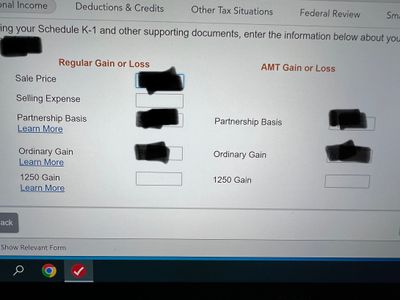

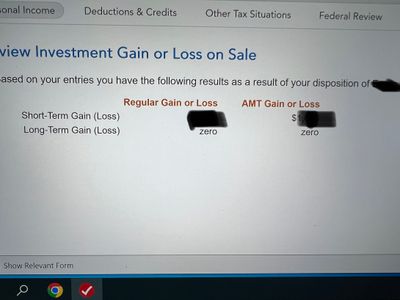

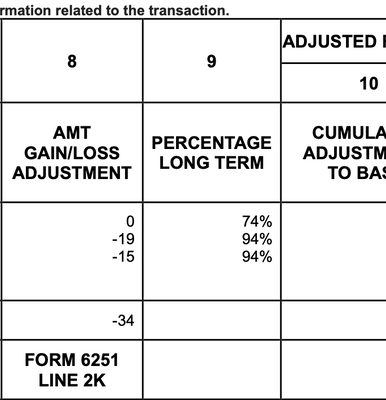

My K-1 sale information for LP has Purchase Date as Various and Sales Date as 03/30/2022. When I entered Sale Price, Partnership Basis, and Ordinary Gain, it always shows the Gain/Loss as Short Term Gain/Loss while the box 9 PERCENTAGE LONG TERM on my K1 is not 0% nor 100% of Long Term. I'm not sure how to enter the information so that it will put the correct amount for the short term and the long term.

Any help is greatly appreciated!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K-1 (form 1065) - How do I enter the sale information for an LP that ended last tax year?

Please clarify if you are reporting the sale of your partnership interest or if you are entering sales information from Schedule K-1.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K-1 (form 1065) - How do I enter the sale information for an LP that ended last tax year?

@PatriciaV I got helps from nexchap in this thread already . Thank you.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K-1 (form 1065) - How do I enter the sale information for an LP that ended last tax year?

Perhaps you add some insight into my K1 situation for tax year 2022. I received a K1 from Cypress Environmental this year for tax year 2022. The cover sheet stated the partnership did NOT qualify as a partnership in 2022. The k1 therefore contains all zeros, and no sales schedule. At 1/1/2022 I had 245K units, which were sold at a loss in 2022, right before they filed for ch11. I have a large "passive loss" from previous years carry I intend to use. The "loss" gets released into my tax return on complete disposition of units on Sch E, but I cannot figure out how to calculate "ordinary gain" from sale on units, which gets reported on Form 4797.

Capital account at year-end was positive 200K and passive loss carryover at year end was (160K). Any insights as to how I can figure "ordinary gain" for Form 4797 from the sale of approx 245k units??

Per the partnership cover letter for 2022....."For the year ended December 31,

2022, CELP did not generate sufficient qualifying income, as defined by the Internal Revenue Code, to qualify as a partnership, and accordingly CELP is treated as a corporation for federal income tax purposes effective January 1, 2022. As a result, the enclosed schedules do not include any

information regarding the income and expenses of CELP subsequent to December 31, 2021, nor any information on any purchases or sales of CELP common units that you may have made subsequent to December 31, 2021."

thanks

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K-1 (form 1065) - How do I enter the sale information for an LP that ended last tax year?

I've only made it part way through this post, but after scouring the Internet for a good part of the evening and being told what is probably incorrect information by one of the Turbotax Experts that I got a call from, this is the single most helpful, best written, clearest description I have seen of the hot mess TurboTax makes of the whole K-1 thing. Thank you. A ton. I'm going to go get some sleep and look at this tomorrow, but I just wanted to say thank you for doing TurboTax's job for them and taking the time to help some of us hapless do-it-yourselfers on the Internet in a clear and helpful way. I'm sure it took some time for you to write this up (not to mention for you to figure it out yourself!), and I definitely appreciate it.

Fantastic work, and thanks again!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K-1 (form 1065) - How do I enter the sale information for an LP that ended last tax year?

Many, many thanks to the people involved in this thread, especially TaxationIsTheft1776! There is no way we could've filled this part of TurboTax out without your help here and in the above thread replies.

Thank you so much for taking the time to do this and doing it so thoroughly, clearly, and well! We had 3 different TurboTax experts call us (now free with our version/level of TurboTax!), and 2 out of the 3 gave us incorrect information (based on this and on the fact that you literally cannot type amounts as small as one told us to use off of the K-1 part II J section - note to readers, DO NOT enter that info into the Partnership Basis question!). The one who DIDN'T give us incorrect information SOUNDED like he knew about K-1s, but immediately after saying not to worry, K-1s are very confusing, we got disconnected, so he didn't have much of a chance to give us information. He did sound confident, though, and I wish we could've had him call us back rather than having to call back in ourselves and get someone who didn't understand as well.

Anyway, thank you for your kind and helpful posts!

- « Previous

-

- 1

- 2

- Next »

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

sam992116

Level 4

RicsterX

Returning Member

texasgranny

Level 1

ew19

New Member

logan10

New Member