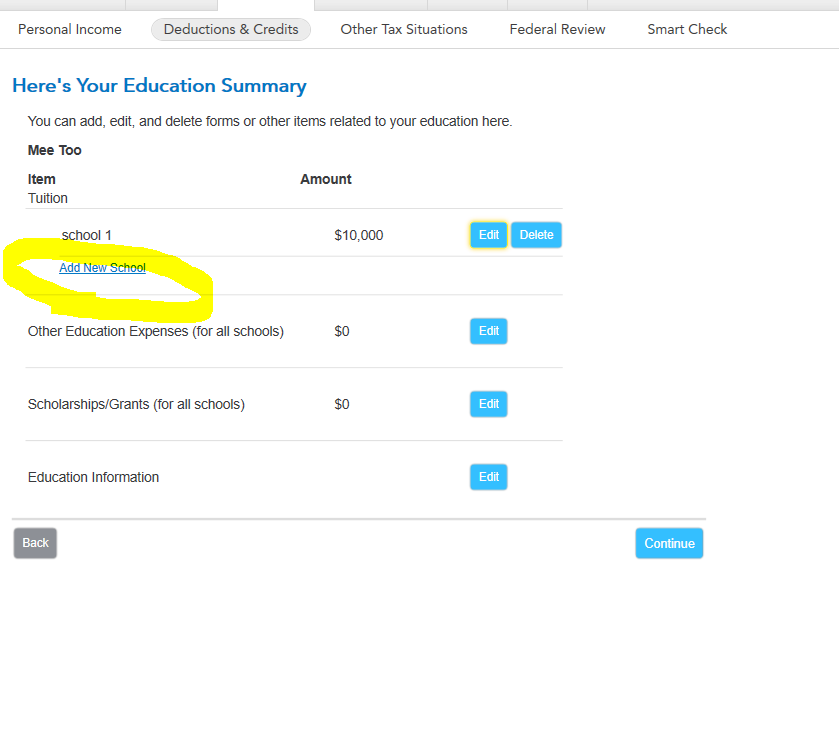

Yes, you can add a second school on the "Here's Your Education Summary" screen in the Education Section under Deductions & Credits

Dorm fees cannot be used towards a credit.

An option to enter Room and Board is only available if you enter a 1099-Q for a 529 or other Education Savings Account distribution since the distribution CAN be allocated to Room and Board.

IF a distribution is entered (Form 1099-Q) Room and Board may be reported in the "Other Education Expenses (for all schools)" by selecting Yes to "Did You Pay for Books or Materials to attend school?"

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"