- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- If I'm using cointracking.info for cryptocurrency transactions and get the TurboTax import, where do I put that in TurboTax?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If I'm using cointracking.info for cryptocurrency transactions and get the TurboTax import, where do I put that in TurboTax?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If I'm using cointracking.info for cryptocurrency transactions and get the TurboTax import, where do I put that in TurboTax?

When I downloaded the "turbotax Download" from cointracking.info, it was NOT in .TXF format, it was HTM whic will not upload to turbotax. So I just added .TXF to the end of the file (rename ), then turbo tax desktop allowed me to upload it. All the data was captured and represented correctly in Turbo tax desktop.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If I'm using cointracking.info for cryptocurrency transactions and get the TurboTax import, where do I put that in TurboTax?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If I'm using cointracking.info for cryptocurrency transactions and get the TurboTax import, where do I put that in TurboTax?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If I'm using cointracking.info for cryptocurrency transactions and get the TurboTax import, where do I put that in TurboTax?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If I'm using cointracking.info for cryptocurrency transactions and get the TurboTax import, where do I put that in TurboTax?

If you already paid for online version, here is what you can do to import cointracking txf file:

- From turbotax online, export tax2017 file and save to your computer

- Download Turbotax Amend software and install it

- From the Amend software, open the tax file and follow the top answer to import cointracking txf file.

- Print out and mail your return b/c can't e-file :(

Hope this help.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If I'm using cointracking.info for cryptocurrency transactions and get the TurboTax import, where do I put that in TurboTax?

I am going crazy. I am using CoinTracking (not CoinTracker), and basically have no idea what to do with TurboTax Online FreeFile. It looks like I need to buy the downloadable deluxe version of TurboTax.

What about using form 8949 with TurboTax Online FreeFile?

Can I get an official response please?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If I'm using cointracking.info for cryptocurrency transactions and get the TurboTax import, where do I put that in TurboTax?

I was able to figure this out last night on the web version. I selected “Coinbase” even though I use CoinTracking. It then asked for a csv file. I tried uploading the csv file that I pulled straight from CoinTracking. TurboTax gave me an error which said something like, “make sure you have these column headers.........”

So I opened the csv file in Excel, made sure the column headers matched what the error message said, saved, uploaded it again, and it worked!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If I'm using cointracking.info for cryptocurrency transactions and get the TurboTax import, where do I put that in TurboTax?

their is no option their to import cryptocurrency. I am using turbotax premier 2019 download software

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If I'm using cointracking.info for cryptocurrency transactions and get the TurboTax import, where do I put that in TurboTax?

I downloaded the desktop version of TT premier and I exported by cointracking file, but I can't seem to find a place on the TT software to upload it. Any advice?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If I'm using cointracking.info for cryptocurrency transactions and get the TurboTax import, where do I put that in TurboTax?

hi, were you able to put all 1400 transactions in the software version for 2018 taxes ? I am asking since i am looking to download the 2018 version( i am filing late taxes) and looking to import the file from cointracker.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If I'm using cointracking.info for cryptocurrency transactions and get the TurboTax import, where do I put that in TurboTax?

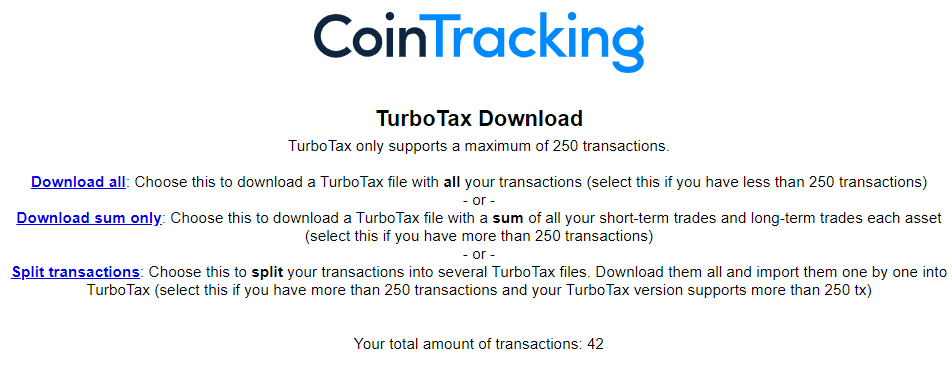

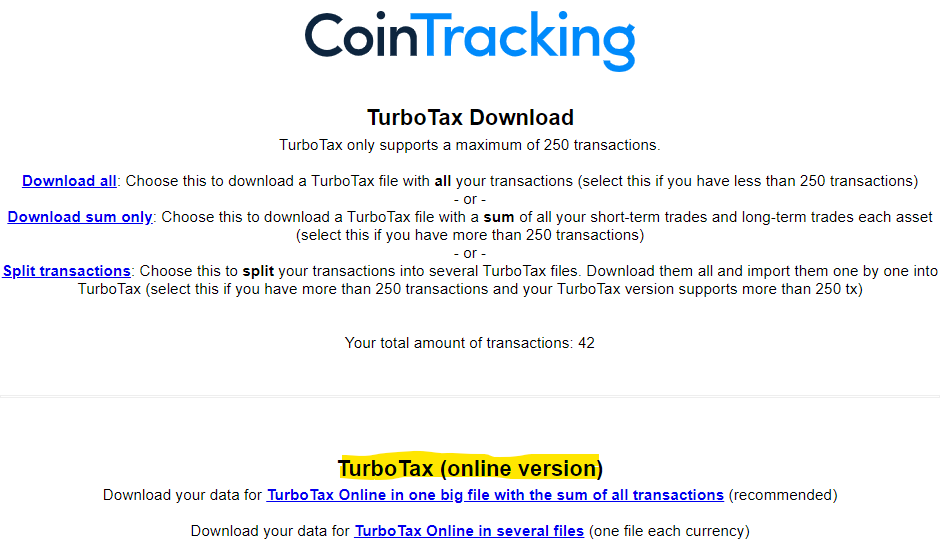

I contacted CoinTracking support about this, and they have a way for you to upload your tax report in the TurboTax online version.

Please do the following:

1. Open your tax report generated in CoinTracking.info

2. On the capital gains report, click on the "TurboTax" Button. Then the following page will open:

3. Add now add "&tt_online" at the end of the URL in your browser. For example (don't use this link - yours will be different:( https://cointracking.info/tax/tax_details/TurboTax.php?tax=14&tt_online

4. On this page, you will find the correct files you need for uploading them into your TurboTax online version.

They format it to fit into the Robinhood format that TurboTax allows, but as noted in the instructions don't worry, you will still be able to upload transactions from all other exchanges as well.

This is a workaround that CoinTracking.info has been able to provide thankfully. All because of TurboTax not listening to users to allow .txf uploads in the online version. Thanks CoinTracking.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If I'm using cointracking.info for cryptocurrency transactions and get the TurboTax import, where do I put that in TurboTax?

I am trying to import a CSV file from CoinTracker.

I am not getting to the point where TT asks me "Did you sell any...?". I already have another 1099-B entered so perhaps I already answered that.

Where and how (in Premier) do I import the CSV???

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If I'm using cointracking.info for cryptocurrency transactions and get the TurboTax import, where do I put that in TurboTax?

In the black bar at the top, go to FILE, select Import. Choose broker or another software.

If you choose another software, you can choose the .txf file to import.

When done- Select Start next to Stocks, Mutual Funds, Bonds, other. Additionally, if you have a foreign wallet, that is considered a foreign asset and may require filing Form 8938. See About Form 8938, Statement of Specified Foreign Financial Assets,

Select an entry option:

1. Enter the total short term on one line and total long term on the next line. Mail in a copy of your 1099-B. Very easy and the program gives you the instructions.

2. You may be able to convert your .csv file to a .txf file and upload it into TurboTax Desktop version.

Follow these steps outlined by JoeFM here.

- Create a .csv file with all transactions using the format shown at Easytxf.

- Used Easytxf to convert the .csv file into .txf file.

- Import .txf file into Turbotax Desktop: File / Import / From Accounting Software / Other Financial Software (TXF) file / Continue / Choose a File to Import / Import now.

- A 1099-B with all Crypto transactions is now created. This entry can now be edited to include the account details. Each transaction can be edited as well.

3 .You can make your own csv file. Manually change your columns to 5 columns in this order:

- Purchase date

- Date sold

- Proceeds

- Cost basis

- Currency name

Then you can upload the document and select 1099-B as the type.

@johnkemmerer

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If I'm using cointracking.info for cryptocurrency transactions and get the TurboTax import, where do I put that in TurboTax?

thanks, this worked for me in the web version

- « Previous

-

- 1

- 2

- Next »

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

user17656733235

Level 1

always1leticia

New Member

Click

Level 5

madcapsel

Level 1

garysandstrom

New Member