- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- How should I handle two 1095-A forms if I was married mid-year?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How should I handle two 1095-A forms if I was married mid-year?

I was married in April, 2023. Both my spouse and I got separate ACA policies for individual coverage at the start of 2023, each policy acquired independently of the other, based on each of our anticipated incomes, etc. When we got married neither of us informed the Marketplace of our change in status from single to married. In reading the instructions for form 8962 on the IRS website I see that we must file jointly to obtain the Premium Tax Credit. I hope someone can tell me what we need to do to properly enter the information from our 1095-A's so that we obtain the premium tax credit.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How should I handle two 1095-A forms if I was married mid-year?

Follow the steps below to enter both of your 1095-A:

- Select Federal on the left menu and Deductions & Credits

- Scroll down to Medical and select Show More

- Select Start/Revisit next to Affordable Care Act (Form 1095-A)

- Answer yes, I received Form 1095-A

- TurboTax will guide you through entering your 1095-A.

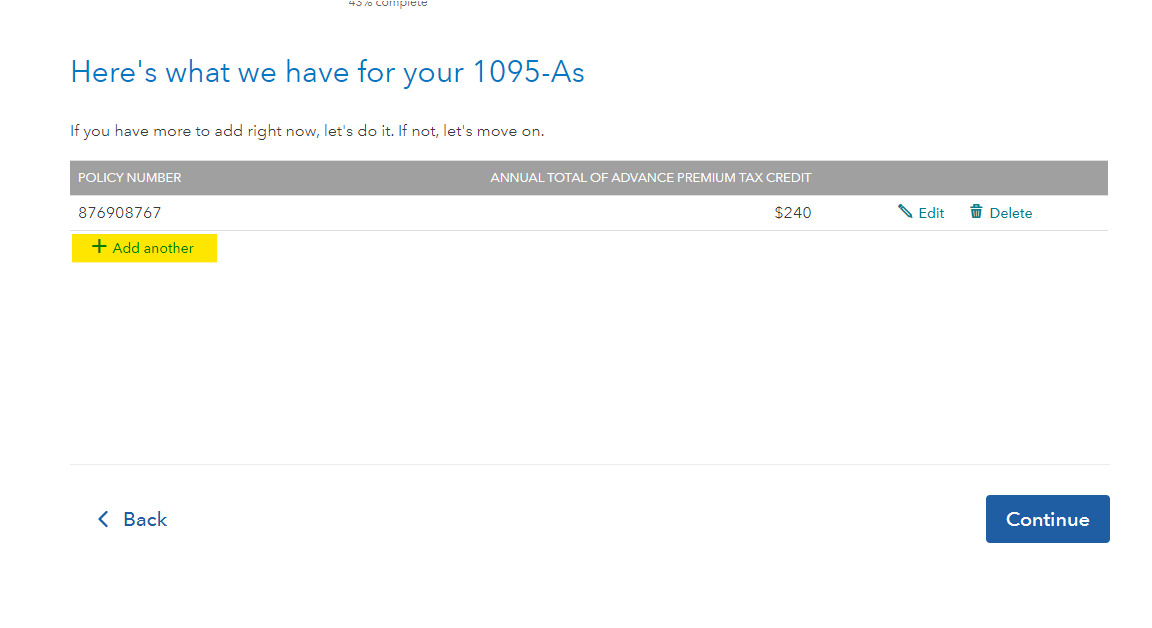

When you finish entering your first 1095-A and answering the questions about your first 1095-A, you will get to the Here's what we have for your 1095-As screen:

- Select + Add another and Continue to add your second 1095-A.

For additional information, refer to the TurboTax Help article Where do I enter my 1095-A?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

Conrad123

New Member

ozgekantar

New Member

zqtnAejpka

New Member

gamblerbad

New Member

katier-2018

New Member