- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- How do you determine the amount needed to enter for Total qualified dividends (Box 1b): "Dividends that meet the 60/90 day holding period" ? Shouldn't TT do this for me?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do you determine the amount needed to enter for Total qualified dividends (Box 1b): "Dividends that meet the 60/90 day holding period" ? Shouldn't TT do this for me?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do you determine the amount needed to enter for Total qualified dividends (Box 1b): "Dividends that meet the 60/90 day holding period" ? Shouldn't TT do this for me?

No, TurboTax doesn't know how long you have owned an investment.

Most people rely on their broker to provide this information. Check box 1b on your 1099-DIV to find this information.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do you determine the amount needed to enter for Total qualified dividends (Box 1b): "Dividends that meet the 60/90 day holding period" ? Shouldn't TT do this for me?

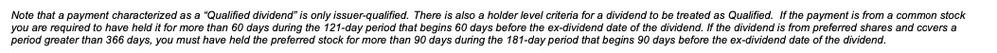

Now I'm confused. I see the note below on my Brokerage's 1099-DIV so I don't think Box 1 necessarily means all the dividends are qualified. The Box 1 entry only applies to the "issuer" not the fund holder. I would have to go back into my records and make sure I held the shares that generated the Dividend for the required holding period.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do you determine the amount needed to enter for Total qualified dividends (Box 1b): "Dividends that meet the 60/90 day holding period" ? Shouldn't TT do this for me?

Box 1a includes amounts entered in boxes 1b and 2e, and it also includes the amount of the recipient's share of investment expenses that you report in box 6.

Box 1b (qualified dividends) - Enter the portion of the dividends in box 1a that qualifies for the reduced capital gains rates. Include dividends for which it is impractical to determine if the section 1(h)(11)(B)(iii) holding period requirement has been met.

A dividend is considered to be qualified if you have held a stock for more than 60 days in the 121-day period that began 60 days before the ex-dividend date. It is an ordinary dividend if you hold it for less than that amount of time. The ex-dividend date is one market day before the dividend's record date.

Certain dividend payments aren't qualified dividends, even if they're reported as such. These are listed in IRS Publication 550 under the "Dividends that are not qualified dividends" section, and they typically include capital gains distributions and dividends you receive from a farmers' cooperative. They are not qualified dividends, even if they are shown in box 1b of Form 1099-DIV.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do you determine the amount needed to enter for Total qualified dividends (Box 1b): "Dividends that meet the 60/90 day holding period" ? Shouldn't TT do this for me?

"Certain dividend payments aren't qualified dividends, even if they're reported as such."

Does this mean Box 1b is essentially useless until you call the mutual fund company and expicitly confirm they dont include capital gains distributions from a farmer's coop?

Why would the 1099-Div Box 1b define distributions as qualified if they don't meet the definition?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do you determine the amount needed to enter for Total qualified dividends (Box 1b): "Dividends that meet the 60/90 day holding period" ? Shouldn't TT do this for me?

Thank you for this very descriptive reply. It's still a bit confusing why I'm using TT so I don't need to see or become a CPA.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

Kofian

New Member

slowreader

Level 4

Richard137

New Member

mitchden1

Level 3

BobbyC777

Level 2