- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- How do I report my original acquisition costs in rental property sales?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I report my original acquisition costs in rental property sales?

I purchased a residential rental property for $300K in cash in 2018 and sold it for $385K in 2023. How do I deduct the original costs when filing the tax return so the actual gain can be reflected correctly? Should I include it in the expenses or should I deduct it from the sales price?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I report my original acquisition costs in rental property sales?

Neither. If you purchased a property for 300K and had 30K in sales expenses, for example, when you set up the Cost Basis for your rental property, you could have entered 330K. Then you would begin depreciation from that amount.

However, you could add your original Acquisition Costs now as an Asset, with the original date, and they will be depreciated along with the property.

When reporting the sale, the Sales Proceeds will be allocated to payoff the undepreciated balance of the Acquisition Costs asset, with the rest applied to the undepreciated balance of the Property (and land).

Don't forget to add Sales Expenses to the current Cost Basis to lessen sale gain.

Follow these steps to Report the Sale of Rental Property.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I report my original acquisition costs in rental property sales?

@MarilynG1 Thank you very much for the help.

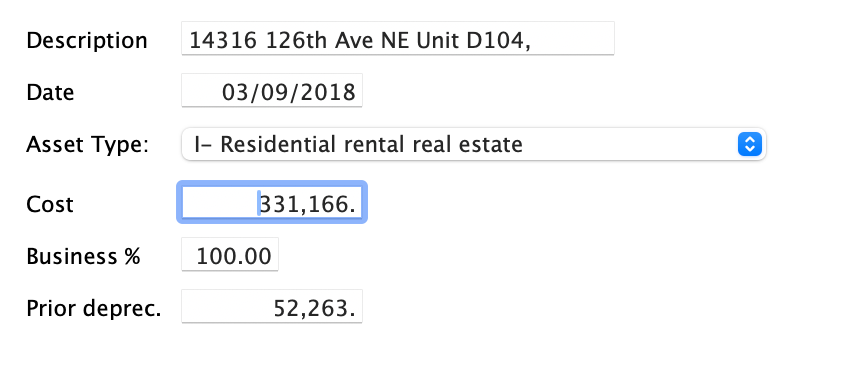

When you said "Cost Basis", do you mean the following screen (my original cost was $299,950, the sales expenses were 31,216, thus $331,166):

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I report my original acquisition costs in rental property sales?

Yes, that is the correct page to enter your original cost (including sales expenses) and accumulated (prior) depreciation.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I report my original acquisition costs in rental property sales?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I report my original acquisition costs in rental property sales?

Neither. If you purchased a property for 300K and had 30K in sales expenses, for example, when you set up the Cost Basis for your rental property, you could have entered 330K. Then you would begin depreciation from that amount.

However, you could add your original Acquisition Costs now as an Asset, with the original date, and they will be depreciated along with the property.

When reporting the sale, the Sales Proceeds will be allocated to payoff the undepreciated balance of the Acquisition Costs asset, with the rest applied to the undepreciated balance of the Property (and land).

Don't forget to add Sales Expenses to the current Cost Basis to lessen sale gain.

Follow these steps to Report the Sale of Rental Property.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I report my original acquisition costs in rental property sales?

@MarilynG1 Thank you very much for the help.

When you said "Cost Basis", do you mean the following screen (my original cost was $299,950, the sales expenses were 31,216, thus $331,166):

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I report my original acquisition costs in rental property sales?

Yes, that is the correct page to enter your original cost (including sales expenses) and accumulated (prior) depreciation.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

obeteta

New Member

angelaboone

New Member

mstruzak

Level 2

hnpot

Level 2

MH002

New Member