- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- How do I get TurboTax to acknowledge that I already paid taxes for my nanny?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I get TurboTax to acknowledge that I already paid taxes for my nanny?

how do i add that i have already paid the household employee taxes as shown on line 26 of schedule h that i received from my online payroll company?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I get TurboTax to acknowledge that I already paid taxes for my nanny?

Have you paid a third party who then pays the household employee wages and employment taxes? If so, you are not required to file Schedule H.

The Instructions for Schedule H page H-3 states:

If a government agency or third-party agent reports and pays the employment taxes on wages paid to your household employee on your behalf, you don't need to file Schedule H to report those taxes.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I get TurboTax to acknowledge that I already paid taxes for my nanny?

We are in the same situation-- we received our Schedule H from our payroll company Nannychex, but the input on TurboTax was incorrect. I see the instructions above that, in line with IRS guidelines, "If a government agency or third-party agent reports and pays the employment taxes on wages paid to your household employee on your behalf, you don't need to file Schedule H to report those taxes."

However, the payroll company remitted our quarterly federal tax payments for the nanny. So, I entered those quarterly tax payments as our estimated payments we'd made. Do I now have to enter all the Schedule H information in the "Nanny and Household Employment Tex" section? If not, does the IRS already have the Schedule H information they need from the payroll company? I just want to know what I need to do to compete our return accurately. Thank you.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I get TurboTax to acknowledge that I already paid taxes for my nanny?

You can delete your Schedule H from your return as long as your payroll company has filed all required federal returns associated with your domestic employee. The purpose of Schedule H is to ensure the payroll taxes are paid and the income is reported to the IRS. Since filing Forms 941, 940, and W-2 accomplishes this goal you are not required to also file a Schedule H.

The payroll company remitted the quarterly federal payments(Form 941). They should have also filed Form 940 (Unemployment Tax) and the W-2. It is not necessary to file a Schedule H.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I get TurboTax to acknowledge that I already paid taxes for my nanny?

Thank you. I just received further instructions from Nannychex for TurboTax users. They say that we need to fill out the Schedule H in TurboTax so it is transmitted with our return, and that we also must enter the estimated tax payments that this payroll service made for us. Does this sound accurate from a tax-law perspective to you?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I get TurboTax to acknowledge that I already paid taxes for my nanny?

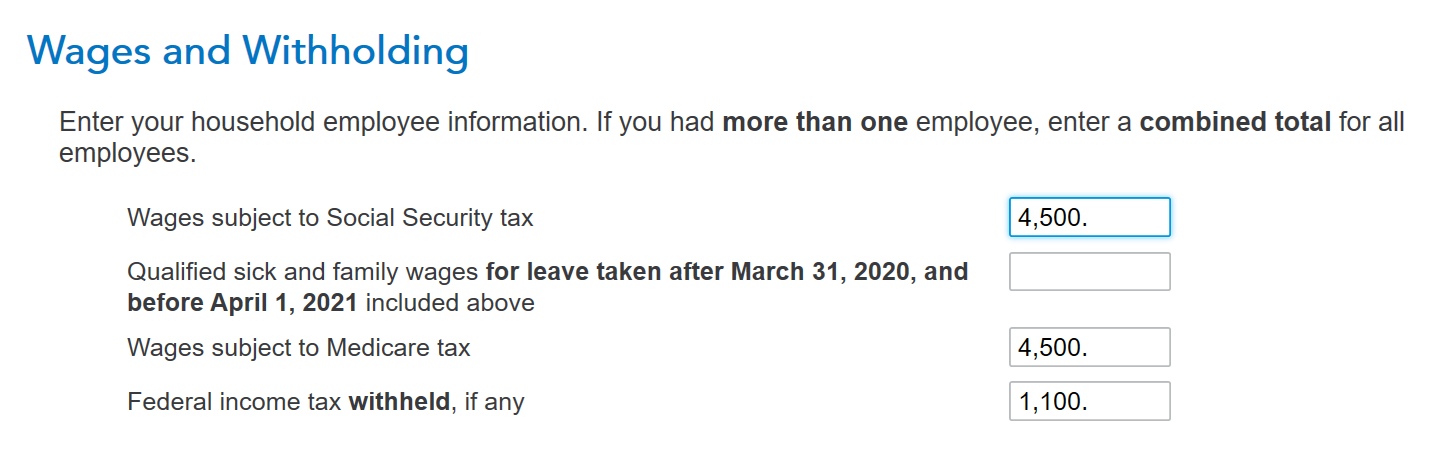

Yes, if you pay federal and most likely state, unemployment taxes you should report this in the Schedule H Interview under "Wages and Withholding". While going through the interview you will answer Yes, to paying more than $2,400 in wages and withholding Federal Income Tax. You will then navigate to "wages and withholding" as illustrated in the screenshot below:

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I get TurboTax to acknowledge that I already paid taxes for my nanny?

Hi - just curious where you entered the estimated tax payments? I'm running into this Schedule H issue too since my payroll provider paid estimated quarterly amounts. But TT is not factoring those in, so my tax bill is inflated by a significant amount. Any insight into how you resolved would be very helpful!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I get TurboTax to acknowledge that I already paid taxes for my nanny?

To enter the federal estimated payments:

- Go to Federal on the left side of TurboTax Online

- Click on Deductions and Credits at the top of the page

- Scroll down to Estimates and Other Taxes Paid

- Select Estimated Taxes Payments- click the Start button

- Select Estimated taxes for 2022, click Start, and follow the prompts

Please see this TurboTax help article for information.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- « Previous

-

- 1

- 2

- Next »

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

cj5

Level 2

sonny.angeles

New Member

HOTLNC

New Member

N7777

New Member

g456nb

Level 1