- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- How do I file a payment my employer made to pay off my student loans using a 1099-NEC under the CARES Act as tax-free and not as income that I owe taxes on?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I file a payment my employer made to pay off my student loans using a 1099-NEC under the CARES Act as tax-free and not as income that I owe taxes on?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I file a payment my employer made to pay off my student loans using a 1099-NEC under the CARES Act as tax-free and not as income that I owe taxes on?

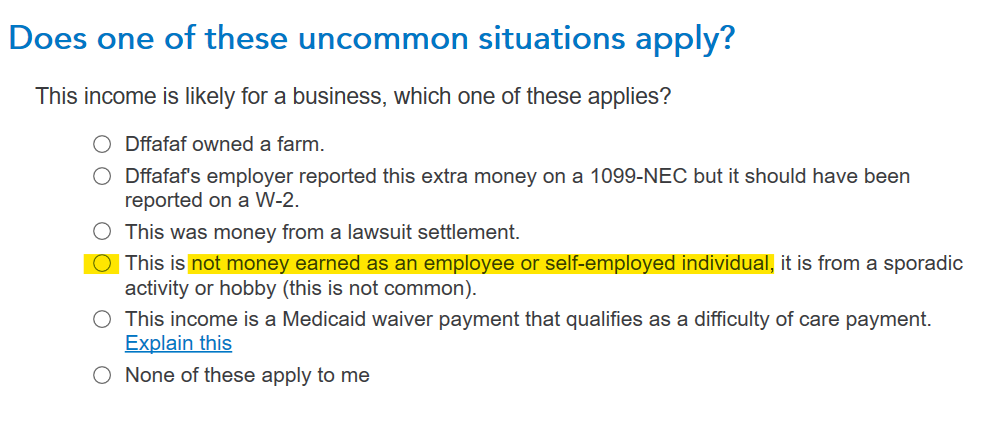

That form reports self-employment - any income on that form is not only taxable for ordinary income taxes - it will include self-employment taxes as well. When you enter the form, there is a box you can mark to indicate it is not self-employment, but it will usually generate an IRS inquiry. Even if you mark that box, the income will still be taxable for ordinary income. If you feel you received the form in error (the IRS also got a copy), you need to get a corrected form from the issuer.

How to enter a 1099-NEC. If the amount is not self-employment, mark the associated box; see below.

Does getting a 1099-NEC or 1099-MISC mean I am self-employed? Usually, yes!

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

jjkim1

New Member

brimelow01

New Member

gogators

Level 1

amflood34

Returning Member

cjkinch

New Member