- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- How do I adjust my OID interest income to account for the shortfall reported on my 1099? I had $750 OID accrued interest but a $416 shortfall. How to report on my 1040?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I adjust my OID interest income to account for the shortfall reported on my 1099? I had $750 OID accrued interest but a $416 shortfall. How to report on my 1040?

Should I simply enter a negative adjustment in TurboTax for my OID income equal to the reported shortfall amount, thereby reducing my OID income by the shortfall amount? From what I've researched I think that is the correct thing to do, but the governing IRS publication (1212) is not easy to follow.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I adjust my OID interest income to account for the shortfall reported on my 1099? I had $750 OID accrued interest but a $416 shortfall. How to report on my 1040?

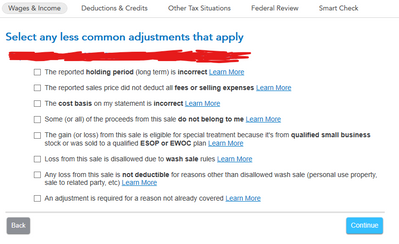

If the OID instrument is not yet mature you should select "I need to adjust the taxable amount", then enter the shortfall as a positive amount. Next, select "This is an original issue discount." TurboTax will reduce the taxable interest amount. (see image attached)

The best way to check your entry is on your tax return by choosing to preview your 1040.

To use this tool while you are signed into your TurboTax account follow the steps here (desktop).

- Select Forms in the upper right

- Then select 1040, in the forms tree on the left

- Scroll to line 8a to check that the interest is the reduced amount

- Select Step-by-Step to return to the interview

Review line 8a, on the 1040 and you will see the net result after your adjustment.

If the OID instrument has matured and been redeemed you should use the instructions below.

The correct procedure is to adjust the basis on the sale. In other words add all previously taxed income to the cost basis of the bond and then report the sale.

Your gain or loss is the difference between the amount you realized on the sale, exchange, or redemption and your basis in the debt instrument. Your basis, generally, is your cost increased by the OID you have included in income each year you held it. In general, to determine your gain or loss on a tax-exempt bond, figure your basis in the bond by adding to your cost the OID you would have included in income if the bond had been taxable. For a covered security, your broker will report the adjusted basis of the debt instrument to you on Form 1099-B

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I adjust my OID interest income to account for the shortfall reported on my 1099? I had $750 OID accrued interest but a $416 shortfall. How to report on my 1040?

If the OID instrument is not yet mature you should select "I need to adjust the taxable amount", then enter the shortfall as a positive amount. Next, select "This is an original issue discount." TurboTax will reduce the taxable interest amount. (see image attached)

The best way to check your entry is on your tax return by choosing to preview your 1040.

To use this tool while you are signed into your TurboTax account follow the steps here (desktop).

- Select Forms in the upper right

- Then select 1040, in the forms tree on the left

- Scroll to line 8a to check that the interest is the reduced amount

- Select Step-by-Step to return to the interview

Review line 8a, on the 1040 and you will see the net result after your adjustment.

If the OID instrument has matured and been redeemed you should use the instructions below.

The correct procedure is to adjust the basis on the sale. In other words add all previously taxed income to the cost basis of the bond and then report the sale.

Your gain or loss is the difference between the amount you realized on the sale, exchange, or redemption and your basis in the debt instrument. Your basis, generally, is your cost increased by the OID you have included in income each year you held it. In general, to determine your gain or loss on a tax-exempt bond, figure your basis in the bond by adding to your cost the OID you would have included in income if the bond had been taxable. For a covered security, your broker will report the adjusted basis of the debt instrument to you on Form 1099-B

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I adjust my OID interest income to account for the shortfall reported on my 1099? I had $750 OID accrued interest but a $416 shortfall. How to report on my 1040?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I adjust my OID interest income to account for the shortfall reported on my 1099? I had $750 OID accrued interest but a $416 shortfall. How to report on my 1040?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I adjust my OID interest income to account for the shortfall reported on my 1099? I had $750 OID accrued interest but a $416 shortfall. How to report on my 1040?

My market-linked CD was set up so that any gain would be paid as part of the redemption. Well, there was no gain. The redemption was just the exact original amount I paid. I paid taxes on OID during the life of the instrument. So, now, I'd like to use the solution in this thread, i.e. increase the basis on the "sale". But there's no 1099-B. Can I just enter all of this on my tax form(s) and not worry about getting a 1099-B?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I adjust my OID interest income to account for the shortfall reported on my 1099? I had $750 OID accrued interest but a $416 shortfall. How to report on my 1040?

The market accretion on a non-covered municipal bond is federally tax exempt, so it can not be entered in 8a of 1040. Can I just enter the amount ((market discount accretion on OID bond) as an addition on my state tax?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I adjust my OID interest income to account for the shortfall reported on my 1099? I had $750 OID accrued interest but a $416 shortfall. How to report on my 1040?

In the federal interview if you do not select your state (TurboTax is looking for where this interest might be exempt because of what state the bond is derived from) the full amount should be taxable on your state.

If you have a percentage of earnings from each state (usually provided by your broker), you can make the necessary entries, one for your state and one for all other. See the image below.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I adjust my OID interest income to account for the shortfall reported on my 1099? I had $750 OID accrued interest but a $416 shortfall. How to report on my 1040?

I have this same issue as bobowobo. I need to claim a tax deduction for the OID accrued & claimed in prior years, but never paid by TIAA upon maturity. How they can get away with this... it's unbelievable! TIAA sent 1099s each year with an amount certain of OID interest that seemed to benefit me, but they kept it all. It benefit them, or they filled out the 1099s incorrectly. Meanwhile I paid tax on it.

Turbotax doesn't seem to cover this issue, but maybe I'm missing it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I adjust my OID interest income to account for the shortfall reported on my 1099? I had $750 OID accrued interest but a $416 shortfall. How to report on my 1040?

Hi DianeW, your information is super helpful! Here, I just want to make sure that I understand it correctly for my circumstance.

I bought a market-linked CD. And for the past five years, I reported (let's say) $200 in my 1099-OID.

In 2021, the CD matured and my 1099-B reported that I have a ordinary gain of $2000. In my 1099-INT, the only non-zero number is interest shortfall on contingent payment debt of $1000 (to my understanding, the total of my OID reported during the past five years).

Based on your comment, I should adjust my cost basis by + 5*$200 = $1000, and only report $2000-$1000 = $1000 as my gain in 2021 shown in the attached figure. Does this sound correct?

Thanks so much!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I adjust my OID interest income to account for the shortfall reported on my 1099? I had $750 OID accrued interest but a $416 shortfall. How to report on my 1040?

@ronyuan Using your example then yes, that is correct. You will increase the basis by the amount that you have paid tax on in OID for the preceding years.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I adjust my OID interest income to account for the shortfall reported on my 1099? I had $750 OID accrued interest but a $416 shortfall. How to report on my 1040?

I am using Turbo Tax 2022. I have the same issue of adjusting OID interest income for a shortfall reported on my 1099. After following these steps and entering a positive number for subtraction (which shows up as a negative number on Schedule B), and submitting to IRS, my return was rejected due to a negative number reported on Schedule B. How can I fix this?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I adjust my OID interest income to account for the shortfall reported on my 1099? I had $750 OID accrued interest but a $416 shortfall. How to report on my 1040?

So at the end of the day, all we want to do is adjust the ordinary gain which would affect the ordinary tax rate. Here's a good way to go about this.

Personal Income/ Less Common Income/ Down at the bottom/ Miscellaneous Income/

then; next screen, Other income not already reported on a Form W2 or Form 1099

then; Did you receive any other wages-Yes

then; Continue,continue, continue until the screen Any other Earned Income-Yes

then; Source of Other Earned Income-Other

then in Description type in OID Prior adjustment with the amount as a negative 1,000

This will flow through to the Wages Wks Line 7 OID Prior Adjustment under the caption Other earned income

then carried forward to Line 1H Other earned income as a negative number.

Consequently, this will decrease your ordinary earned income and will reduce your tax liability by this amount.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I adjust my OID interest income to account for the shortfall reported on my 1099? I had $750 OID accrued interest but a $416 shortfall. How to report on my 1040?

Regarding your method to adjust the ordinary gain to change the ordinary tax rate with these long term market linked products--

I had a 5 year structure product (CPDI) that was linked to the stock market index. The projected OID income amounts I paid every year were too high. After the five years, the actual proceeds were about $5000, but the projected OID I paid was $21000. I would love to reduce this years income by the $16000 that I overpaid. But some people are telling me that I have to increase the cost basis causing a loss, get only $3000 capital loss credit for this year, and carry-over the rest of the loss to the future years-which I dont like.

It is ok to just reduce my income this year by the total amount of excess OID paid the previous years? Or do I have to instead change the basis value and then have a gain carry-over for the next few years?

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

kmccormally

Level 1

landmeistr

New Member

Zman8228

Level 2

DickinSD

Level 1

droll901

Level 1