- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- How can I add my AGI from the previous year to my 2019 taxes?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How can I add my AGI from the previous year to my 2019 taxes?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How can I add my AGI from the previous year to my 2019 taxes?

To add your 2018 AGI to your 2019 return, follow these steps while in TurboTax:

- Select File from the left hand side of your screen,

- Complete Step 1 and 2 if you haven’t already done so, then go to Step 3.

- When getting to the Let’s get ready to e-file screen after selecting Step 3, select I want to e-file before you continue.

- Follow the online instructions. When prompted, put in your exact 2018 AGI.

- Continue through the screens until you’ve re-transmitted your return.

If you used TurboTax last year you can view your 2018 AGI by selecting Documents on the left hand side of your screen. Select View Documents from: Select 2018 on the drop down menu.

OR

You can obtain a copy of last year's tax transcript online using IRS link: Transcript

OR

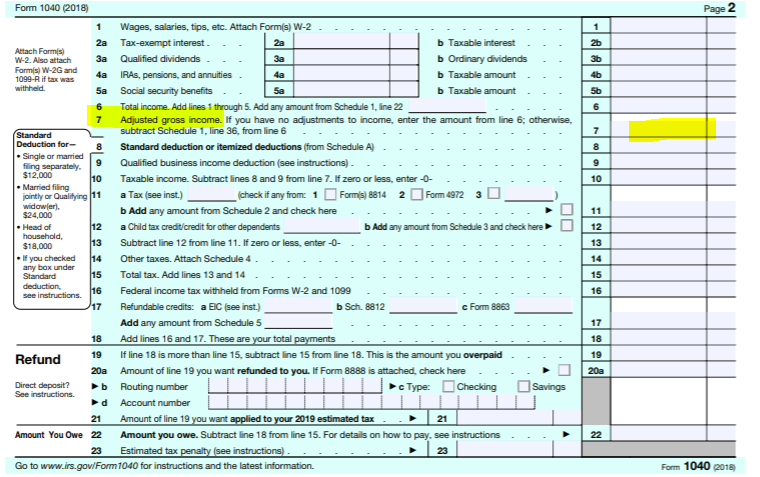

If you have a copy of your 2018 tax return, your AGI is located on line 7.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How can I add my AGI from the previous year to my 2019 taxes?

Mu Turbo Tax has been sent to Turbo Tax already. They said it had been accepted. I received a text saying you need my 2018 AGI. I want to enter it. Can I tell you and you do it?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How can I add my AGI from the previous year to my 2019 taxes?

I know the amount to enter. I just do not know

how to get into Turbo Tax to add the informa-

tion.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How can I add my AGI from the previous year to my 2019 taxes?

You will input your 2018 AGI in the e-filing section as your identity PIN for e-filing.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

a1a00608cab4

New Member

Austin_Mike

New Member

shorteebrown-hot

New Member

trace-owens14-ic

New Member

mageshcmouli

Level 2