- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Form 8960 Error caught by IRS - line 13 modified adjusted income incorrect.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8960 Error caught by IRS - line 13 modified adjusted income incorrect.

I filed my dads 2022 1040SR last month and he just received a letter from the IRS. He had $208000 of adjusted gross income (2400 interest income, 80 dividends, 12000 taxable social security and 194,000 capital gain on the sale of investment real estate). On the original return turbo tax simply took his adjusted gross income of $208,000, deducted the 200K limit for his filing status (head of household) and computed the net investment tax of $316. Now it appears the IRS is saying his social security should not have been included in his modified adjusted gross income (and per my research on the IRS website this appears correct. He is getting a refund for his net investment tax of $316. I looked at the return on turbo tax and line 13 (modified gross income) has his total adjusted gross income from line 11 1040 SR. It was not forced by me but put in by the program. I just wanted to point out this error because I see other issues with Form 8960 that people are having. I thought turbo tax was guaranteed to be correct.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8960 Error caught by IRS - line 13 modified adjusted income incorrect.

Whereas I have not tried out a scenario for the use of form 8960 for an individual as described in your post but clearly Social Security and similar items are not included in the computation of MAGI --- .>>

https://www.irs.gov/pub/irs-pdf/i8960.pdf

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8960 Error caught by IRS - line 13 modified adjusted income incorrect.

@rmilling3165 wrote:

Now it appears the IRS is saying his social security should not have been included in his modified adjusted gross income (and per my research on the IRS website this appears correct. He is getting a refund for his net investment tax of $316.

I wonder what is going on, exactly, because the TurboTax calculation appears to be correct according to the Form 8960 instructions for Line 13.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8960 Error caught by IRS - line 13 modified adjusted income incorrect.

"the net investment tax of $316. "

Someone at IRS, for whatever reason, decided to scratch and refund that extra tax.

Don't look a gift horse in the mouth.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8960 Error caught by IRS - line 13 modified adjusted income incorrect.

My other tax software, does exactly the same thing.

namely, Form 1040 AGI is used, not reduced by Social Security.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8960 Error caught by IRS - line 13 modified adjusted income incorrect.

Was the IRS playing its own version of Monopoly here?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8960 Error caught by IRS - line 13 modified adjusted income incorrect.

@tagteam

The instructions appear to contradict or are incomplete.

Per the instructions to Form 8960

Definitions

Excluded income. Excluded income

means:

• Income excluded from gross income in

chapter 1 of the Internal Revenue Code;

• Income not included in net investment

income; and

• Gross income and net gain specifically

excluded by section 1411, related

regulations, or other guidance published in

the Internal Revenue Bulletin.

Examples of excluded items are:

• Wages,

• Unemployment compensation,

• Alaska Permanent Fund Dividends,

• Alimony,

• Social security benefits,

• Tax-exempt interest income,

• Income from certain qualified retirement

plan distributions, and

• Income subject to self-employment

taxes.

So social security is excluded for net investment income but then......

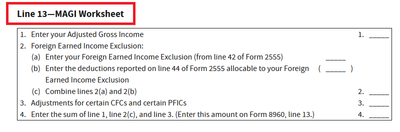

Line 13—Modified Adjusted Gross

Income (MAGI)

If you didn’t exclude any amounts from

your gross income under section 911 and

you don’t own a CFC or PFIC, your MAGI

is your AGI as reported on Form 1040 or

1040-SR. If you exclude amounts under

section 911 or own certain CFCs or

PFICs, your MAGI is your AGI as modified

by certain rules described in Regulations

section 1.1411-10(e)(1)

Since my dad had no foreign income and did not own a CFC (controlled foreign corporation) or PFIC (passive foreign investment company) the instructions for modified adjusted gross income appear to be saying his modified adjusted gross income is his AGI (adjusted gross income) and thats what the program did which is incorrect. The instructions are at best incomplete and (as are many sections of the internal revenue code) very confusing even for people who like me, worked for a living as a CPA. A person just assumes if a program like turbo tax (that has how many people reviewing it??) says something is correct, then thats the way it must be. In this case the program clearly made a mistake.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8960 Error caught by IRS - line 13 modified adjusted income incorrect.

@fanfare

I think its because the instructions for line 13 dont specifically say "as reduced by excluded sources of income see definitions). The instructions just say

Line 13—Modified Adjusted Gross

Income (MAGI)

If you didn’t exclude any amounts from

your gross income under section 911 and

you don’t own a CFC or PFIC, your MAGI

is your AGI as reported on Form 1040 or

1040-SR. If you exclude amounts under

section 911 or own certain CFCs or

PFICs, your MAGI is your AGI as modified

by certain rules described in Regulations

section 1.1411-10(e)(1)

When reading the instructions for line 13 you have to remember the list of items at start of the instructions for excluded income. If you didnt do that, you end up just using AGI which is incorrect.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8960 Error caught by IRS - line 13 modified adjusted income incorrect.

@pk

Now looking at this again it appears in order to get to the correct MAGI for Line 13 of Form 8960 the preparer has to remember the list of excluded items of income at the start of the instructions when they read the instructions to Line 13. The instructions for Line 13 make no mention of this list. It only says

Line 13—Modified Adjusted Gross

Income (MAGI)

If you didn’t exclude any amounts from

your gross income under section 911 and

you don’t own a CFC or PFIC, your MAGI

is your AGI as reported on Form 1040 or

1040-SR. If you exclude amounts under

section 911 or own certain CFCs or

PFICs, your MAGI is your AGI as modified

by certain rules described in Regulations

section 1.1411-10(e)(1)

When I read the instructions I simple skipped the beginning (where there is a list of excluded income items like social security to calculate net investment income) and went straight to the instructions for Line 13 (which shows how important it is to read ALL of the instructions). The instructions for Line 13 make no mention that I can see (maybe I am reading them wrong) of excluded income items beyond the above. One would have to remember the list at the beginning and include that in the instructions for Line 13 even though the specific instructions for line 13 dont include that. Maybe that is why turbotax and at least another tax software program as mentioned in another reply, are incorrect.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8960 Error caught by IRS - line 13 modified adjusted income incorrect.

@rmilling3165 wrote:your MAGI is your AGI as modified by certain rules described in Regulations section 1.1411-10(e)(1)

Did you read that section?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8960 Error caught by IRS - line 13 modified adjusted income incorrect.

26 CFR § 1.1411-10 - Controlled foreign corporations and passive foreign investment companies CFR

Not trying to be difficult but why would anyone who doesnt own a controlled foreign corporation or a passive foreign investment company read this?? I think the instructions are just unclear. You have to read the instructions for line 13 while remembering at the beginning of the instructions it gave a list of excluded income items not included in the instructions for line 13. No where does it even say (see list of excluded income items at beginning of instructions). I am a retired CPA and should not have just skipped ahead to the instructions for line 13, but what is turbo tax's excuse?? I don't put all the blame on turbo tax. The instructions at best are incomplete. A preparer should not have to put disparate instructions together in this way to come up with the correct answer. Turbo tax evidently read the instructions for line 13 just like I did and also came up with the wrong answer. I assumed turbo tax was correct and would have probably made the same mistake it did. I think the IRS should change the instructions to point a preparer to the list of excluded income items in the definitions. Then this probably wouldn't happen.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8960 Error caught by IRS - line 13 modified adjusted income incorrect.

@rmilling3165 Sorry, see 26 CFR § 1.1411-2 - Application to individuals. | Electronic Code of Federal Regulations (e-CFR) | U...

Also, we need to ensure we're making the proper distinction between what is excluded from net investment income and what is excluded for the purposes of calculating NIIT.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8960 Error caught by IRS - line 13 modified adjusted income incorrect.

@rmilling3165 wrote:

@tagteam

The instructions appear to contradict or are incomplete.

Per the instructions to Form 8960

Definitions

Excluded income. Excluded income

means:

• Income excluded from gross income in

chapter 1 of the Internal Revenue Code;

• Income not included in net investment

income; and

• Gross income and net gain specifically

excluded by section 1411, related

regulations, or other guidance published in

the Internal Revenue Bulletin.

Examples of excluded items are:

• Wages,

• Unemployment compensation,

• Alaska Permanent Fund Dividends,

• Alimony,

• Social security benefits,

• Tax-exempt interest income,

• Income from certain qualified retirement

plan distributions, and

• Income subject to self-employment

taxes.

I just re-read your post (carefully this time) and the instructions do not appear to contradict.

The items of income listed in the "definitions" (from the instructions) are items of income excluded from net investment income and not items of income excluded from the calculation of the NIIT (big difference).

Clearly, the instructions are confusing, but the calculation appears to be correct on Line 13. Perhaps, the IRS is interpreting this scenario differently.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8960 Error caught by IRS - line 13 modified adjusted income incorrect.

@tagteam

You wrote: "The items of income listed in the "definitions" (from the instructions) are items of income excluded from net investment income and not items of income excluded from the calculation of the NIIT (big difference)."

There is no difference. Net investment income tax is calculated based upon net investment income.

I think we are getting down into the weeds here. Either something is investment income and therefore subject to net investment income tax or it is not. What this all boils down to is Social security is not considered investment income and is not subject to Net investment income tax. The IRS should make reference to the list of items excluded from net investment income in the instructions to line 13 and they dont. The IRS caught the mistake that turbo tax (and apparently at least one other software program) made. Just a google search shows article after article on the net investment income tax and they all say social security is not investment income, hence not included in net investment income subject to the net investment income tax. I just wanted to bring this to the attention of others including turbo tax.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8960 Error caught by IRS - line 13 modified adjusted income incorrect.

@rmilling3165 wrote:

@tagteam Net investment income tax is calculated based upon net investment income.

We are definitely in agreement that net investment income does not include social security benefits (as well as a host of other excluded items of income), but apparently disagree about how the NIIT is calculated (the main point here is that a taxpayer's MAGI has to exceed the threshold before NIIT is even a factor).

I am not at all sure how this is going to be resolved, but resolving this issue will certainly not be left to us. Regardless, I am not making an absolute assertion that the IRS got this wrong, but it is absolutely not out of the realm of possibility.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

phraxos

Level 3

ombgupta

Level 1

debbiek405

Level 2

bigboozbucks

New Member

tswarts2

New Member