- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Form 8949 is so confusing

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8949 is so confusing

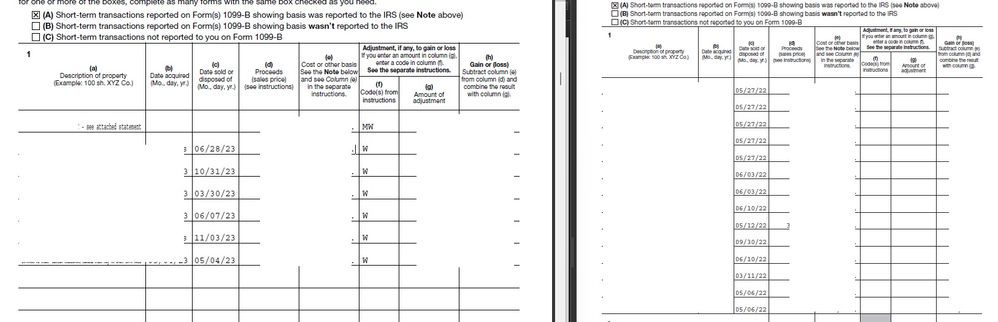

Broker 1: Imported. I expected all transactions showing up in form 8949, but it ends up with only 6 lines of data, all with code in column f. I don't know how the system works, it seems that the system put most of other imported data to Schedule D line 1a. It did not work that way in 2022, all imported data appeared in form 8949, and there were multiple sheets of form 8949.

Broker 2: Cannot import correctly, too much review needed, so I enter Summary Data, and it shows "Broker 2 - see attached statement". And I will mail out form 1099B. This line looks fine for me.

Broker 3: Cannot import correctly, too much review needed, so I enter Summary Data, but it does not even mention anything related to broker 3 in form 8949. I double checked TurboTax desktop software, I indeed entering summary number, not importing 1099B.

The good thing is Schedule D line 7 Net Short Term Gain/Loss and line 15 Net Long Term Gain/Loss are correct. So I just e-filed the form.

The whole thing (form 8949) makes me so confused. If form 8949 indeed does not show correctly(not something I did wrong), then I think I am done with TurboTax, I want to use other company for tax filing next year.

The other thing is: I need to go to USPS to mail out supporting form1099B for the reason I entering summary numbers. It does not allow attaching files. That is not good.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8949 is so confusing

there is nothing wrong with using lines 1a and 8a (I wish that worked when importing from my broker rather than needless pages of form 8949) . that's a summary of transactions when 1) proceeds are reported to the IRS 2) cost basis is reported to the IRS 3) and there are no adjustments either by broker or taxapayer like for wash sales. For these trades, NO detail needs to be sent to the IRS not even the 1099-B as either an attachment to a mailed return or with form 8453 if e-filed.

all transactions of any type with any adjustment must be reported separately or detail otherwise provided to the IRS. Code W indicates wash sales. If separately reported on form 8949 no detail needs to be sent to the iRS. If grouped (code M - multiple transactions reported on same line) and any other lines coded with M details need to be sent to the iRS.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8949 is so confusing

@Mike9241 Thanks. So if every piece of data is imported, wash sale transaction is on form 8949, and non wash sale (no adjustment) transactions are on schedule D line 1a and 8a.

Then there is no need to mail out attachment, correct?

Thanks.

One more question: so non wash sale (no adjustment) transactions can also be entered in form 8949, correct? It is optional for non wash sale (no adjustment) transactions to use form 8949?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8949 is so confusing

1. You can see in Form 8453 and the instructions that you do not appear to need to mail your forms for the federal. However, some states may require mailed in forms. You can reply or check your state, How do I contact my state Department of Revenue?

2. You must use Form 8949. The sale of capital assets is reported on Form 8949. See About Form 8949, Sales and Other Dispositions of Capital Assets

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8949 is so confusing

If you summarize (recommended),

you only need to supply details of 1099-B covered transactions with adjustments that are not listed on your e-Filed Form 8949. and all non-covered transactions not listed there.

A couple of years ago, TurboTax changed the processing of Form 8949 in an undocumented way.

TurboTax takes advantage of this rule and suppresses some line item details.

Your results for broker no.1 are correct.

Based on prior forum complaints about this. it's not clear exactly what rule it is using, and there is no way to force TurboTax to list all transaction details on Form 8949, as allowed by IRS.

Maybe that's been addressed. I doubt it.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

latefiler5

Level 1

rwdanko

New Member

mariocelaya2

New Member

CharlesANorris

New Member

Garbanzor29

Level 2