I have a foreign account and needs to report form 8938.

Also, this year I received a foreign gift from a foreign relative exceeding $100K, I will separately file form 3520 to report this gift.

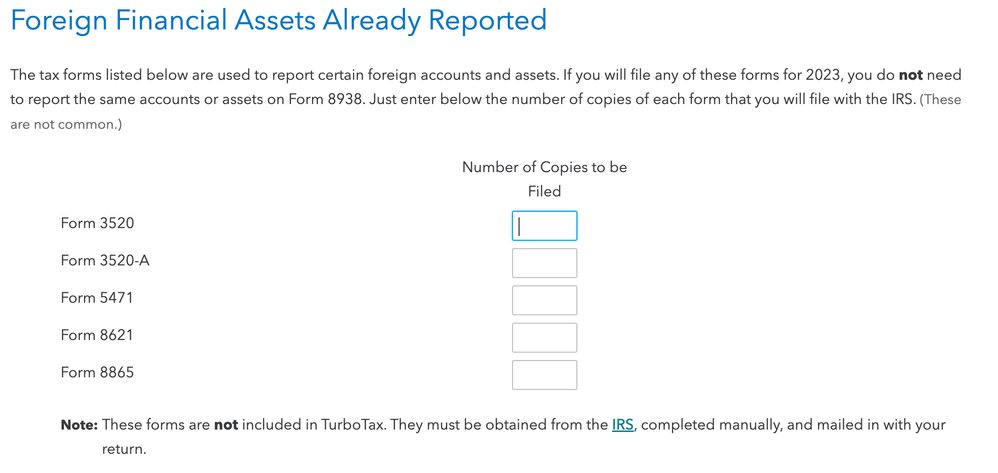

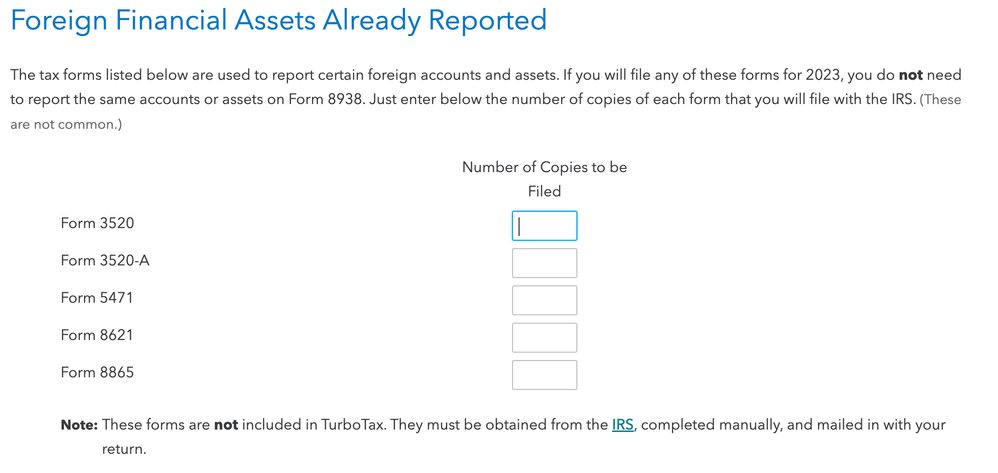

In TT's 8938 interview question, it asks "Foreign Financial Assets Already Reported", and asks number of copies of 3520 filed. This will generate the Part IV of form 8938: "Excepted Specified Foreign Financial Assets". See screenshot below.

I believe for my case, I should put 0 for "copies of Form 3520 to be filed" in this interview question right? Because even tho I am filing 3520, but 3520 has mixed purposes: 1) to report foreign trust 2) to report received foreign gift. And received foreign gift (my case) is not a foreign asset, so it's correct to put 0 here.

Otherwise if I put 1 here, the generated 8938 Part IV will indicate that there's 1 "Excepted Specified Foreign Financial Assets" reported in 3520, which is incorrect as I am not reporting foreign asset in 3520, but a received gift.

Am I correct?