- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Form 8915T

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8915T

i need help with the 2021 8915. I took a qualified distribution in 2020 related to COVID19. one of the questions asked is what is the FEMA disaster number.

i don't understand why i need to enter this i wasn't asked it last year when i filed.

the amount i took was $45K in 2020 and i am choosing to spread over 3 years therefore $15K in 2020 and $15K in 2021 and $15k in 2022.

Am I doing something wrong?

the software asks me to check if this is a coronavirus disbribution - and i check yes.

then it asks me to go to my 2020 form 8915E line 4 col b and enter the number which $45K but because i enter the $45K

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8915T

I need help with 2021 8915. I took qualified distribution in2020 related to COVID 19, one of the question asked is what is the FEMA disaster number.

I don't understand why I need to enter this I wasn't asked it last year when I filed. the amount I took was $15k and I choose to repay in 3 year 5,000in 2020 and $5K in 2021 and $5k in 2022. What am I doing wring.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8915T

When you are entering the information for a 2020 Retirement Distribution related to Covid and took the option to repay over three years, you need to make sure you indicate that it was a distribution before 2021. The only time you should see the question about a FEMA number is if you indicated it is a 2021 disaster distribution.

The best way to correct this is to Delete the Form 8915 (How do I view and delete forms in TurboTax Online?)

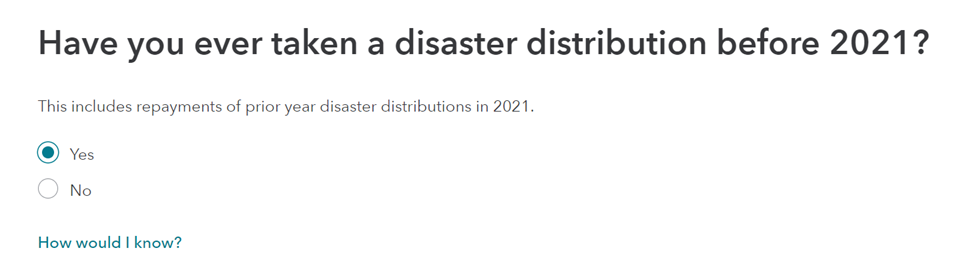

Then go back to the 1099-R entries. Make sure you enter the "Have you ever taken a disaster distribution before 2021?"

If this does not work, please feel free to send a diagnostic copy so we can review. A diasgnostic copy of your return scrubs all personal information, but sends us the data file so we can see your entries. In TurboTax Online:

- Click Tax Tools in the menu to the left.

- Click Tools, and then

- Click Share my file with Agent.

- A pop-up message will appear. Click OK to send the sanitized diagnostic copy to us.

Provide the token number that is generated onto this thread.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8915T

The correct entry if that field come up is: None

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8915T

979282

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8915T

Token #979282

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8915T

Still doesn’t work am getting the message review your 1099-Rhave reviewed it a fees times and still nothing

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

rribay78

Level 2

gianna15

Returning Member

Djmaern5639

New Member

fsheps1

New Member