- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Form 7203

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 7203

Second request on this issue. Form 7203 will not allow any value on Part 1 Shareholder Stock Sale Line 8a Nondeductible expenses. This causes the stock basis to be incorrect so it won't match the 7203 worksheet supplied by the accountant. Also, in looking back at 2022, I now see that form 7203 in incorrect and when I redid it , the 2022 one would not allow the Nondeductible expenses then either. I assume I will have to amend 2022 taxes?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 7203

Are you using TurboTax Online?

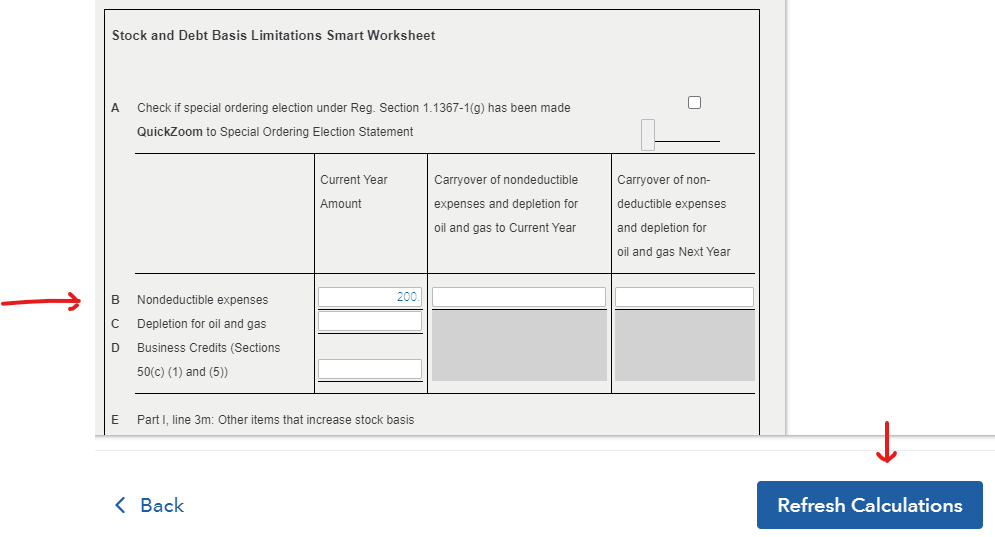

If so, nondeductible expenses may be entered in the Stock and Debt Basis Limitations Smart Worksheet line B.

Click Refresh Calculations.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 7203

Thanks for your help! I am using the desktop version of Premier for Windows, not sure if that makes any difference? I will try to find that worksheet but I am confused as to whether that will correct the end of the corporation's year basis?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 7203

Thank you,again, James, that took care of it. Now I assume I need to amend my 2022 Form 7203.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 7203

Yes, you will want to amend the 2022 IRS form 1040 tax return to correct the calculations on the IRS form 7203.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 7203

I also just discovered that TurboTax has been auto-generating Form 7203 for the last two years (incorrectly). Per IRS rules and TurboTax instructions, I have not needed to file this form, yet the program has been submitting it anyway. It would be one thing if the form was correct, which should be easy given the K-1 information, but it has just taken information from my 2021 taxes (when I did need to file it). Do I now need to amend my 2022 and 2023 (just submitted) taxes due to TurboTax's software bugs?!! How do we get a live person to submit this bug to be fixed. Apparently it has not been addressed for years based on the posts.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 7203

IRS Form 7203 was first used for the 2021 tax return. It replaced the Worksheet for Figuring a Shareholder's Stock and Debt Basis in the Schedule K-1 (1120-S).

IRS Instructions for Form 7203, here, page 1, states:

It may be beneficial for shareholders to complete and retain Form 7203 even for years it is not required to be filed, as this will ensure their bases are consistently maintained year after year.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 7203

Yes, but this is being automatically generated INCORRECTLY (showing 2021 basis) and filed (it shows up in the filing version). I would understand it if this was only showing up in the records version. This is a bug, as far as I'm concerned as now the IRS has incorrect data for 2022 and 2023. Also, it would be very simple for TT to pull the data from the K-1 to CORRECTLY auto-fill it. My concern is that when I actually need to file it, the IRS will flag it.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

jmzchz5560

Returning Member

NICAAC

Level 1

ESG S-Corp

Returning Member

charlestonsc11

New Member

emma60608

Level 1