- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Form 5695 eFile - Possible IRS transmission error

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 5695 eFile - Possible IRS transmission error

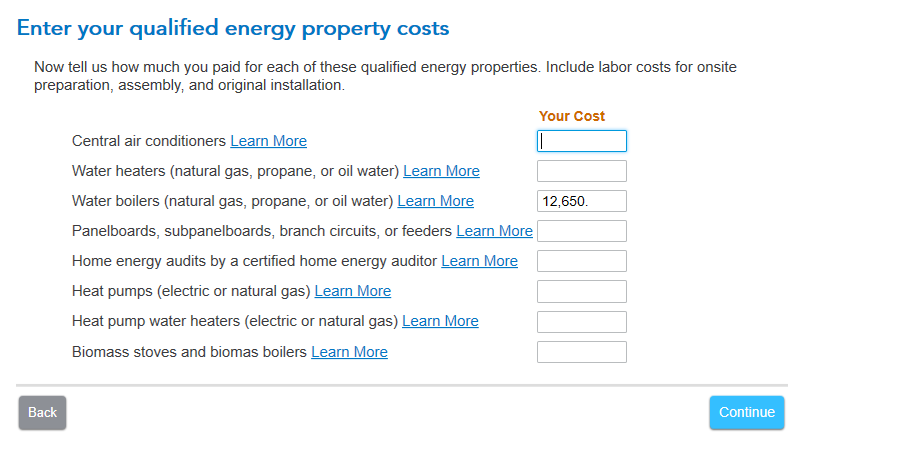

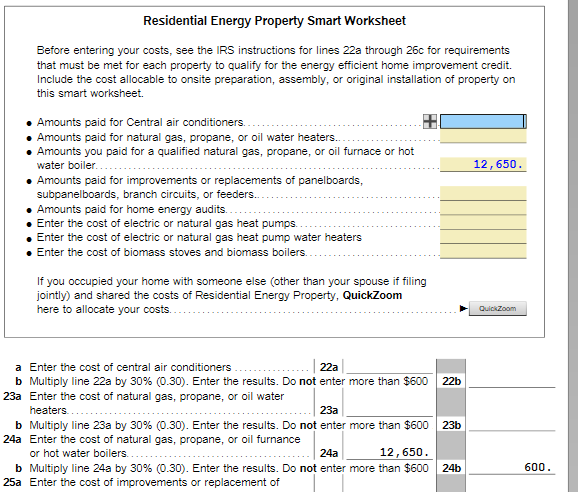

I installed a natural gas furnace in 2023 that qualifies for a Home Energy Tax Credit on Form 5695. The TurboTax step-by step instructions does not mention furnaces, however my entry for the cost of the furnace did enter correctly on the Residential Energy Smart Worksheet, and on line 24a of Form 5695.

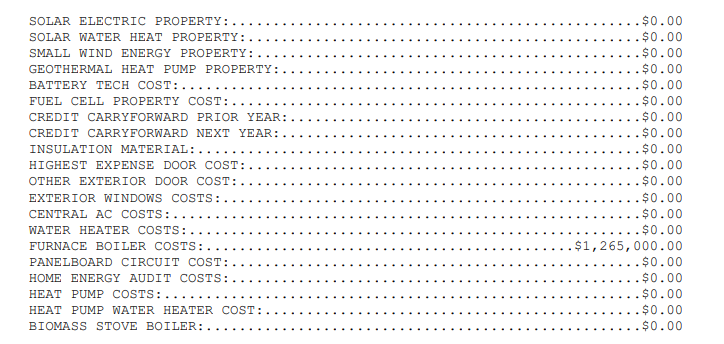

However after eFiling, I checked my Record of Account on the IRS website. The section for Form 5695 shows $1,265,000 for "Furnace Boiler Costs". There is either an error on the TurboTax transmission to the IRS, or on the IRS side. I tried to report this through the help line, however the agent did not know how to open a case on a program error.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 5695 eFile - Possible IRS transmission error

Since you’ve already double-checked your entries on TurboTax to confirm the correct amount was entered, then you must report the error on your transcript directly to the IRS. See here under the section Get Transcript Online or by Mail FAQs, Q6: If the transcript obtained doesn't appear to be correct or contains unfamiliar information due to possible identity theft, call us at 800-829-1040.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 5695 eFile - Possible IRS transmission error

Since you’ve already double-checked your entries on TurboTax to confirm the correct amount was entered, then you must report the error on your transcript directly to the IRS. See here under the section Get Transcript Online or by Mail FAQs, Q6: If the transcript obtained doesn't appear to be correct or contains unfamiliar information due to possible identity theft, call us at 800-829-1040.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

osgood53

New Member

NeUnhappy

New Member

Cat_Sushi

Level 2

ValerieC1

New Member

biscuitme

New Member