- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Form 1065 Sch K Line 13d

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 1065 Sch K Line 13d

In TurboTax Business Desktop, I am getting an error message, "Form 1065 p5-6, Sch K, Line 13d Code must be entered", but none of us partners have a Sec. 59(e) deduction and both the oil and gas income and deductions are already entered in the Alternative Minimum Tax Items section on Lines 17 d and e. Why is TurboTax giving me this error message?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 1065 Sch K Line 13d

That entry comes from a box 13 entry on a K-1 form. It references other deductions associated with the partnership. I suggest you look at your K-1 entries in box 13, see if there is an entry there.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 1065 Sch K Line 13d

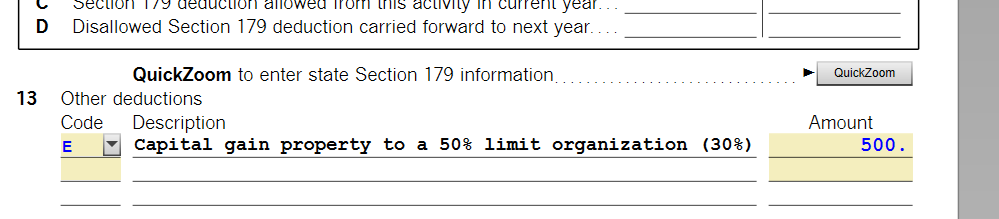

A zero was entered in line 13d and the software printed "See statement" in the 1 box. A zero was also entered in line 13e and the software printed "see statement" in the "type" box. The statement for Sch K, Line 13e, Other deductions said "Deductions-royalty income" = 0 and "Medical insurance payments for partners" = 0. I don't understand why the software required me to enter zeroes on lines 13d and 13e.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 1065 Sch K Line 13d

It would be helpful to have a TurboTax ".tax2023" file to test further.

If you would be willing to send us a “diagnostic” file that has your “numbers” but not your personal information, please follow these instructions:

In TurboTax Desktop, open your return and go to Online in the TurboTax header. (On a Mac computer, choose File >> Share.)

- Choose Send Tax File to Agent.

- You will see a message explaining what the diagnostic copy is. Click Send on this screen and wait for the Token number to appear.

- Reply to this thread with your Token number and tag (@) the Expert requesting the token from you.

- Please include any States that are part of your return.

We will then be able to see the same experience you are having. If we are able to determine the cause, we'll reply here and provide you with a resolution.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

Tax_Lego

Returning Member

jd2004

Level 1

PASSIVE FARMER

New Member

johnh

Returning Member

lc50

Returning Member