- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Foreign Housing Exclusion Question (Both employer-furnished housing AND THEN changed to housing stipend cash paid)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Foreign Housing Exclusion Question (Both employer-furnished housing AND THEN changed to housing stipend cash paid)

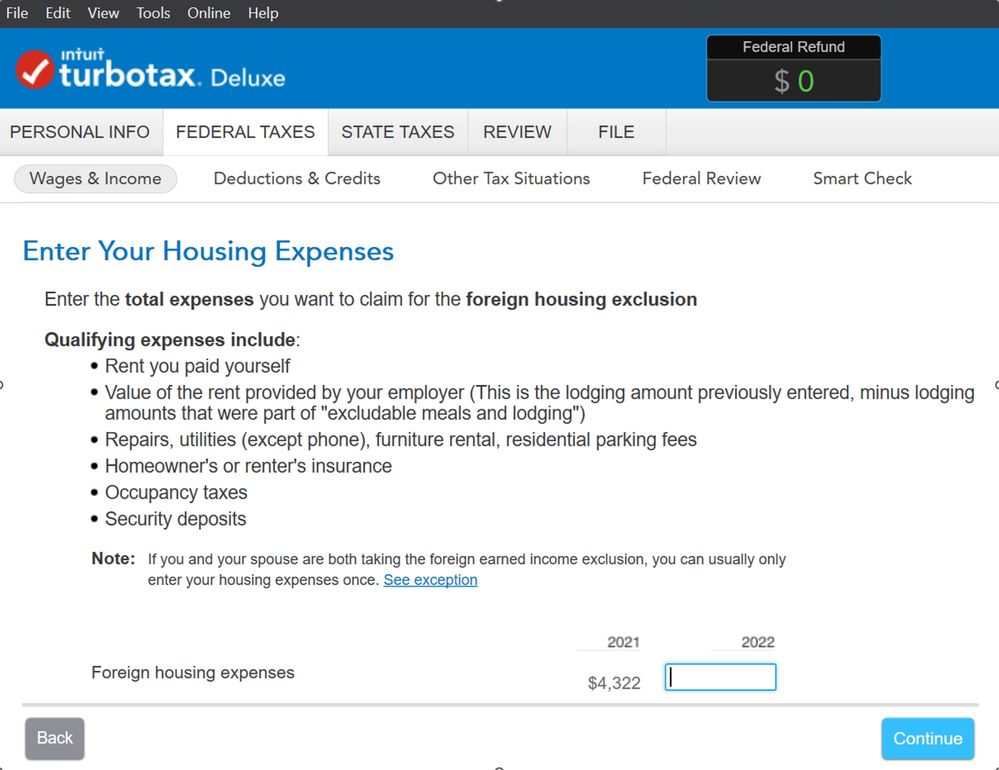

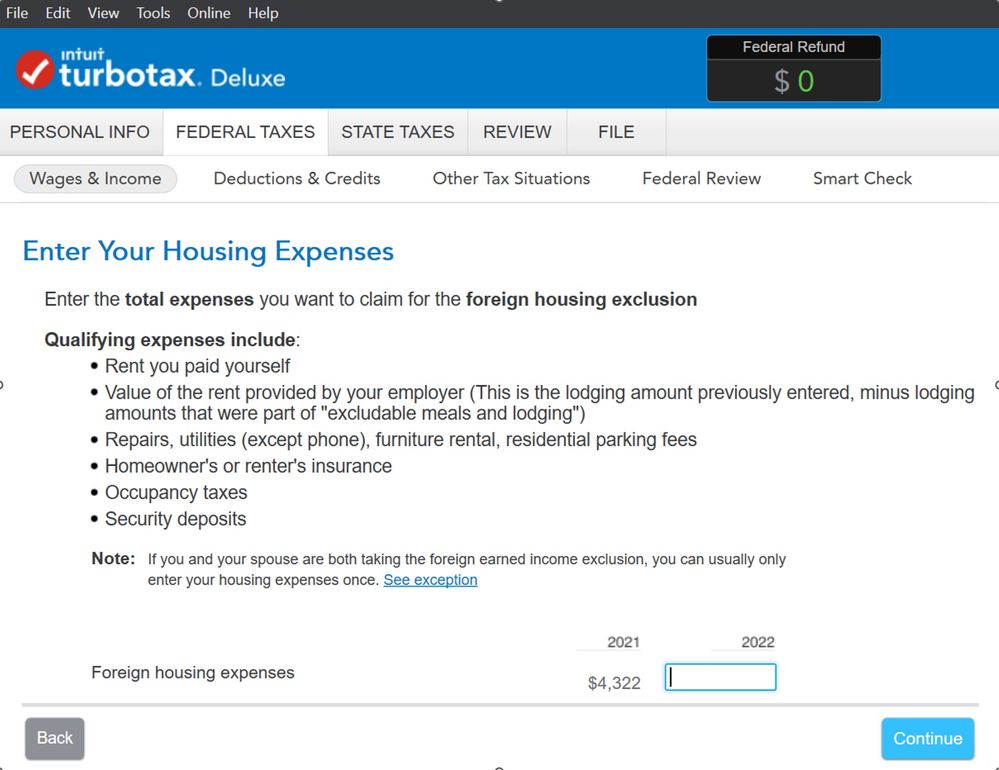

I have a question for this page (see screenshot).

For the first part of the year, I had foreign employer-provided housing which I inputted the amount on a previous page that said the fair value of the housing.

For the second part, I received a HOUSING ALLOWANCE (CASH STIPEND) in lieu of housing. I inputted this on another page which showed money paid in cash for "Quarters" by the foreign employee.

For the Foreign housing expenses, do I only include the first part (value of the foreign employer-provided housing)? Or the combination of both the employer-provided housing market value AND the CASH provided in the housing allowance (cash stipend)? I didn't fully use the cash stipend directly for rent or whatever and I don't want to itemize all of the other things on there (utilities, taxes, etc.).

For now, I just put the foreign employer-provided housing only. But, if I need to add the housing allowance (cash stipend) to it, I can.

Is it maybe even my choice since it's an exclusion? Thanks in advance!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Foreign Housing Exclusion Question (Both employer-furnished housing AND THEN changed to housing stipend cash paid)

@shanesnh , all the amounts received from your employer ( whether as wages , cash stipend, in-kind benefits etc. ) has to be accounted and taxed somewhere.

In your particular situation , your housing expenses that you are trying toto exclude , includes FMV of the housing provided, amounts that you incurred directly -- with NO employer participation and any cash / re-imbursements provided by your employer for housing purposes. Thus your housing expenses include rent paid by the employer on your behalf AND cash that the employer provided to you for purposes of housing purposes --- even though as you commented , you did not spend all that in housing ( it is simpler to include this as part of housing or you have add the non-spent amount as part of your wages .

Does this make sense ? For reference take a look at the instructions for form 2555 at www.irs/gov and of course Pub 54.

Is there more I can do for you ?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Foreign Housing Exclusion Question (Both employer-furnished housing AND THEN changed to housing stipend cash paid)

I will page Champ @pk for this question as well as your other question. Please stand by.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Foreign Housing Exclusion Question (Both employer-furnished housing AND THEN changed to housing stipend cash paid)

Thanks 🙂

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Foreign Housing Exclusion Question (Both employer-furnished housing AND THEN changed to housing stipend cash paid)

@shanesnh , all the amounts received from your employer ( whether as wages , cash stipend, in-kind benefits etc. ) has to be accounted and taxed somewhere.

In your particular situation , your housing expenses that you are trying toto exclude , includes FMV of the housing provided, amounts that you incurred directly -- with NO employer participation and any cash / re-imbursements provided by your employer for housing purposes. Thus your housing expenses include rent paid by the employer on your behalf AND cash that the employer provided to you for purposes of housing purposes --- even though as you commented , you did not spend all that in housing ( it is simpler to include this as part of housing or you have add the non-spent amount as part of your wages .

Does this make sense ? For reference take a look at the instructions for form 2555 at www.irs/gov and of course Pub 54.

Is there more I can do for you ?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Foreign Housing Exclusion Question (Both employer-furnished housing AND THEN changed to housing stipend cash paid)

Hi there @pk

Thanks for the answer.

So, I should include ALL (BOTH) the fair market value (which is employer provided) for when I was given free employer-provided housing AND the actual cash amounts of the housing allowance/cash stipend for housing (received after moving out of employer's housing) together on that page?

(I did already report these numbers both and they are both added to income -- FMV of employer-provided housing was added to my income and then the cash paid for the housing allowance was also added to my income).

Also, because of the Foreign Earned Income Exclusion, I owe $0 in taxes and paid $0, anyway. And even without this Foreign Housing Exclusion, it's still $0, so I wonder if it even makes a difference for me. Please let me know. Thanks so much!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Foreign Housing Exclusion Question (Both employer-furnished housing AND THEN changed to housing stipend cash paid)

@shanesnh , if at the end of all your entries ( i.e. recognition of all incomes associated with the foreign employment ), your Foreign Earned Income exclusion eliminates all your foreign income from US taxes , then you have met your goal. Any foreign taxes on this excluded income is NOT eligible for Foreign tax credit ? deduction.

Does this answer your question ? Or am i in the left field ?

pk

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Foreign Housing Exclusion Question (Both employer-furnished housing AND THEN changed to housing stipend cash paid)

Because the Foreign Earned Income Exclusion already brings my taxes to $0, doing this additional Foreign Housing Exclusion seems like it's not needed but TurboTax asks me anyway. I did it last year but last year I only had employer-provided housing so it was simple: I just put in the same number when it asked me how much the employer-provided housing fair market value was and then also on this page (in my screenshot) for the Foreign Housing Exclusion.

But, this year, at the beginning of the year, I had the same type of employer-provided housing (free house no rent needed to be paid) and so I marked all the forms the same way I did last year when it asked me. The fair market value of the employer-provided housing is $2746.54.

On top of that fair market value, I moved out of housing and moved in with my girlfriend (now my wife). So, I got extra CASH in my paycheck instead every month as a housing allowance/housing stipend. The amount I received for that was $1,168.80. I also had to input this on another page when it asked me how much I was given in CASH for housing.

So, my question was, do I just put in the $2746.54 since that is what the question says "Value of the rent provided by your employer". It says that is "the amount you entered previously" when it asked me the fair market value... So, I though maybe it's just the $2746.54 since the extra $1,168.80 was CASH and it doesn't mention the CASH payments on that screen (it just says rent you paid for yourself, utilities, etc. and I don't wanna itemize all that out). So, I'm not sure how to do it. Is it $2746.54? Or $2746.54 + $1,168.80? Or, it doesn't really matter? Please let me know.

--Shane H.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Foreign Housing Exclusion Question (Both employer-furnished housing AND THEN changed to housing stipend cash paid)

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

mpiseter

New Member

K_lead90

New Member

TomG6

New Member

MGloeckler

New Member

obeteta

New Member