- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Foreign earned income exclusion offset to Adjusted Gross Income

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Foreign earned income exclusion offset to Adjusted Gross Income

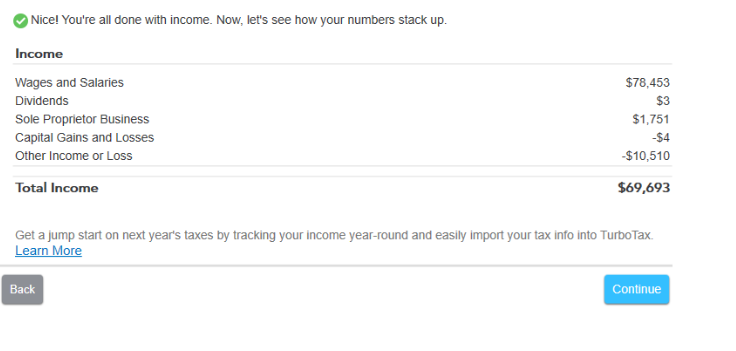

I am in a situation where I was filing taxes jointly for me and my wife in Michigan, she used to live in Canada and had an income of $10,510 USD working on contract for a long term care home and has a T4A, my income in Michigan was $78,453.

I filed the $10,510 for my wife under the foreign earned income exclusion through the bona-fide residence election as "A form 1099-misc or other self-employment income".

There is also an excess from my wife's side of $1751 from a non employee compensation job in Michigan on a 1099-NEC which I had to create a schedule C for, I still have doubts about this being the proper way to report it but it is not a wage so I identified it as a QBI (qualified business income).

My doubt is that when I go to my summary of 2022 income the $10,510 offsets the $78,453 which leads to an artificial offset since my wife's income exclusion shows up as -10,510, would this not artificially inflate our return since it is lowering our overall taxable income by the $10,510 amount.

That didn't seem right to me so I went ahead and added a sole proprietor business with her Canadian contract salary under the "other income" tab. This also doesn't seem like the best possible solution but this would create a breakeven on Wife's side and make the foreign earned income not considered in the tax return other than just for informational purposes, the reason why this doesn't make sense is because it decreases the return amount significantly seemingly being considered and actually harming the return.

I am wondering what needs to be done in this case to ensure the filing is correct?

Thank you in advance to anyone who can provide info!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Foreign earned income exclusion offset to Adjusted Gross Income

Follow thes steps in Turbotax for entering the foreign income thereby calculating the foreign earned income exclusion. If you had taxes withheld on those earnings, they may not be excluded anymore because you already excluded the foreign income (10,510) from your US taxable income so you are already not being taxed on this income. See HERE

If you are entitled to foreign income exclusion, then yes all 10,510 would be excluded. For 2022, the maximum exclusion is 112,000 per person. See HERE for more detail on how this is calculated. In your case, you most likely will get the full deduction.

As far as your wife's side income , you did it correctly by creating a Sch C for this amount. To determine if this is QBI to be eligible for the QBID , see HERE.

Thank you.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

knownoise

Returning Member

obeteta

New Member

RShaunSmith

New Member

temperaturesealion

Level 1

megan0956

Returning Member