- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Foreign Earned Income Exclusion: 2022 had BOTH employer-provided housing (beginning of year) and then moved to unrelated apartment w/ cash stipend. How do I answer this question

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Foreign Earned Income Exclusion: 2022 had BOTH employer-provided housing (beginning of year) and then moved to unrelated apartment w/ cash stipend. How do I answer this question

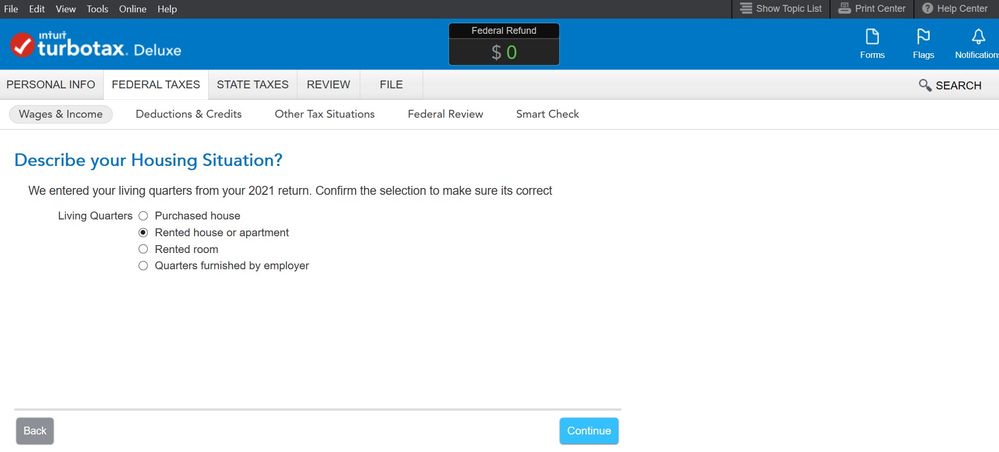

I need help with this question for the Foreign Earned Income Exclusion.

In, 2022 I had BOTH employer-provided housing (at the beginning of year for 7 months) and then moved to an unrelated apartment with an extra cash stipend from the employer (for the last 5 months of the year). How do I answer this question? I was going to pick "rented house or apartment" as that was the condition at the end of the tax year. Does this matter? I technically was at employer-provided housing for longer, but at the end of the year, I was at an unrelated house getting the stipend. I inputted values for BOTH employer-provided housing (lodging) AND for cash stipends for housing allowance (quarters) on previous pages.

Thanks in advance!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Foreign Earned Income Exclusion: 2022 had BOTH employer-provided housing (beginning of year) and then moved to unrelated apartment w/ cash stipend. How do I answer this question

Did you not start another thread on this issue? Was you question not answered?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Foreign Earned Income Exclusion: 2022 had BOTH employer-provided housing (beginning of year) and then moved to unrelated apartment w/ cash stipend. How do I answer this question

Different question. Other question was about exclusion amounts. This question is about which box to check. Related for sure. All related to the FEIE. I thought when you buy turbotax, you are allowed to ask them directly for help. I felt like I've done it in the past when I was like 18 or 19 but I don't remember for sure..

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

shanesnh

Level 3

shanesnh

Level 3

shanesnh

Level 3