- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Excess HSA Employer Contribution With Closed HSA Account

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Excess HSA Employer Contribution With Closed HSA Account

Background. On my wife's W2 for 2022 there's $358 "W" employer HSA contribution in box 12. Of them $54 were in excess. That excess wasn't withdrawn yet. Back then my wife had 2 HSA accounts (one with no contributions in 2022 from previous employer). After marring in January 2022, my wife wasn't eligible for HSA anymore, and moved from high deductible to shared deductible health plan. So excess contribution happened in Jan 2022. In 2023 funds in the HSA account that got excess contributions ran out because of service fees every month, and account got closed. 1099-SA wasn't provided for 2023 for that HSA account since there were no contributions, or distributions, only service fees. Another HSA account from previous employer is still open with >$54, and 1099-SA was provided for it (I think because of distributions).

Problem. When filing taxes for 2023, Turbotax now keeps asking in the loop if my wife had high deductible in 2023 / Dec 2022, and I keep answering "no". I cannot file because of that.

Question. It's my understanding that we need to reach out to HSA account provider asking to withdraw excess contribution in order to resolve this issue. But since the HAS account was closed in 2023, it doesn't make sense to me. So what should we do to file this year? Since account is closed, is amount considered withdrawn? If so, how can we report it in Turbotax? Should we reach out to HSA provider to withdraw anyway? If so, which one? Should I ask for IRS extension at this point?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Excess HSA Employer Contribution With Closed HSA Account

Answer: "No, we are not going to make this withdrawal". This is because, as TurboTax pointed out, you can't withdraw as an "excess contribution" a carryover of excess from a previous year.

1c) Oddly, when you make that withdrawal for a carryover in the years after the initial excess, you don't worry about the interest and earnings. That's what the 20% penalty is for.

All the withdrawal for non-medical expenses has to cover is the original excess amount (the $54 in your case) that is being carried over.

Form 5329 will figure out what you have done, and erase the carryover. It will, I promise.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Excess HSA Employer Contribution With Closed HSA Account

My wife just told me that she was wrong about which HSA account got excess contribution. It's not the closed account, but the one with >$54. I assume I should follow "choice 2" from this recommendation to unblock myself.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Excess HSA Employer Contribution With Closed HSA Account

The excess was made in tax year 2022.

Following the directions given in the other answer, you will still pay the penalty on the excess for tax year 2023.

Make the distribution for the excess and any earnings in 2024.

Next year, you will report that as a non-qualifying distribution (to zero out the excess) and you will then pay tax on that distribution (report that it was NOT used for medical expenses).

The excess will no longer be reported after tax year 2024.

If you made distributions in 2023, you could do the same thing for 2023, claim part of the distribution (the amount of the excess) as non-qualifying.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Excess HSA Employer Contribution With Closed HSA Account

I think I understand what you suggested to do, but not what the difference it would make, or how to report it in turbotax in 2023 filings.

My understanding of your recommendation is not to reach out to HSA provider asking for excess withdrawal (it's my understanding they would send me a check in this case). Instead you suggest to use HSA for non medical purposes (say, groceries) for amount that is larger than excess + earnings from excess.

1. How does getting check from HSA provider different than spending money on non-qualifying purchases? What is the benefit of doing non-qualifying purchases?

2. If I go this way, how do I unblock my 2023 filing in turbotax?

I don't care as much if it's 6% or 12% or 100% of $54. Just looking for the easiest way to get rid of this head ache.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Excess HSA Employer Contribution With Closed HSA Account

#1. It is too late to withdraw the 2022 excess - this had to be done by the due date of the 2022 return. Yes, you may think that you can just call up the HSA custodian and as for the withdrawal of the excess (the the HSA custodian won't know any better), but the paperwork would be all wrong in the event of an audit.

#2. "Turbotax now keeps asking in the loop if my wife had high deductible in 2023 / Dec 2022, and I keep answering "no". I cannot file because of that."

I assume that you are referring to the question "What type of High Deductible Health Plan (HDHP) did [name] have on December 1, 2022? You should answer this with None, if I understand your history correctly, since your wife lost the HDHP coverage in January 2022.

But I don't understand why you are in a loop. What questions are you being asked in this loop? I don't see why this should result in a hang-up?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Excess HSA Employer Contribution With Closed HSA Account

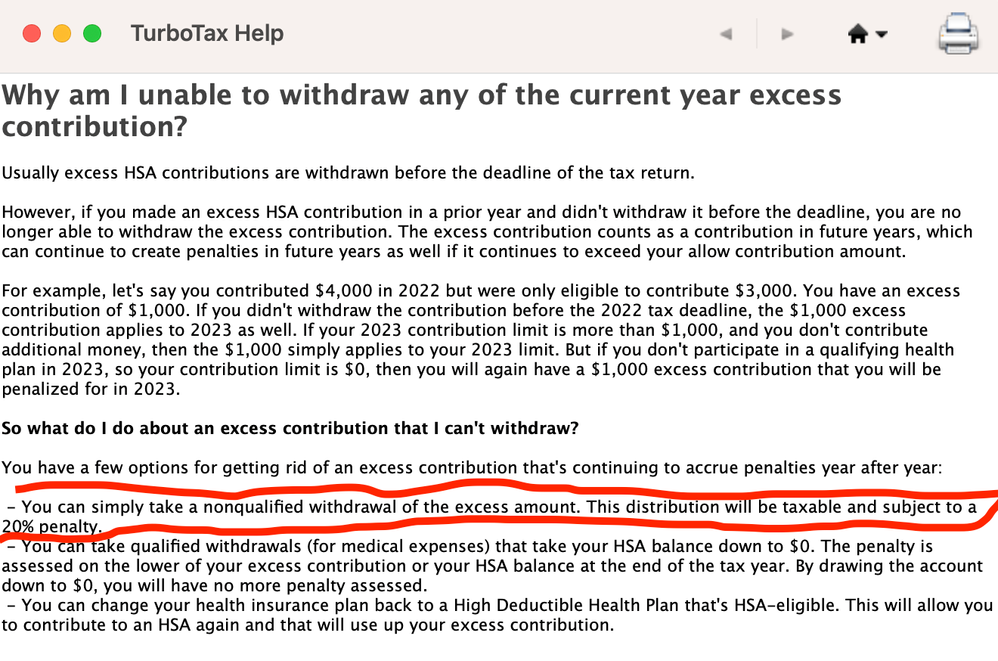

(1) So it sounds like doing excess contribution removal is going to be more head ache in the future, it's why you recommend doing non-qualifying withdrawal instead. I found detailed explanation of this in Turbotax help as shown below (with recommended by you option highlighted).

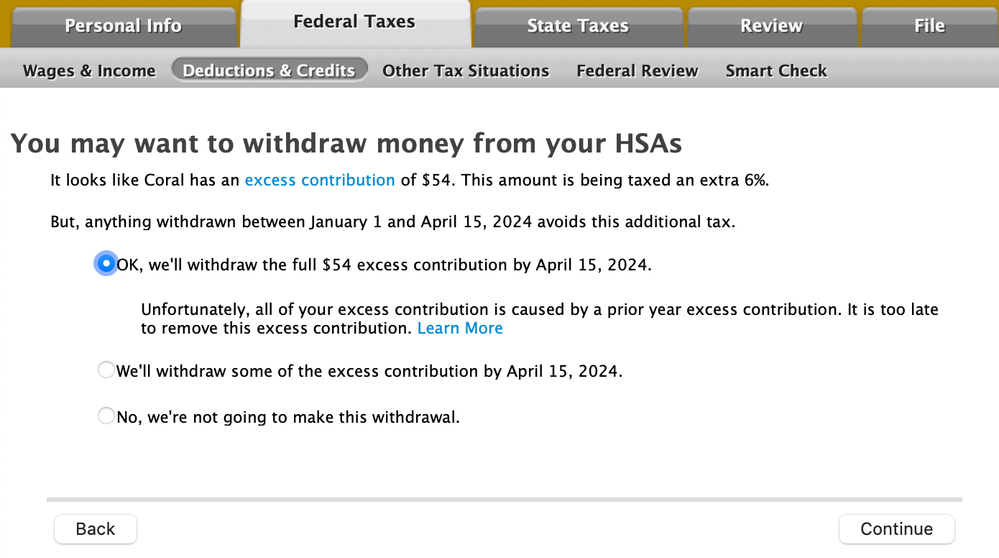

1b) Or should I choose option 3 since we are not removing the excess withdrawal directly? (if so, how Turbotax 2024 will know not to ask about these $54 excess?)

1c) Can my wife withdraw more than excess plus interest in order for this to work? I don't think we can figure out interest reliably, so I'm guessing significantly larger sum than the interest (say, $75) should cover it, right?

Working on your questions for question (2) now...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Excess HSA Employer Contribution With Closed HSA Account

Answer: "No, we are not going to make this withdrawal". This is because, as TurboTax pointed out, you can't withdraw as an "excess contribution" a carryover of excess from a previous year.

1c) Oddly, when you make that withdrawal for a carryover in the years after the initial excess, you don't worry about the interest and earnings. That's what the 20% penalty is for.

All the withdrawal for non-medical expenses has to cover is the original excess amount (the $54 in your case) that is being carried over.

Form 5329 will figure out what you have done, and erase the carryover. It will, I promise.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Excess HSA Employer Contribution With Closed HSA Account

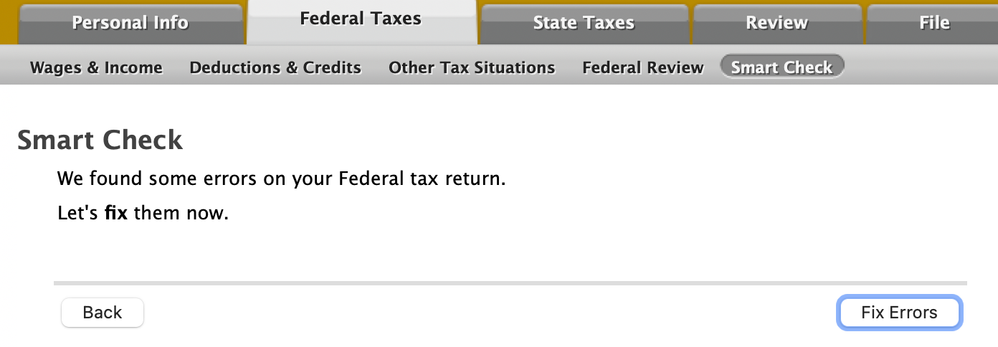

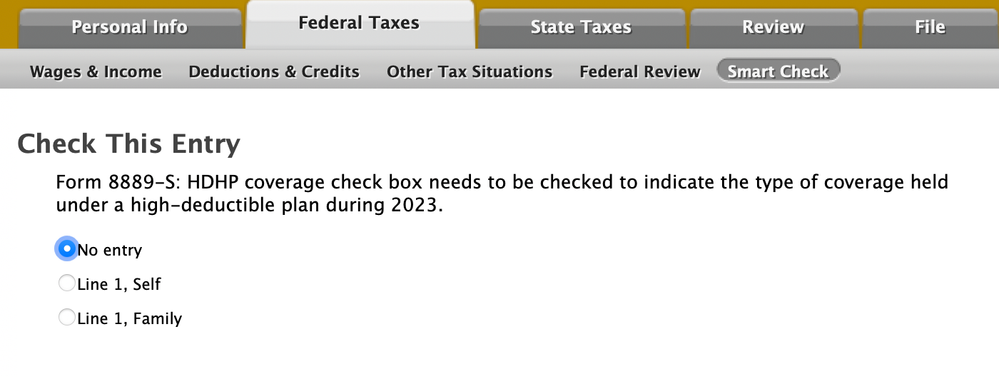

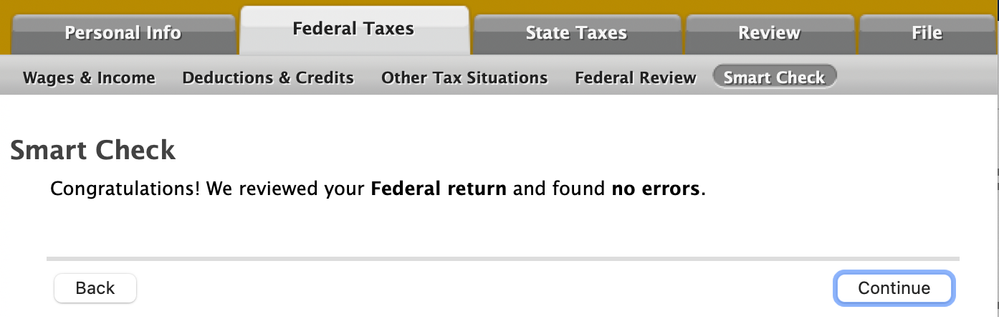

I'm getting SmartCheck errors as shown at screen shots below. They are the loop I was talking about.

"No entry" since my wife was under shared deductible since Jan/Feb 2022

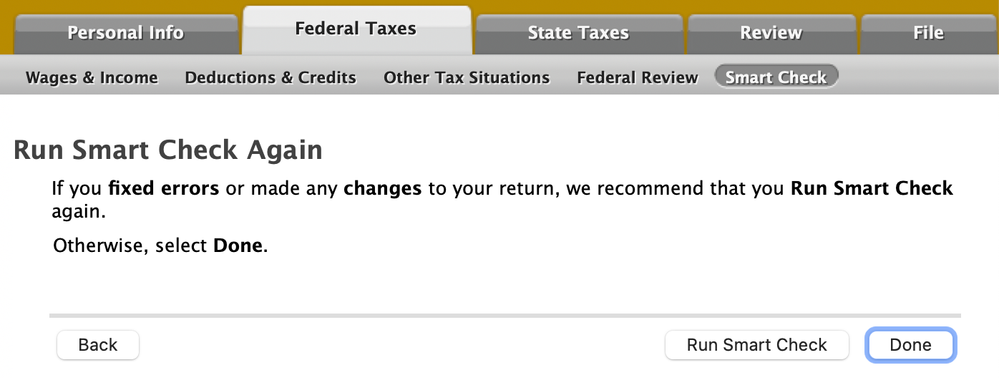

I run smart check again, and getting the same error.

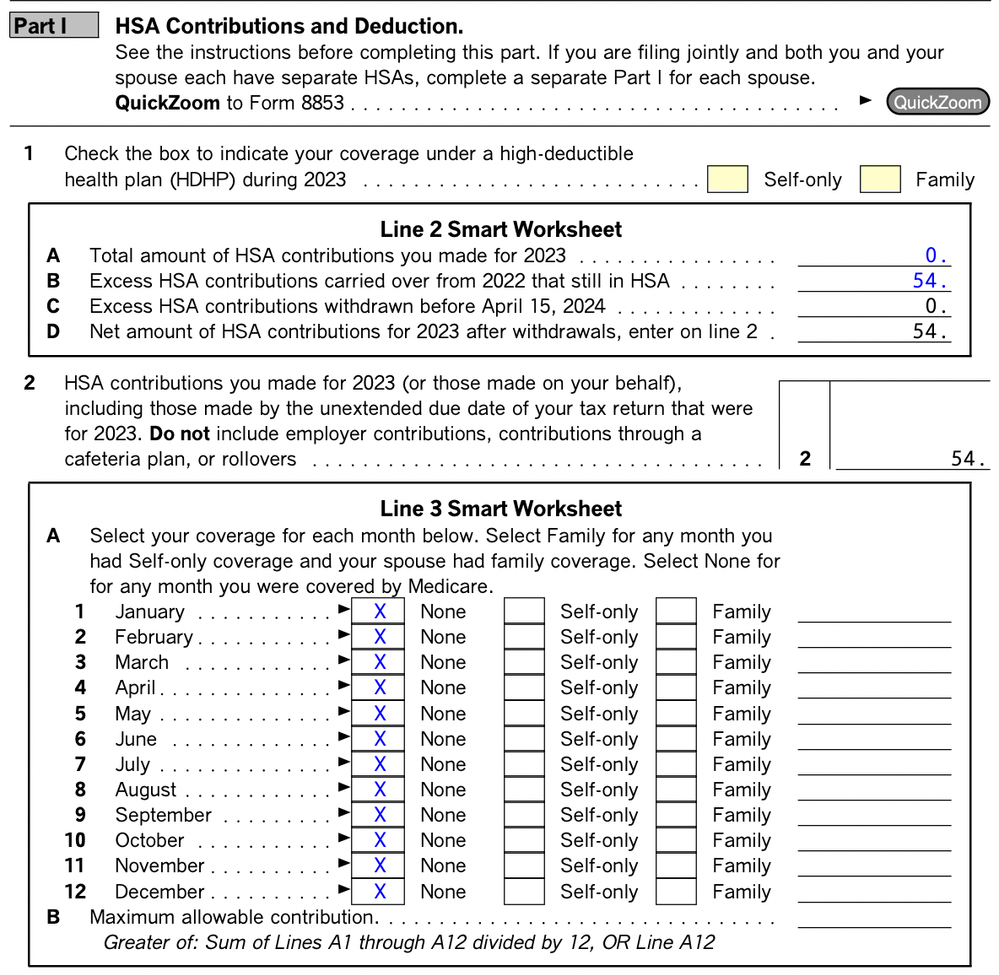

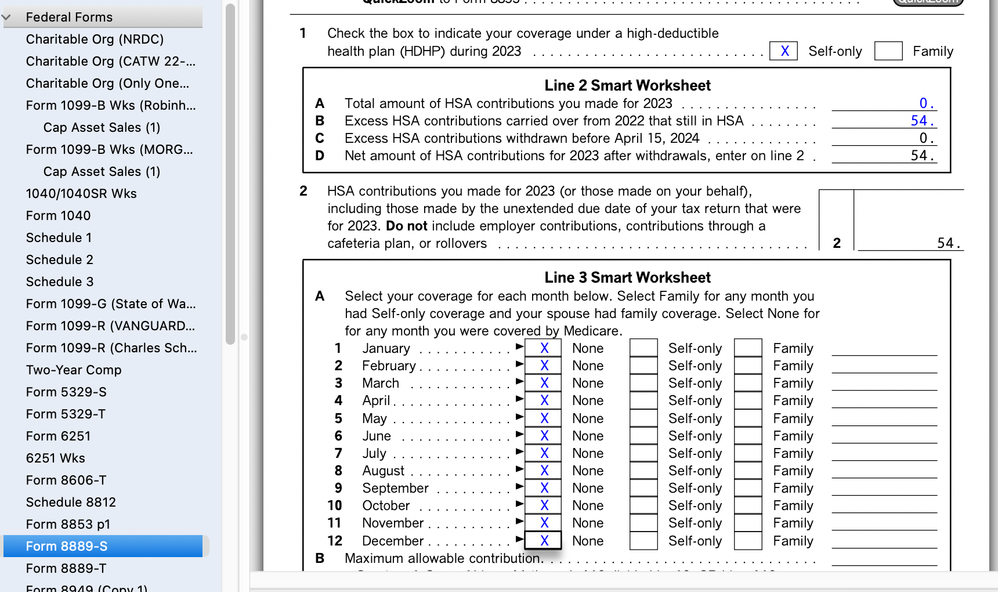

Here is how it looks in Forms in 8889-S:

In some other thread I've seen people suggesting choose "Self-Only" in line 1 of 8889-S (which is not technically true), but then choosing "None" in 2A for all months (which makes it non-sensual, but more true). When I did this, the issue went away (no more SmartCheck errors) as shown below, but I don't know if it's the right thing to do:

2a. Is it what I'm supposed to do in TurboTax every year that my wife has HSA account, but no high deductible health plan?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Excess HSA Employer Contribution With Closed HSA Account

Yes, checking Self is the right thing to do in your case. This is because the Review is confused on why you have an 8889 when you don't have any HDHP coverage. We have not been able to persuade the Developers to update this.

Checking Self will not affect the calculations, but will get you past this Review question.

The carryover was your spouse's right? That's the only reason your spouse has an 8889 this year. If you succeed in getting the 5329 to delete her carryover (as described above), then TurboTax will not create an 8889 for your spouse, and the Review question goes away.

You will still continue to see (unless we can fix this as well) the question, "What type of High Deductible Health Plan (HDHP) did [name] have on December 1, 2022?" (well, whatever the previous tax year is) will still appear. So long as your spouse or you did not have HDHP coverage in the previous year, you can just check NONE to this question.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Excess HSA Employer Contribution With Closed HSA Account

Yes, the carryover was my spouse's. I got completely unblocked and filed my tax return yesterday. We will use HSA card for $54 non-qualifying purchase today. Thank you so much!

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

megan0956

Returning Member

Andy_W

Level 1

berolee

Level 1

Sachin Kunagalli

New Member

erikaeriga

Level 1