- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Etrade 1099 shows an unfair cost basis on shares of stock I sold

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Etrade 1099 shows an unfair cost basis on shares of stock I sold

Determining the cost basis of stock

Last November I sold shares of 426 shares of xyz corp. @194

The shares had been purchase at various dates in 2017 & 2018 and 2022 at various prices ($114, $174 & $194).

In determining the cost basis Etrade used the $125 purchase price instead of a later share price of $174

Can I change the cost basis to the shares sold to $114 to 174 which would save me a substantial difference in capital gains tax liability?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Etrade 1099 shows an unfair cost basis on shares of stock I sold

You should NOT attempt to fill out the 8949 worksheet manually. Time consuming and easy to mess up. TT will download your 1099's directly from your brokerage account. If you sold a security that was purchased at different times and prices, etrade's software will probably use "first in, first out". It will use as the cost basis for each sale the price paid for the oldest shares first. It's just math, "fairness" has nothing to do with the calculation of the gain/loss. It's very easy to check that all of your trades have been included. Just compare the TT summary screen with what's on the front summary page of the 1099.

I know about 8949's because I do my son-in-law's taxes. He trades options and his 2023 tax return, if printed out, would be 70 pages, mostly LOTS of 8949's]

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Etrade 1099 shows an unfair cost basis on shares of stock I sold

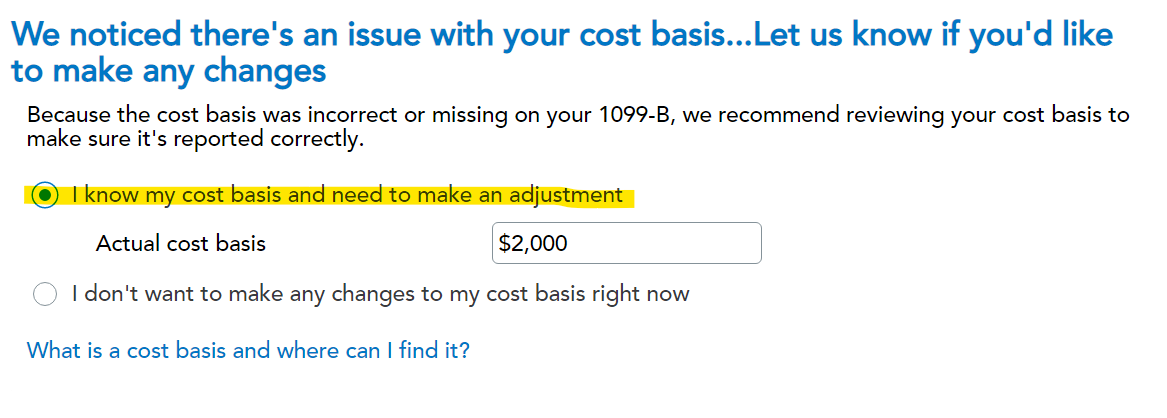

If you determine that the cost basis reported on the Forms 1099-B are incorrect, you can adjust the cost basis reported on your tax return. You will see an option for this when you enter the Form 1099-B information in TurboTax. On the screen where you enter the sales proceeds and cost basis, just check on the box that says The cost basis is incorrect or missing on my 1099-B:

So, you enter the cost basis reported on your Form 1099-B then on another screen you'll see an option to enter the correct cost basis:

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

amyonghwee

Level 4

johnsantaclara2

Level 2

dina_sm

Level 2

SelfTaxPreper

Returning Member

forologia

Level 3