- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- ESPP Sale Question (not answered previously)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

ESPP Sale Question (not answered previously)

For the first time I sold some of my ESPP shares. They are all in little lots by quarter. I selected the lowest gain ones and sold them. I got my 1099b and even found the supplement. Here's my question/s. I used the bulk feature to mark all the little transactions as ESPP. When I entered the first one I checked and all the information on the details is correct from the import from my financial institution but, the first one asked about things not on the supplement. First, the plan discount, which I know is 10%. When I clicked next it requested information from my 3922 for this sale (which I have no idea which one so that didn't help). I used the supplement to figure out the sale price and the adjusted price I paid for it. I looked up fair market value on the day of issue and sale from an online database and just used the opening price to fill it in. Is that the right thing to do?

Now here is the weird part. I have about 25 more of these sales to address. They are all marked ESPP but when I click next I don't get the same screen. Instead I just get a single box for the adjusted cost basis (which I got from the supplement and is incidentally the same as my cost basis reported). So, it seems like I need to do the same thing for the rest of the ESPP shares but I'm not being prompted for the information. How to I figure out what to do here? Thanks in advance for the guidance.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

ESPP Sale Question (not answered previously)

The discount amount per share for a qualified employee stock sale will be the discount percentage times the market price on the grant date. You would multiply that times the number of share sold to determine the discount applicable to the shares you sold.

On the screen where you enter the investment sale, you will see an option to indicate that the cost basis is missing or incorrect:

As you continue through that section, you see an option to enter the correct cost basis:

If you know the correct cost basis, once you enter it that is all you need to do for that stock sale. The discount should be reported on your W-2 form as wages in box one, and once you enter the correct cost basis for the Form 1099-B reporting, you have accounted for the capital gain.

When you are done with that section, you will see an option to Add more sales:

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

ESPP Sale Question (not answered previously)

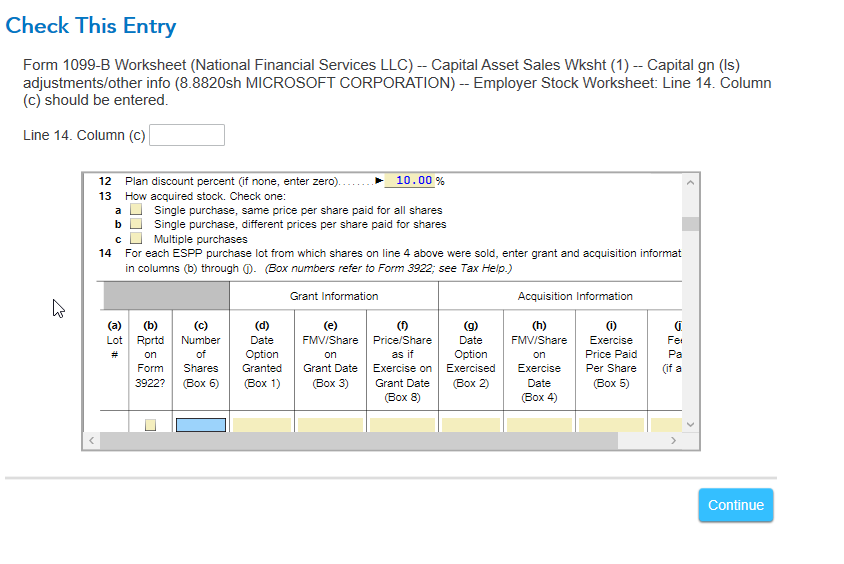

Thanks for the reply Thomas. The images are really help too. Make sense, but on one of the ESPPs I got a prompt to fill the discount % and that other worksheet appeared asking for 3922 info I don't have. Now that triggered the creation of this form. I originally filled it out for one stock (as described above), but tried to deleting that info hoping the form would go away (it didn't). Now the "smart check" is stopping on this form again asking me to fill it out (see below). Do I need this? Is there any way to delete this form? It seems above and beyond what you described. Also, I don't have all the requested inf. I tried to delete the information but I still have this form and the check keeps stopping at it. Thanks for your help.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

ESPP Sale Question (not answered previously)

You may be able to delete the 1099-B worksheet. There is one for every Form 1099-B you entered, so you'd need to delete the correct one. You will see the name of the broker in parathesis next to the worksheet name. I believe they are in order by the ones entered first to last.

Follow these instructions:

1. Choose the Tax Tools option on your left menu bar

2. Choose Tools

3. Choose the Delete a form option under Other Helpful links

4. Look for the Form 1099-B Wks (broker name) in the list of forms and delete it

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

ESPP Sale Question (not answered previously)

Yep that is exactly what I did. Hopefully the right form. It seems only two of them of the 25 or so were flagging trouble so I removed and now it is passing status check. Thanks again for the help.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

nessa1614

New Member

Fuzzy Red Baron

Returning Member

tommymaulmaul

New Member

ja19584

New Member

smlhaberman

Level 2