- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Employee HSA contribution does not show up in W-2 Box 12W

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Employee HSA contribution does not show up in W-2 Box 12W

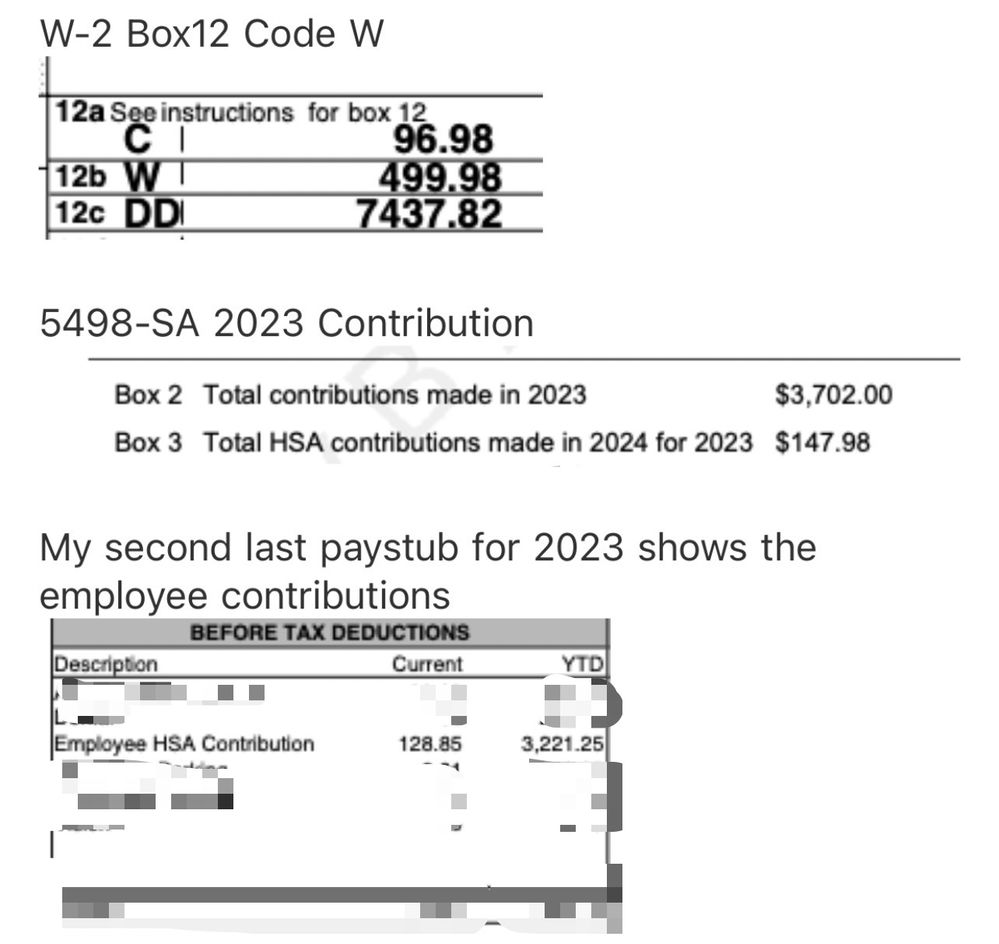

I'm in the process of filing my 2023 taxes and encountered a discrepancy regarding the HSA contributions on my W-2. I'm seeking some clarification on this matter.

Here is the context. In 2023, I enrolled in an HSA and made a pre-tax contribution of $3,350 through payroll deductions. Additionally, my employer contributed $500 pre-tax to my HSA account. So, collectively, the total contributions amounted to $3,850. On my W-2, in Box 12, there is an entry labeled "W" with a value of $500. My understanding is that this figure represents the $500 contribution made by the employer and does not encompass my own contribution. Furthermore, the $3,350 contribution I made is deducted from my gross pay, so it is not reflected in Box 1 of the W-2.

However, I also received a 5498-SA tax form for my HSA account, which indicates a total contribution of $3,850 for 2023. This figure seems to encompass both my contribution and the employer's contribution. I'm concerned about the disparity between the amount in W-2 Box 12W and the total contribution shown on the 5498-SA. Should I ever include the $3350 contribution on my tax return? If so where should I put it?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Employee HSA contribution does not show up in W-2 Box 12W

I enrolled in an HSA and made a pre-tax contribution of $3,350 through payroll deductions.

This should be included in 12W of your w-2. salary reduction is proper because that's where you get the tax deduction when you make HSA contributions through an employer plan.

Additionally, my employer contributed $500 pre-tax to my HSA account.

that should be added to your contributions and $3850 should be in box 12W

box 9 on the 8889 should reflect 3850

you need to contact your employer to get a correct the W-2 and since yours is wrong most likely the W-2 for every other employee that made an HSA contribution through the employer is wrong.

from w-2 instructions

W—Employer contributions (including amounts the employee elected to contribute using a section 125 (cafeteria) plan) to your health savings account. Report on Form 8889.

if your employer refuses you'll have to contact the iRS

see this iRS link

https://www.irs.gov/faqs/irs-procedures/w-2-additional-incorrect-lost-non-receipt-omitted

calling instructions

- Call 1-800-829-1040 between the hours of 7:00 AM – 7:00 PM local time.

- Press “1” for English or “2” for Spanish.

- Press “2” for “answers about your personal income taxes.”

- Press “1” for “questions about a form you have already submitted or a payment or to order a tax transcript.”

- Press “3” for “all other questions about your tax history or payment.”

- Press “2” for “all other questions about your tax history or payment.”

- Do not input your Social Security Number when the recording tells you to.

- Press “2” for “personal- or individual-tax related question.”

- Press “3” for “all other inquiries.”

- Wait to be connected to someone at the IRS.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

Andy_W

Level 1

henry1959

New Member

erikaeriga

Level 1

jjyoo92

New Member

htb14

Returning Member