- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- E-File LLC Partnership return 1065

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

E-File LLC Partnership return 1065

I'm not able to e-file my LLC Partnership return using Turbo Tax Business, form 1065. I get the following pop-up.

The Intuit Electronic Filing System is having difficulty recognizing the data in the return you are sending. Make sure your Turbo Tax program is up-to-date. Go to the online menu and check for updates. If you still can't transmit your return, go to www.support.turbotax.com for a solution or work around. In some cases you may need to file the return by mail. -Tax Year 2022 transmissions are not available. -Turbo Tax Business is not ready to process Tax Year 2022 for this return.

I tried a work around I found on the website but it didn't resolve the situation.

What is the problem with e-filing form 1065?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

E-File LLC Partnership return 1065

If you have updated TurboTax, run the Federal Review with no errors and still have this experience, you may wish to review the contents of your return using Forms Mode. Note that all forms for a partnership return are available for e-filing as of 2/19/2023.

- Open your return and click the Forms icon in the header.

- Above the list of forms on the left, click the Errors icon.

- Review the list of forms - any with a red exclamation mark need your attention.

- Click on the form name to open it in the large window.

- Entries that need your attention will appear either as red box or in a red font.

- An explanation for any errors will appear in the footer below the form.

- Correct the error manually if you can. Be sure the new value appears in a blue font.

- Note that a green font indicates a value imported from last year's return. A value in black is generally a calculated or linked value that cannot be changed.

- Once you have reviewed/corrected all errors, use the Step-by-Step icon in the header to go back to the main screens.

- Save your return, check for updates, then attempt to e-file again.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

E-File LLC Partnership return 1065

Following the steps you provided I had no form with red exclamation points. The review runs without finding an error.

My software is up to date. I still get the same pop-up when I try to e-file.

Any other ideas of what is causing the issue?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

E-File LLC Partnership return 1065

I am having the same exact issue with the same pop up msg. My turbo tax is also up to date with updates and I have no errors on my return. Please help resolve this issue!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

E-File LLC Partnership return 1065

Please check this table (TurboTax Partnership Forms) to see if any forms in your return are listed as "unavailable" or "unsupported" in the e-file column. Either form status will prevent you from e-filing. Unavailable forms will be released in a future TurboTax update. But if the form is unsupported, you will need to print and mail your return to the IRS.

To print your return for mailing, follow the instructions under the File tab in TurboTax, or use the Print Center link in the menu bar and choose all official forms required for filing. We recommend sending your return by certified mail with return proof of delivery. Be sure it is postmarked by the due date for your return.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

E-File LLC Partnership return 1065

Hi Patricia,

I checked the table and the form 8453-PE shows "unsupported" for e-file.

This must be a mistake since the form 8453-PE is the signature declaration form for the return? How could the signature Declaration form be unsupported for e-file? is this a mistake on Turbo Tax side? This makes no sense that the Signature Declaration form would be unsupported.

I have been filing my business taxes with Turbo Tax for the last 9-10 years and that form was part of every filing and there was no issue with that form being supported.

Can you please check into this. This would mean every business return that used 1065 cannot efile because every one of them would have a form 8453-PE Signature Declaration form attached to it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

E-File LLC Partnership return 1065

I am having exactly the same issue. How can the 8453-PE, Partnership Declaration be unsupported? It has always been supported in the past, and TurboTax prompts you through the printing/signing/scanning/uploading process. Come on TurboTax, please fix this problem ASAP. You are charging nearly $200 for the software and not delivering!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

E-File LLC Partnership return 1065

@PatriciaV - this requires immediate attention and escalation with TurboTax as everyone else mentioned. How can the signature form required to E-file be unsupported? TurboTax needs to issue refunds this year to everyone who bought the software then..

The form in question:

Form 8453-PE, Partnership Declaration for an IRS e-file Return

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

E-File LLC Partnership return 1065

We have determined that this form should not be included in your business tax return. Please follow the steps below in an attempt to delete the form.

Open your return and click the Forms icon in the TurboTax header.

- Look for Form 8453-PE in the list of forms on the left.

- Click the form name to open it in the large window.

- Click Delete Form in the form footer and confirm the deletion.

- Click Step-by-Step in the header to return to the main screens.

- Go to the File tab and attempt to e-file again.

If you are unable to delete form or if you are still unable to e-file, please consider allowing us access to a diagnostic copy of your return for further investigation as follows:

Please go to Online in the TurboTax header.

- Choose Send Tax File to Agent.

- You will see a message explaining what the diagnostic copy is. Click Send on this screen and wait for the Token number to appear.

- Reply to this thread with your Token number.

This diagnostic copy (numbers only; no personal info) of your tax file will allow us to see the same experience you are having. If we are able to determine the cause, we'll reply here and provide you with a resolution.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

E-File LLC Partnership return 1065

@PatriciaVThanks for the reply.

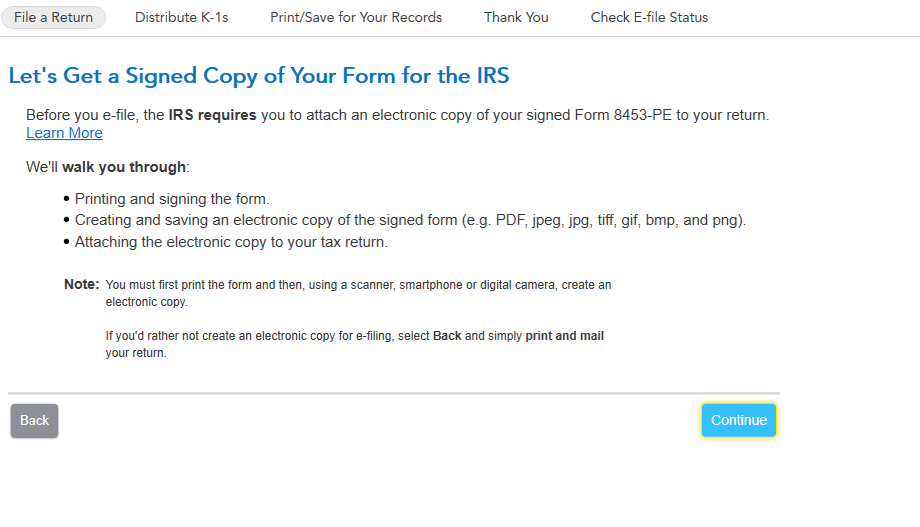

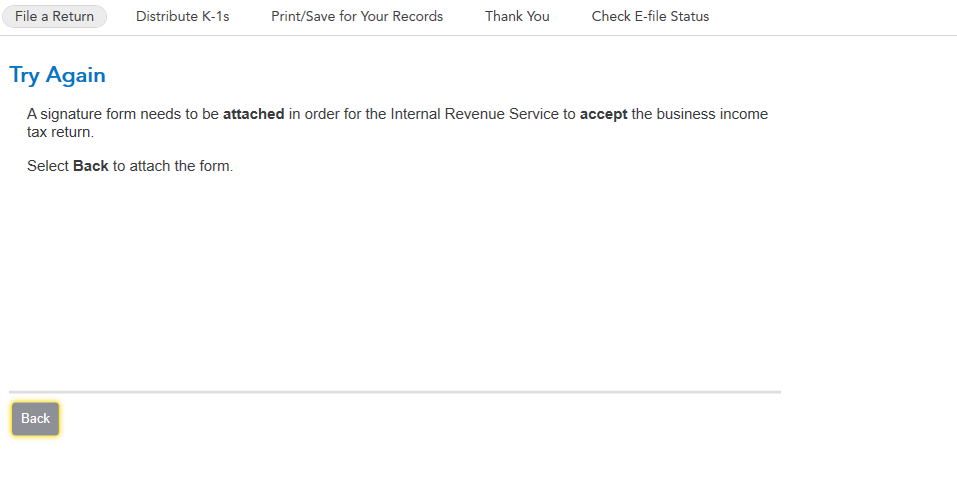

The software literally will not let you proceed with e-filing unless the form is attached. Not sure if anyone is having more luck getting around it than me, but here are the screens I see:

Deleting from Forms does not allow you to circumvent these screens either. The form automatically creates a new one as soon as it is deleted.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

E-File LLC Partnership return 1065

Patricia,

This is absolutely insane! That form 8453-PE is the signature for the return.

It is absolutely required by the IRS otherwise the tax return is not valid. Whoever on your team is telling you that this form is not required is with all due respect is absolutely incorrect. That form has been part of every business return for turbo tax for at least the last 10 years. That is your signature for your tax return. I don't believe you are getting correct information on this. Turbo tax literally has you go through printing and signing the 8453-PE form then uploading it prior to e-filing the return. You absolutely cannot e-file and expect the IRS to not reject your return. That is like mailing in a return without signing the return.

As a reference, you can take a look at your past business returns filed via Turbo Tax and see that that form is part of every business 1065 return. No return is valid unless the return is signed and the 8453-PE is that signature form if you look at the form. So instructing people to delete the signature form is incorrect. PLEASE FIX THE ISSUE AS THIS IS A HUGE PROBLEM.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

E-File LLC Partnership return 1065

Here is the diagnostic copy of my business return TOKEN # 1077065

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

E-File LLC Partnership return 1065

Thank you for the token. We will investigate further and escalate as needed.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

E-File LLC Partnership return 1065

Here is what I have discovered. After spending 2 hours (yes 2 hours) on the phone with support, I decided to try e-filing the federal and state taxes separately. Turned out that the federal taxes went through fine, even with the "unsupported" 8453-PE included. So, that form is not the problem. My state is NY and now I cannot get that to go through. My support agent (who was super nice and definitely trying very hard to help) and I eventually agreed to just try again today to see if it would go through. I am guessing it is a software issue and it needs to be fixed and updated but, ugh!!!!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

E-File LLC Partnership return 1065

@lucyvcarr Please confirm that you successfully e-filed your Federal Form 1065, including Form 8453-PE.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

Cornfused357

New Member

Bonnied1

Returning Member

gfrink451

New Member

JJK2

Returning Member

jimlestaxatatt1

New Member