- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Do need to report community property adjustment if my spouse is Nonresident alien?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do need to report community property adjustment if my spouse is Nonresident alien?

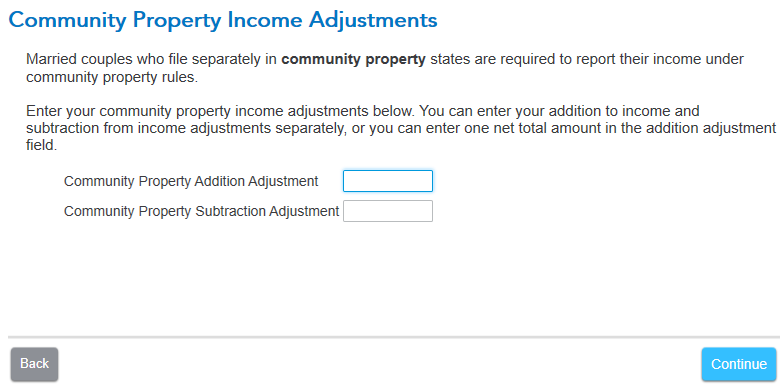

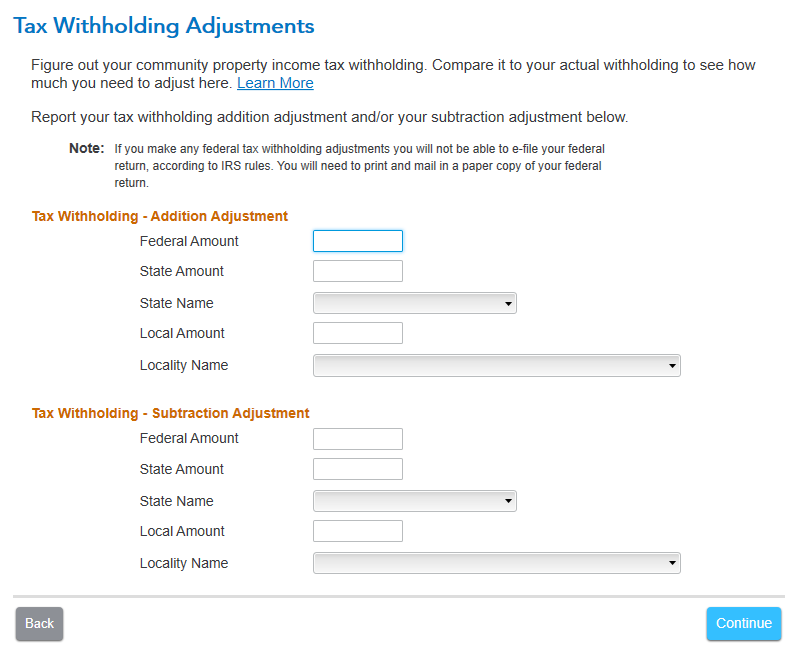

I am in California, I planning to use turbotax to file my tax return with filing status Married filing separate because my wife is a nonresident alien and living abroad. My question is: Do I need to report any community property adjustments or community income for the year 2023? if yes, how to fill out the community property addition adjustment , subtraction adjustment and tax withholding adjustment?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do need to report community property adjustment if my spouse is Nonresident alien?

Yes, you do need to report income made by yourself and spouse according to Publication 555. On page 8, it explains that if you treat your spouse as a non-resident alien, you can , treat your community income as Spouses living apart all year. However, you don't have to meet the four conditions that are listed there. Here is how you will report the income.

You would report the income each of you made. You do not need to allocate it according to the community property rules. Page 9, illustrates a perfect example how this is done. Thus in the screens you included above, you would not make any adjustments because each income is treated separately. Otherwise, if you weren't given this special provision, you would need to allocate everything bit of income, withholding, and deductions 50/50, which may take a bit of work.

If your wife does not have an ITIN or Social Security Number, you will need to mail the return in accordance with the instructions that will be included in the return.

- Prepare your return in TurboTax by choosing the option as Married Filing Separately. For the Social Security number, If she doesn't have a Social Security Number or ITIN, leave that blank.

- Complete your return.

- When you get to the Let’s get ready to e-file screen, select File by Mail, unless your wife has a SSN or ITIN. If so, you may efile.

- TurboTax will give you an error regarding the missing Social Security number or ITIN for your spouse. Proceed to print with the error, but write Nonresident Alien or NRA in the space for your spouse’s Social Security number before mailing in your return.

- Mail the return to the address on the instruction sheet that prints with the return.

- You may include an explanation statement stating that your wife is a non-resident alien that lived abroad during the year thus you did not make the community property allocations and treated her as a Spouse living apart from you all year and then quote the text that is on page 8 of Publication 555.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do need to report community property adjustment if my spouse is Nonresident alien?

Yes, you do need to report income made by yourself and spouse according to Publication 555. On page 8, it explains that if you treat your spouse as a non-resident alien, you can , treat your community income as Spouses living apart all year. However, you don't have to meet the four conditions that are listed there. Here is how you will report the income.

You would report the income each of you made. You do not need to allocate it according to the community property rules. Page 9, illustrates a perfect example how this is done. Thus in the screens you included above, you would not make any adjustments because each income is treated separately. Otherwise, if you weren't given this special provision, you would need to allocate everything bit of income, withholding, and deductions 50/50, which may take a bit of work.

If your wife does not have an ITIN or Social Security Number, you will need to mail the return in accordance with the instructions that will be included in the return.

- Prepare your return in TurboTax by choosing the option as Married Filing Separately. For the Social Security number, If she doesn't have a Social Security Number or ITIN, leave that blank.

- Complete your return.

- When you get to the Let’s get ready to e-file screen, select File by Mail, unless your wife has a SSN or ITIN. If so, you may efile.

- TurboTax will give you an error regarding the missing Social Security number or ITIN for your spouse. Proceed to print with the error, but write Nonresident Alien or NRA in the space for your spouse’s Social Security number before mailing in your return.

- Mail the return to the address on the instruction sheet that prints with the return.

- You may include an explanation statement stating that your wife is a non-resident alien that lived abroad during the year thus you did not make the community property allocations and treated her as a Spouse living apart from you all year and then quote the text that is on page 8 of Publication 555.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do need to report community property adjustment if my spouse is Nonresident alien?

is it means that I don't need to attach Form 8958 to my tax return?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do need to report community property adjustment if my spouse is Nonresident alien?

You will still use Form 8958 however, if filing Married Filing Separately with a nonresident spouse, you will not allocate your income the same way as all other taxpayers filing separately in a Community Property State.

Let me first point out that you are not restricted to filing separately just because your spouse is a nonresident, you can also file Married Filing Jointly.

Here is a link that explains your options.

If you still decided to file separately, and you live in a Community Property State, such as California, YES use Form 8958. When you allocate (assign) income and withhold, you follow the rules listed in IRS Pub 555 as if you and your spouse lived apart. You do NOT split your earned income.

Nonresident alien spouse.

"If you are a U.S. citizen or resident alien and you choose to treat your nonresident alien spouse as a U.S. resident for tax purposes and you are domiciled in a community property state or country, use the community property rules. You must file a joint return for the year you make the choice. You can file separate returns in later years. For details on making this choice, see Pub. 519, U.S. Tax Guide for Aliens.

If you are a U.S. citizen or resident alien and don't choose to treat your nonresident alien spouse as a U.S. resident for tax purposes, treat your community income as explained next under Spouses living apart all year."....

"Earned income.

Treat earned income that isn't trade or business or partnership income as the income of the spouse who performed the services to earn the income. Earned income is wages, salaries, professional fees, and other pay for personal services.

Earned income doesn't include amounts paid by a corporation that are a distribution of earnings and profits rather than a reasonable allowance for personal services rendered.

Trade or business income.

Treat income and related deductions from a trade or business that isn't a partnership as those of the spouse carrying on the trade or business.

Partnership income or loss.

Treat income or loss from a trade or business carried on by a partnership as the income or loss of the spouse who is the partner.

Separate property income.

Treat income from the separate property of one spouse as the income of that spouse.

Social security benefits.

Treat social security and equivalent railroad retirement benefits as the income of the spouse who receives the benefits.

Other income.

Treat all other community income, such as dividends, interest, rents, royalties, or gains, as provided under your state's community property law."

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

kb115_

Level 2

morg2019

Level 2

user20225320

New Member

absmile

New Member

kcoub1

New Member