No, you should enter the full amount of your W-2 wages, tax withheld and other income in TurboTax. After you are done entering your income and deductions, you will see a screen on which you can enter an adjustment to income to account for your share of your community property income. The entries on Form 8958 don't transfer over to your Form 1040, they are for informational purposes only.

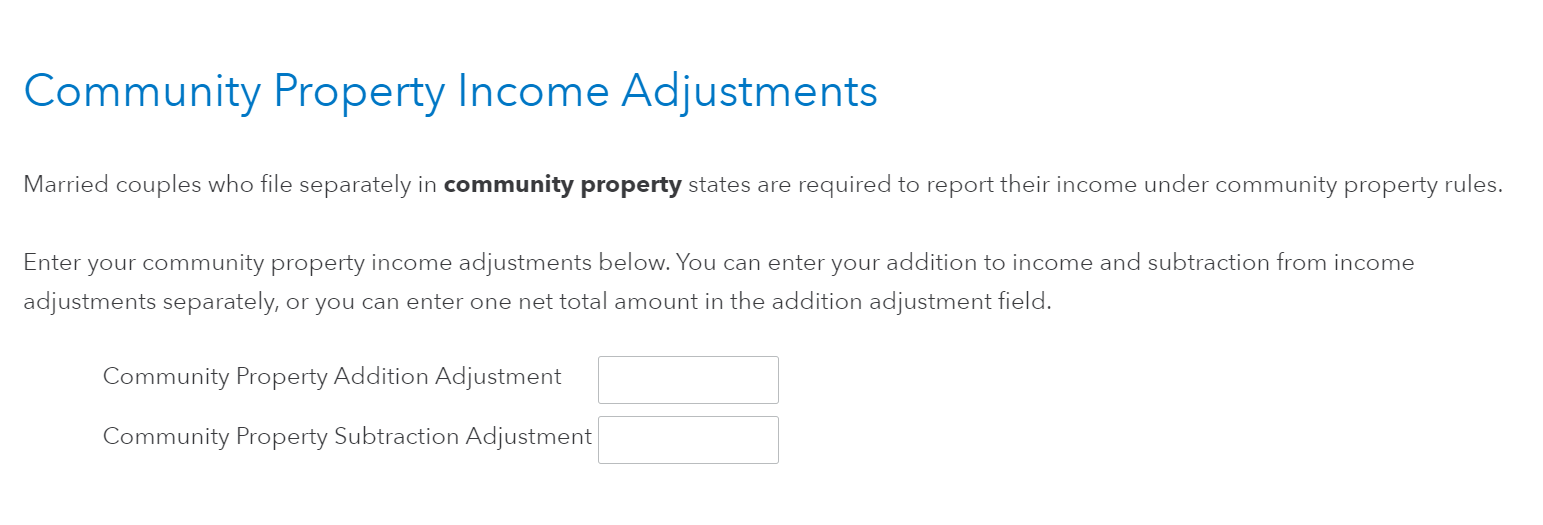

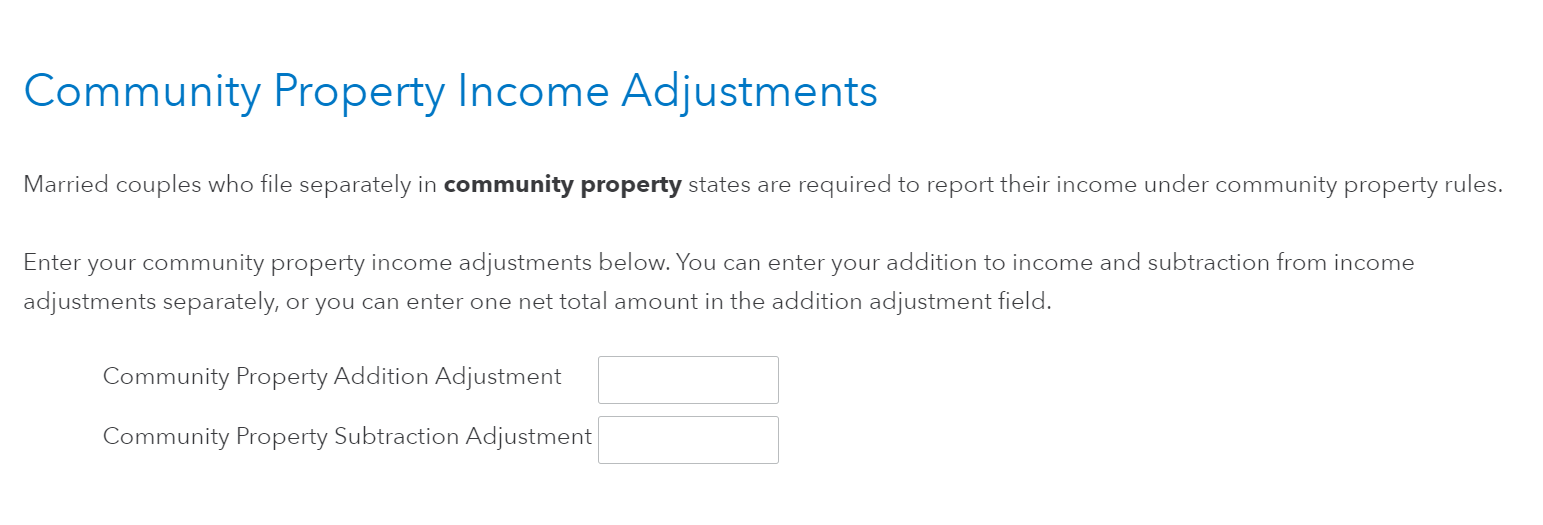

You will see a screen that says Community Property Income Adjustments on which you will enter your total community property income adjustment:

You do a similar adjustment for your tax withholdings.

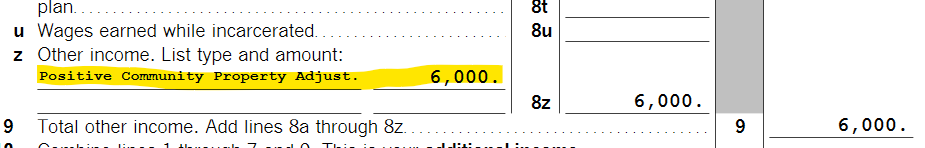

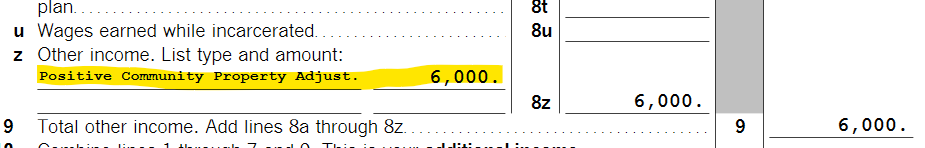

Your income adjustment will show on line 8(z) on schedule 1 of your Form 1040:

Withholding adjustments will show on line 25(c) on form 1040.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"