- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Did you use this home for anything other than your primary home? What do I choose in my below case?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Did you use this home for anything other than your primary home? What do I choose in my below case?

I bought home in 2010, lived there until 2017, rented for about 1.5 years and sold it in 2019. I never moved back this home after I rented. I bought other home as my primary residence in 2017.

For the question "Did you use this home for anything other than your primary home", when I click turboTax's help center link, it says below and for me it sounds like I should answer "No" but if I just look at question, I think I should answer "Yes". What should be my choice, please help.

This is what TurboTax's Help center says, if you are interested in:

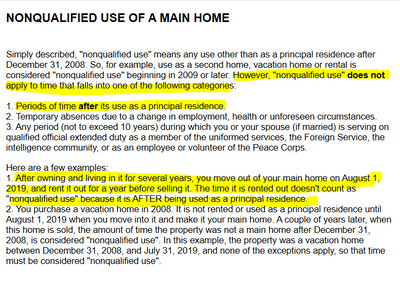

NONQUALIFIED USE OF A MAIN HOME

Simply described, "nonqualified use" means any use other than as a principal residence after December 31, 2008. So, for example, use as a second home, vacation home or rental is considered "nonqualified use" beginning in 2009 or later. However, "nonqualified use" does not apply to time that falls into one of the following categories:

1. Periods of time after its use as a principal residence.

2. Temporary absences due to a change in employment, health or unforeseen circumstances.

3. Any period (not to exceed 10 years) during which you or your spouse (if married) is serving on qualified official extended duty as a member of the uniformed services, the Foreign Service, the intelligence community, or as an employee or volunteer of the Peace Corps.

Here are a few examples:

1. After owning and living in it for several years, you move out of your main home on August 1, 2019, and rent it out for a year before selling it. The time it is rented out doesn't count as "nonqualified use" because it is AFTER being used as a principal residence.

2. You purchase a vacation home in 2008. It is not rented or used as a principal residence until August 1, 2019 when you move into it and make it your main home. A couple of years later, when this home is sold, the amount of time the property was not a main home after December 31, 2008, is considered "nonqualified use". In this example, the property was a vacation home between December 31, 2008, and July 31, 2019, and none of the exceptions apply, so that time must be considered "nonqualified use".

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Did you use this home for anything other than your primary home? What do I choose in my below case?

@mellish7777 well renting ended on May 2019 and the property was sold on August 2019, I dont know whether that makes any difference.

@Carl thanks for good explanation. That makes sense to me. But information on "TurboTax", in this case is misleading and that needs to be corrected.

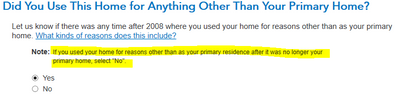

Please see below on what TurboTax says:

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Did you use this home for anything other than your primary home? What do I choose in my below case?

You said you lived there since 2017 and sold in 2019 and rented for 1.5 years so did you rent AFTER you used the house as a main home? Doesn't sound like it but it does sound like you have 1.5 years of nonqualified use due to rental before you used the house as your main home.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Did you use this home for anything other than your primary home? What do I choose in my below case?

@mellish7777 did you read the first point and first example? based on that, I should answer "No", hence I am confused

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Did you use this home for anything other than your primary home? What do I choose in my below case?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Did you use this home for anything other than your primary home? What do I choose in my below case?

@mellish7777 "I bought home in 2010, lived there until 2017, rented for about 1.5 years and sold it in 2019". After I moved out of this home and rented it, I never came back to this home. At the time of sale, it was still rented. In 2017, I bought other home as my primary home. Help me understand what should be my case

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Did you use this home for anything other than your primary home? What do I choose in my below case?

OK, if the last use of the house was as a rental you should be reporting it as the sale of rental property and not the sale of a home. You'll still get the exclusion but will have to recapture depreciation for the time it was a rental.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Did you use this home for anything other than your primary home? What do I choose in my below case?

Did you use this home for anything other than your primary home?

YES YOU DID!

If you lived in the property AS YOUR PRIMARY RESIDENCE for at least 2 of the last 5 years you owned it, then your first $250K ($500K if filing joint) is exempt from income tax. Now you state the property was purchased in 2010. So the "lookback" for the tax exclusion only looks back to Jan 1, 2009 or your closing date on the purchase if it was *after* Jan 1, 2009.

So if you closed on July 1st, 2019 the look back is to your purchase closing date in 2010. If the property was NOT your primary residence for any period of time between your purchase closing in 2010 and your sale closing date in 2019 *AND* *YOU* were the last occupant to vacate the house prior to the sale, then you *DO* have unqualified use of the property. Based on your dates of unqualified use, your tax exclusion will be pro-rated.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Did you use this home for anything other than your primary home? What do I choose in my below case?

Carl.... shishirdahal said "At the time of sale, it was still rented..." so shishirdahal was NOT the last occupant to vacate the house prior to the sale. It was converted to a rental from a main home and was a rental at the time of the sale.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Did you use this home for anything other than your primary home? What do I choose in my below case?

@mellish7777 well renting ended on May 2019 and the property was sold on August 2019, I dont know whether that makes any difference.

@Carl thanks for good explanation. That makes sense to me. But information on "TurboTax", in this case is misleading and that needs to be corrected.

Please see below on what TurboTax says:

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Did you use this home for anything other than your primary home? What do I choose in my below case?

It seems clear to me, just fine. Remember, the key date is *AFTER* Dec 31 of 2008. (I incorrectly stated 5 year look back previously. My oversight.)

So if *YOU* were the last occupant to vacate the property prior to the closing date on the sale, any period of time "AFTER" Dec 31 2008 *OR* from the date of purchase (whichever date is the soonest) that the property was *not* your *primary* residence is unqualified use. Your exclusion amount will be pro-rated acordingly.

Also understand the pro-ration is not based on the maximum exclusion allowed. It's based on a percentage of your "actual" gain. So if you have a gain of $100,000 with 30% time of unqualified use, then only $70K will be tax exempt and you will pay taxes on $30K.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Did you use this home for anything other than your primary home? What do I choose in my below case?

If the last occupant to move out of the house prior to closing on the sale was a tenant, then you *SHOULD* be reporting this sale in the Rental & Royalty Income (SCH E) section of the program. It does not matter if the property sat vacant for 3 months after the last renter moved out either. It also doesn't matter if you lived in it for any reason *OTHER* than your *PRIMARY* residence for those last 3 months prior to the closing either.

In fact, it's perfectly possible you may have stayed in the house for a few weeks getting it ready for sale. That time does not count against you for *ANYTHING*, because you did not live in the property for *YOUR* *PERSONAL* *PLEASURE* of any type.

So if the last person to move out was a paying tenant, "unqualified use" does not come into play at all here.

Reporting the Sale of Rental Property

If you qualify for the "lived in 2 of last 5 years" capital gains exclusion, then when prompted you WILL indicate that this sale DOES INCLUDE the sale of your main home. For AD MIL personnel who don't qualify because of PCS orders, select this option anyway, because you "MIGHT" qualify for at last a partial exclusion.

Start working through Rental & Royalty Income (SCH E) "AS IF" you did not sell the property. One of the screens near the start will have a selection on it for "I sold or otherwise disposed of this property in 2019". Select it. After you select the "I sold or otherwise disposed of this property in 2019" you continue working it through "as if" you still own it. When you come to the summary screen you will enter all of your rental income and expenses, even it it's zero. Then you MUST work through the "Sale of Assets/Depreciation" section. You must work through each individual asset one at a time to report its disposition (in your case, all your rental assets were sold).

Understand that if more than the property itself is listed in your assets list, then you need to allocate your sales price across all of your assets. You will only allocate the structure sales price; you will NOT allocate the land sales price, since the land is not a depreciable asset. Then if you sold this rental at a gain, you must show a gain on all assets, even if that gain is $1. Likewise, if you sold at a loss then you must show a loss on all assets, even if that loss is $1

Basically, when working through an asset you select the option for "I stopped using this asset in 2019" and go from there. Note that you MUST do this for EACH AND EVERY asset listed.

When you finish working through everything listed in the assets section, if you ever at any time you owned this rental you claimed vehicle expenses, then you must also work through the vehicle section and show the disposition of the vehicle. Most likely, your vehicle disposition will be "removed for personal use", as I seriously doubt you sold your vehicle as a part of this rental sale.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Did you use this home for anything other than your primary home? What do I choose in my below case?

@shishirdahal I posted hours ago that you should report this as the sale of rental property.....Carl only repeated it.....and there's nothing wrong with the nonqualified use wording in TT with the example you highlighted....the facts you gave do NOT present an issue of nonqualified use because the renter was the last occupant before the sale. Report this as a sale of rental property and be sure to remember that there will be depreciation recapture involved.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Did you use this home for anything other than your primary home? What do I choose in my below case?

Exceptions to Non-Qualified Use

The Housing and Economic Recovery Act of 2008 has provided three (3) exceptions to homeowners where the sale of their primary residence may not otherwise qualify for the tax free exclusion under the new requirements now included in Section 121.

- The first exception will have the greatest impact. Homeowners can move out of their primary residence and convert it to any other non-qualified use such as rental, investment, vacation, or business use property and still qualify for the tax free exclusion under Section 121.

The key is that homeowners must still qualify for the other requirements under Section 121 at the time they close on the sale of their primary residence. They must have (1) owned and (2) lived in the real property as their primary residence for at least a combined total of 24 months out of the last 60 months (two out of the last five years) in order to qualify for 121 exclusion treatment. - This also means that Revenue Procedure 2005-14 still applies and that homeowners can also complete a 1031 exchange to defer any balance of capital gains above the 121 exclusion limitations.

- The second exception involves those homeowners affected by qualified official extended duty such as military service.

- The third exception involves unforeseen circumstances.

https://www.exeterco.com/article_changes_to_section_121

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

obeteta

New Member

jl_brooks

Level 1

bruced63

New Member

debjit21

New Member

sparksj337

New Member