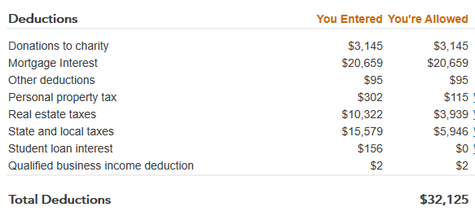

I have Turbotax Deluxe on Windows desktop and something is not calculating deductions correctly. See this deduction summary... if you add up the lines in the "You're Allowed" column it adds up to $33,899 NOT the reported $32,125. it is off by $1,774.

Math incorrect

Math incorrect

This happens to be the amount of money reported as a charitable deduction in Schedule K-1 box 13 (Label A). It shows up on the "Cash Contributions" Worksheet for Schedule A Line 16, but the total amount is not actually showing up on Schedule A, only my direct contributions ($1,369).

I cannot figure out how to make this do the right math and the summary form (screenshot above) is clearly incorrectly adding amounts.

Please help!