- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- De Minimis Safe Harbor Election - How to expense the cost of Labor?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

De Minimis Safe Harbor Election - How to expense the cost of Labor?

I am familiar with the process on how to use the De Minimis Safe Harbor Election for items. My question is how do I expense the cost of the labor?

Ex. I purchased a new water heater that cost $800 and I paid the plumber $200 to install it. I bought the water heater at the store and paid the worker when he was done with the installation. One receipt has the total purchase of the water heater and the 2nd receipt is from the plumber for $200 for the installation. I do understand I can expense the water heater using the De Minimis Safe Harbor but according to the TurboTax help section the De Minimis Safe Harbor election states the following: "This amount doesn't have to include costs like delivery or installation fees, unless these costs are already on the same receipt as the item." Since I have 2 separate receipts how do I expense the cost of the $200 labor that I paid the plumber for the installation?

Thank you,

David

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

De Minimis Safe Harbor Election - How to expense the cost of Labor?

You may report the $200 as Repairs, Maintenance, Building Contractor or a similar expense category.

This IRS website states:

Similarly, the de minimis safe harbor doesn't change your ability to deduct repair and maintenance costs that don't qualify under the de minimis safe harbor, for example, costs that exceed the safe harbor threshold. Therefore, for costs that don't qualify under the de minimis safe harbor, you apply the general rules for identifying and deducting repair and maintenance costs, incidental supplies, and non-incidental materials and supplies.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

De Minimis Safe Harbor Election - How to expense the cost of Labor?

Hello James,

Thank you for your response. I might need some clarification that is related to my previous question. To deduct an item as an expense in the same year under $2,500 I can use the De Minimis Safe Harbor Election. And to deduct items in the same year that are over $2,500 I can use the Safe Harbor Election for Small Taxpayer.

The Safe Harbor Election for Small Taxpayers allows me to deduct items or Improvements (such as, repairs, maintenance and improvements) that are over $2,500.

Why does the election allow me to expense items or improvements over $2,500 using the Safe Harbor Election for Small Taxpayers but cannot expense Improvements that are under $2,500?

Ex. If I installed a new fence (Improvement) that cost over $2,500 and I had separate receipts for the material and labor work to build the new fence I can expense the total cost of the fence using the Safe Harbor Election for Small Taxpayers, however, if the fence cost under $2,500 (Improvement) does not allow me to expense it because the De Minimis Safe Harbor Election is used to expense an Item only.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

De Minimis Safe Harbor Election - How to expense the cost of Labor?

The two Safe Harbor Elections are complimentary, in that assets that would normally be depreciated are instead reported as expenses. The De Minimis Safe Harbor covers assets under $2,500 for most businesses. The Safe Harbor for Small Taxpayers covers assets and improvements over that amount, subject to some limitations.

The basis of any asset includes all related costs such as shipping and installation/labor. Combine all your costs for each asset before you apply either Safe Harbor Election.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

De Minimis Safe Harbor Election - How to expense the cost of Labor?

Hello Patricia,

Regarding De Minimis Safe Harbor. You stated that "The basis of any asset includes all related costs such as shipping and installation/labor. Combine all your costs for each asset before you apply either Safe Harbor Election." I am assuming when you state "Combine all your costs" you mean to combine all your receipts that pertains to that item or asset that is used in your business (rental property).

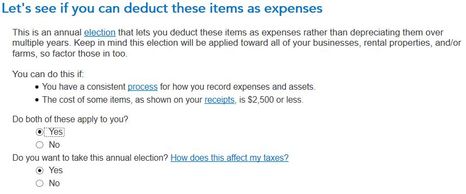

If you click on the word "receipt" under the cost of some items (pls. see image below). It states "This amount doesn't have to include costs like delivery and installation fees, unless these costs are already on the same receipt as the item." If understand this statement correctly, it means that all costs must be on the same receipt in order to be able to use this election.

If the asset that I installed is under $2,500 (ex. fence, storage unit, water proofing stairs etc.) and all materials that were purchased to build this asset were in separate receipts can I still use this election?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

De Minimis Safe Harbor Election - How to expense the cost of Labor?

In determining whether the cost of an item "exceeds" the $2,500 or $5,000 threshold, you must include all additional costs that are on the same invoice with the tangible property—for example, delivery and/or installation fees. However, you are not required to include "additional costs of acquiring or producing" the property that "are not included in the same invoice as the tangible property." In other words, you are not required to use to additional costs from other invoices if these costs are going to put you "above the limit."As long as the additional costs from the other invoices still keep you under the 2,500, then you may include them for purposes of the DeMinimus Safe Harbor Deduction. deminimus

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

De Minimis Safe Harbor Election - How to expense the cost of Labor?

Thanks for your reply. I could not find your answer in the IRS publication. Can you please provide the article or publication were you found the information you stated?

"In determining whether the cost of an item "exceeds" the $2,500 or $5,000 threshold, you must include all additional costs that are on the same invoice with the tangible property—for example, delivery and/or installation fees."

Can you also provide the article or publication were you found this as well?

"However, you are not required to include "additional costs of acquiring or producing" the property that "are not included in the same invoice as the tangible property." In other words, you are not required to use to additional costs from other invoices if these costs are going to put you "above the limit."As long as the additional costs from the other invoices still keep you under the 2,500, then you may include them for purposes of the DeMinimus Safe Harbor Deduction. deminimus"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

De Minimis Safe Harbor Election - How to expense the cost of Labor?

In determining whether the cost of an item exceeds the $2,500 or $5,000 threshold, you must include all additional costs that are on the same invoice with the tangible property—for example, delivery and/or installation fees. However, you are not required to include "additional costs of acquiring or producing" the property that "are not included in the same invoice as the tangible property." The best strategy is to have such additional costs included on a separate invoice. See HERE. under the section "Maximum DeMinimus Amount."

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

De Minimis Safe Harbor Election - How to expense the cost of Labor?

Thank you.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

Aims173

Level 2

abooth001

Returning Member

johntkerich7203

Level 1

joerowleypower-g

New Member

BrianH7

Returning Member