- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Crypto Staking Income

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Crypto Staking Income

When I post my Crypto Staking Income from 1099-MISC, the TurboTax Online Software automatically assumes its business income. There is no way around it, and I cannot post 1099-MISC income in the "other miscellaneous income" section. I then have to pay social security and medicare taxes. HELP

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Crypto Staking Income

Enter staking rewards in TurboTax as other income.

Follow these steps to enter in TurboTax Online:

- Down the left side of the screen, click Federal.

- Down the left side of the screen, click Wages & Income.

- Click the down arrow to the right of Other Common Income.

- Click to the right of Form 1099-MISC.

- At the screen Let's enter the income, enter the information from the form.

- At the screen Describe the reason, enter 'staking rewards'. Click Continue.

- At the screen Do one of these uncommon situations apply, select None of these apply. Click Continue.

- At the screen Did the staking rewards involve work that's like your main job?, select No. Click Continue.

- At the screen How often did you get income for staking rewards?, select the answer. Click Continue.

- At the screen Did the staking rewards involve an intent to earn money?, select No. Click Continue.

The entries will be reported:

- on line 8z of Schedule 1 of the Federal 1040 tax return, and

- on line 8 of the Federal 1040 tax return.

The IRS has ruled that staking rewards only become taxable once the taxpayer "acquires the ability to transfer, sell, exchange, or otherwise dispose of the cryptocurrency." You will need to convert your rewards to US dollars if they have not been issued in U.S. dollars.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Crypto Staking Income

The question Did the staking rewards involve an intent to earn money? does not come up when I go through the prompts and it automatically assumes taxes on the staking rewards. Is there a workaround or another place to select this?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Crypto Staking Income

Are you using TurboTax Online or Desktop?

Are you reporting the information from an IRS form 1099-MISC? Or something else?

If the reporting is an IRS form 1099-MISC, at the screen Do one of these uncommon situations apply, did you select None of these apply?

"and it automatically assumes taxes on the staking rewards."

If the transaction is reported on an IRS form 1099-MISC, it likely is a taxable transaction. Or are you referring to self-employment income? Please clarify.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Crypto Staking Income

I am having a similar problem. Coinbase sent a 1099-MISC for my staking income, and after answering all the questions as you recommend, it says it will report it on Schedule C, which according to IRS publications, is wrong unless I'm actually doing it as a trade or business.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Crypto Staking Income

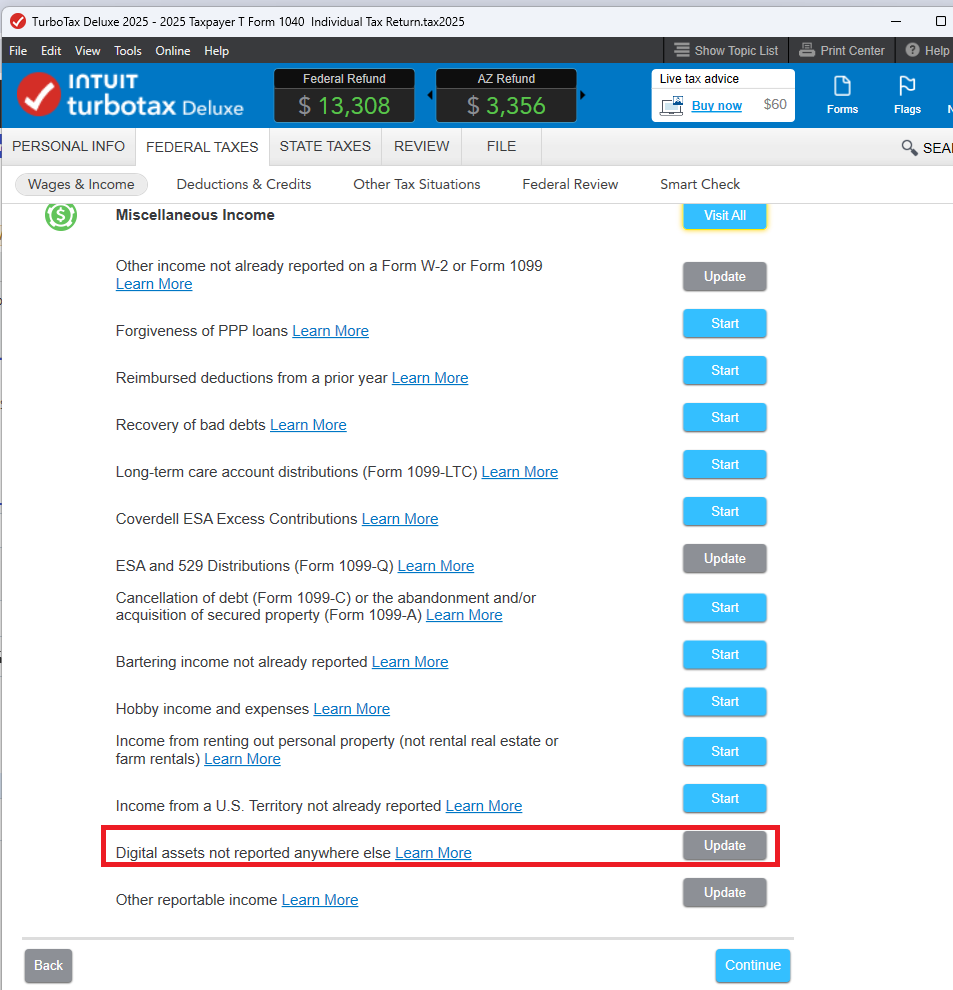

On the Income Topics page, scroll down to Less Common Income > Miscellaneous Income 1099A, 1099C and choose Start/Update.

On the next page, scroll down to Digital Assets Not Reported Elsewhere.

On the next page, enter the amount from your 1099-Misc from Coinbase.

The income will be reported on Schedule 1, Line 8v, and be included on Form 1040, Line 8.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

asdfasdf4

Returning Member

gw1948

New Member

harscoet

New Member

fargo121

Level 2

SmedleyJ

Level 2