- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- CANNOT Enter LAND VALUE on Line 38 of Form 8829

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

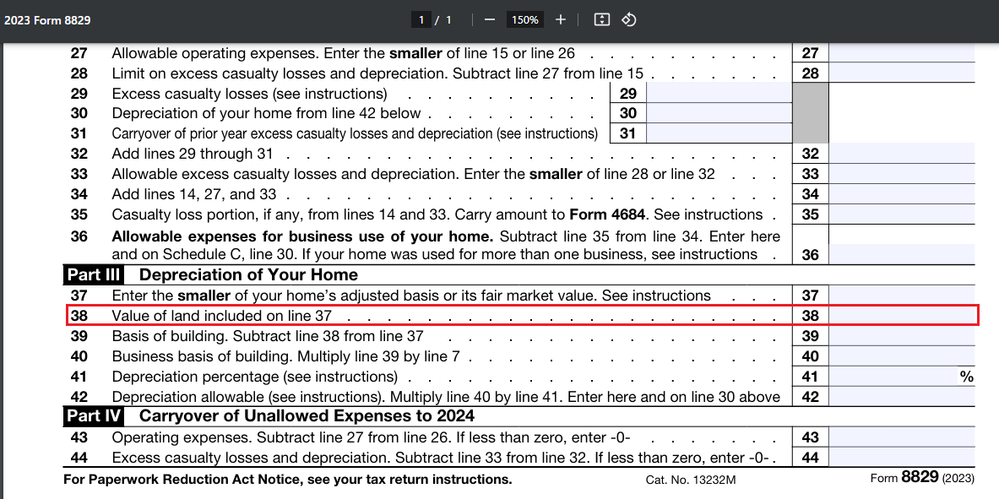

CANNOT Enter LAND VALUE on Line 38 of Form 8829

2022 was the first year I claimed home office expenses, but I did not fill in the land value on Line 38 of Form 8829 because I didn't know which number to fill in. This year, I want to include the land value for my 2023 tax returns, but the TurboTax Home & Biz section doesn't allow me to input it. I need experts to guide me on how to fill it in for the 2023 tax returns.

Note: I accessed the forms section in the software and navigated to Form 8829 to make direct edits on line 38. However, when I input and press enter, the software continues to leave it blank (input unsuccessful).

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

CANNOT Enter LAND VALUE on Line 38 of Form 8829

Sounds like you established it in 2022, so that can't be changed in 2023.

The value of the land will lower the depreciation since land does not depreciate.

I suggest you try to lower the amount on Line 37 (lower it by the value of the land)

If none of that works, you'll need to end that home office and enter a new home office with an adjusted basis.

The adjusted basis will be the original basis you used (tax year 2022 line 37) less the value of the land less the depreciation taken in 2022.

Keep a note of the depreciation taken in 2022 since you might need to account for that when you sell.

EXAMPLE

you listed 100,000 on line 37 for tax year 2022 and the home office used 300 for depreciation.

You decide land is worth 20,000, so you end that office and enter a new office with 79,700 building (to account for the 300 depreciation taken in 2022) and 20,000 land.

Now the yearly depreciation is 290 a year.

Ten years later you sell at a profit, you need to claim Depreciation Recapture.

You will THINK the depreciation recapture is limited to 2,900 (10 years at 290) but really it is 3,200 (2,900 + 300)

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

CANNOT Enter LAND VALUE on Line 38 of Form 8829

HOW CAN I ENTER A NEW HOME OFFICE WHILE STILL RETAINING THE OVER $2000 HOME OFFICE DEDUCTION CARRY FORWARD FROM LAST YEAR?

I didn't end this home office and enter a new one because I have over $2000 in home office deduction carry forward. I noticed that I would lose the carry forward amount if I entered a new one.

Reducing the basis value like that may be correct numerically, but it still contradicts the theory when the IRS questions me "why is the land value left blank?" It might make the issue more complicated to correct later. Furthermore, no one wants to report less than the actual huge amount they had to spend.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

CANNOT Enter LAND VALUE on Line 38 of Form 8829

If the amount you reported last year on Line 37 included the value of the land, you have taken too much depreciation for this asset. In this case, you would need to amend your prior year return to reduce the property basis by the land value and lower the depreciation expense.

If the amount on Line 37 last year did NOT include the land value, then Line 38 should be zero (or blank). The total on line 39 is the property basis used for depreciation and is the total basis from Line 37 less the land value included in Line 37. The value of the land is needed only for this calculation. It does not affect any other area of your Home Office Deduction.

However, if you decide to stop using this home office and enter a new one, you may report the carryover or prior year operating expenses in the Home Office setup, which is reported on Line 31.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

CANNOT Enter LAND VALUE on Line 38 of Form 8829

1. If I can't edit line 38, can I edit line 39 in TurboTax Home and Business for Windows?

2. If I enter a new home office, how do I input carry forward from 2022 as you mentioned? Please guide me step by step in TurboTax Home & Business for Windows.

3. If I wait until my 2022 return amendment is accepted and completed, it will be past the deadline to file 2023 returns. Do I still need to file 2023 returns now with line 38 blank, continuing to depreciate more than actual, then amend 2023 after the 2022 amendment has been approved by the IRS?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

CANNOT Enter LAND VALUE on Line 38 of Form 8829

1) No, nothing in Part III of Form 8829 can be edited manually. Changes to this section can be made either on the Asset Worksheet for the Home Office or using the step-by-step interview. See below.

2) The path in TurboTax Home & Business is Business >> Business Income & Expenses >> Edit your business >> Home Office Expenses.

As you go through the home office expenses section for your business, look for the question near the end of the section that says, "Did you have any home office expenses not deducted in a prior year?" Answering yes to this question will open the page for entering prior year expenses that can carry over.

3) Correct your basis for 2023 to report the correct amount of depreciation this year. If you know what the total prior depreciation should be, you can correct that as well under the Asset profile for the home office.

File the amended return after you file the current year.

The path is Home Office Expense >> Edit home office >> Continue to the page Home Office Asset Summary >> Edit asset continue to page "Review Information."

See screenshot below (click to enlarge).

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

CANNOT Enter LAND VALUE on Line 38 of Form 8829

I succeeded. Thanks. I didn't know the home office expense and home office depreciation were different sections. Editing one doesn't affect the other. Have a wonderful week!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

CANNOT Enter LAND VALUE on Line 38 of Form 8829

I too found almost all the data I'd input in Investments missing when I tried to edit it. Incredibly frustrating! Then I discovered the "step by step" feature in the "forms" view, and tried to change directly in the form. TT wouldn't allow it! But then I noticed on the left side of the screen a miniature view of what I was trying to fix. I made the changes there, and lo and behold, the main form changed too.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

rkeeton88

New Member

youngbuck4202

New Member

NeUnhappy

New Member

Cat_Sushi

Level 2

backwebstores

New Member